Aaron Passman is editor of Credit Union Journal, the nation’s leading credit union news resource. He was appointed editor in 2018 after two years as an assistant editor at CUJ and nearly five years as a reporter there. He has worked as a staff writer or freelancer for a variety of publications across the country and is a graduate of the University of Kansas.

-

Members of NW Iowa Credit Union soundly rejected merging into Siouxland Federal Credit Union. The pandemic could lead to more unexpected results.

July 7 -

The $338 million-asset institution already serves more than 3,000 members in the county who were able to join through affiliations with Harford County.

July 6 -

Heritage Trust Federal Credit Union will buy the bank's deposits and assume its liabilities.

July 2 -

The credit union has agreed to buy Elberfeld State Bank, broadening its reach in the Evansville, Ind., market.

July 2 -

The report from the regulator offers an industry-wide look at how credit unions have fared during the pandemic. Since the outbreak worsened in April and into May, credit quality could possibly worsen while earnings may sag even further.

July 2 -

The credit union regulator has not yet announced an agenda, but the meeting could potentially include mattes related to field of membership and risk-based net worth.

July 1 -

In spite of the pandemic, the Columbus, Ohio-based corporate credit union was able to return the funds to some owners on the strength of strong earnings through the firs two quarters.

July 1 -

The Consumer Financial Protection Bureau's leadership structure could be set for a revamp, but there may be political reasons for both parties to maintain the status quo. Either option could prove problematic for the industry.

July 1 -

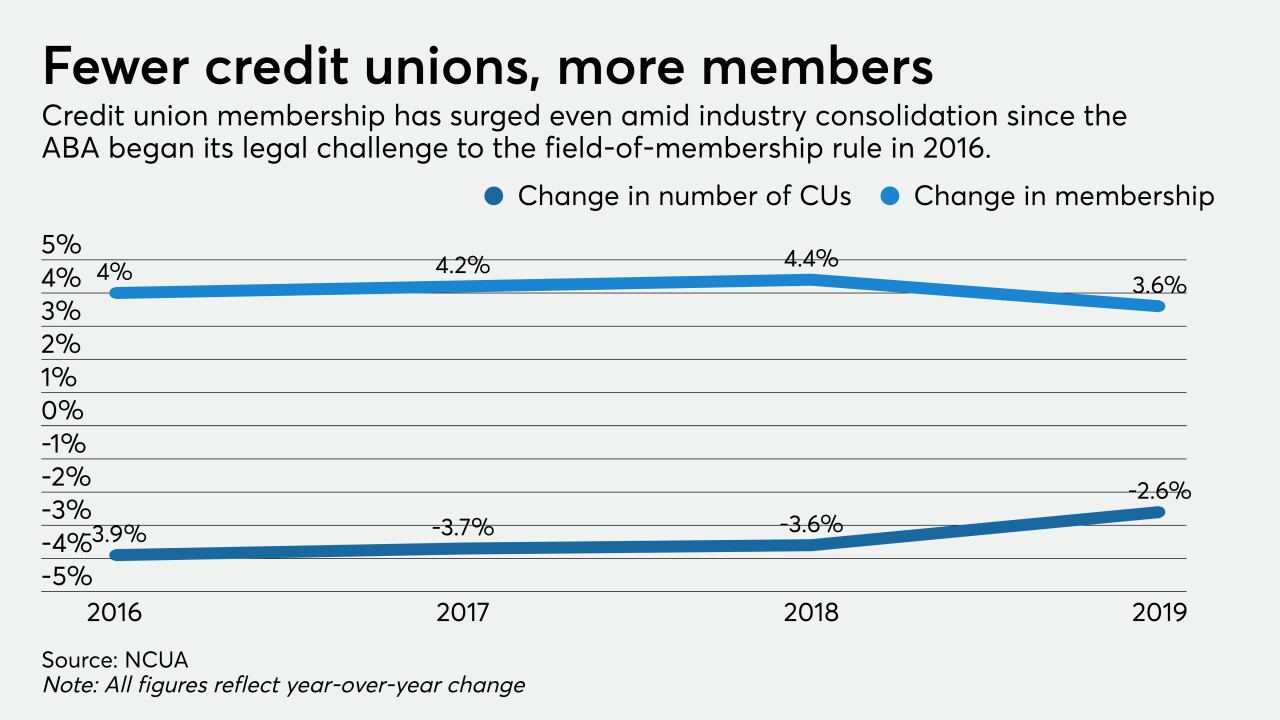

The industry claimed victory over banks as the Supreme Court elected not to hear a challenge to a controversial 2016 rule, but the landscape has shifted dramatically since NCUA approved the measure.

June 30 -

The court's decision not to consider an appeal from the American Bankers Association is likely to be the last step in a legal saga dating back to 2016.

June 29