Allissa Kline is a Buffalo, New York-based reporter who writes about national and regional banks and commercial and retail banking trends. She joined American Banker in 2020 and previously worked for more than a decade at Buffalo Business First, where she covered banking and finance, insurance and accounting. Kline started her journalism career at the Observer-Dispatch in Utica, New York. She graduated from Colgate University and the S.I. Newhouse School of Public Communications at Syracuse University.

-

If the French megabank retreats from the U.S. retail banking market, it would be the fifth foreign-owned company to do so in the past 12 months.

November 15 -

KeyCorp, Zions and Capital One are among the companies making big moves in a sector that is growing fast and viewed as recession-proof.

November 10 -

Even as the pandemic has hastened adoption of digital banking, industry officials say branches remain vital points of contact with consumers.

November 8 -

The establishment of the Office of Minority and Community Development Banking comes less than two months after the agency created an investment fund to match private investors with minority-owned banks and community development financial institutions.

November 2 -

Scott Anderson, president and CEO of Zions Bank, was recently elected chair of the American Bankers Association. In an interview, he encouraged Washington to scrutinize tech giants’ moves into financial services but expressed concern about some potential implications of financial agencies’ spotlight on climate change.

October 31 -

Deland Kamanga, the company's head of global markets, has been tapped to lead a unit with operations in both Canada and the U.S.

October 29 -

The deal for Michigan-based Flagstar Bancorp, announced in April, was originally expected to be completed by the end of the year. The New York bank’s CEO expressed optimism that it will still get regulatory approval.

October 27 -

During third-quarter earnings calls, Bill Demchak of PNC raised concerns about stablecoins, while Jane Fraser of Citigroup pledged that there will be accountability for fixing her company's regulatory troubles and Jamie Dimon of JPMorgan Chase sounded downbeat about the Biden-era regulatory environment.

October 25 -

The upstate New York company, which has agreed to acquire People’s United Financial in Connecticut, is the latest bank to negotiate a multibillion-dollar spending commitment with the National Community Reinvestment Coalition.

October 25 -

The third-party investigation will assess the bank’s progress on a pledge to spend at least $1 billion providing mortgages, small-business loans and other banking services in underserved neighborhoods.

October 22 -

Investment banking fees helped propel the Cleveland bank's noninterest income, which has been a focus for the last decade and continues to rise as a percentage of total revenue.

October 21 -

The Buffalo, New York, bank dipped relatively close to the minimum common Tier 1 equity ratio in stress tests run by the Fed. The results “suggested that there might be more capital-friendly ways to participate” in the commercial real estate industry, its chief financial officer said.

October 21 -

The Indiana company told investors that it’s ready to complete its combination with First Midwest Bancorp but that it’s unclear whether a recently filed mortgage discrimination lawsuit will get in the way of Fed approval.

October 19 -

The unnamed firms must shut down because they lack securities registration, according to an order issued by state Attorney General Letitia James. Her office asked three other cryptocurrency-related companies to submit detailed explanations of their business models.

October 18 -

The company created through the combination of BB&T and SunTrust Banks expects to hit two final milestones in the first quarter of 2022. The bank is now turning its focus to performance, CEO Bill Rogers said.

October 15 -

Jane Fraser told analysts the company will spend what’s necessary to satisfy regulators’ concerns about risk management and internal controls. That includes incentives to encourage senior executives to resolve the problems promptly.

October 14 -

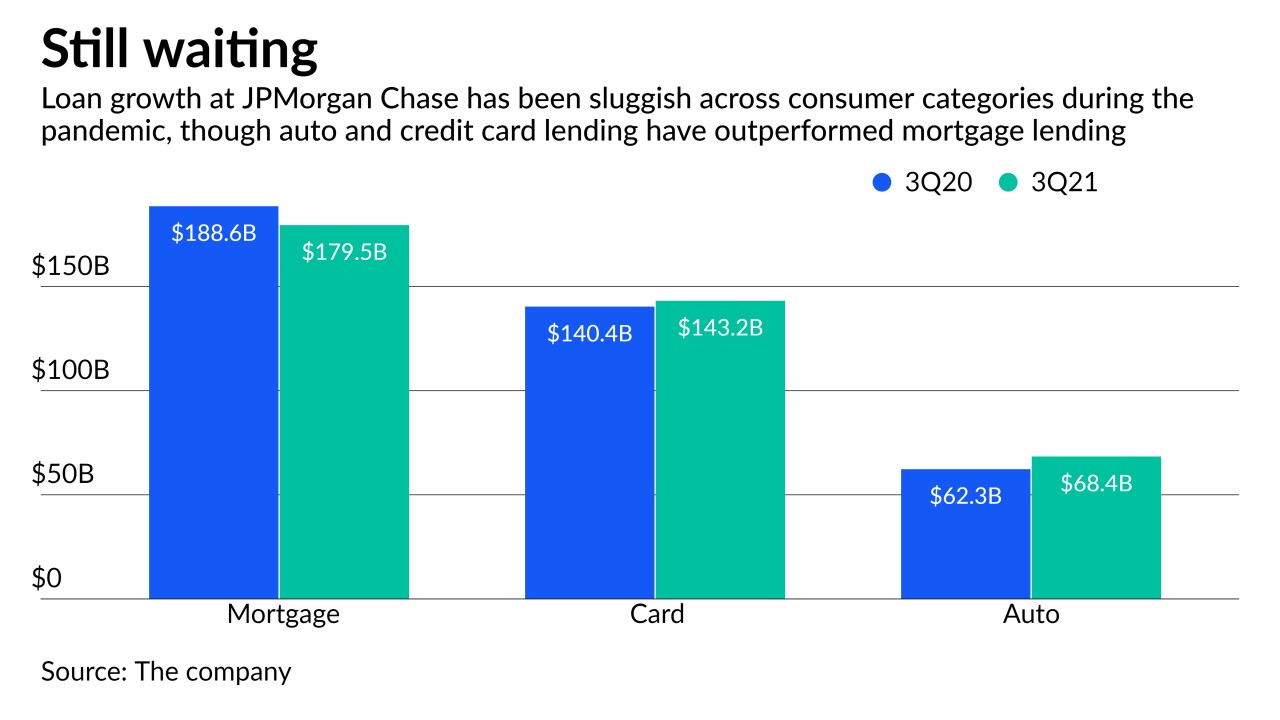

Spending on cards continued to increase during the third quarter, while loan balances rose slightly and payment rates began to return to more normal levels. A top company executive expressed confidence that loan growth will pick up but said, “It’s going to take time.”

October 13 -

More banks are boosting salaries to lure and keep workers in a highly competitive hiring market, but the pressure is on to trim expenses elsewhere to offset the pay hikes.

October 12 -

Seven months into her new role, Fraser is leading a corporatewide restructuring aimed at unifying and simplifying business operations, improving profitability and returning more capital to shareholders.

October 6 -

Lake is in her third role in four years at the nation's largest bank. Her breadth of experience makes her a likely CEO contender when current CEO Jamie Dimon retires.

October 6