Ian McKendry is the Congress reporter for American Banker. He previously covered the Federal Deposit Insurance Corp., anti-money laundering and cybersecurity. Before joining American Banker he was an economic reporter for Market News International.

-

Citigroup isn't the poster-child for "too big to fail" anymore, Chief Executive Michael Corbat claimed Wednesday, arguing the bank had scaled back and learned from its mistakes leading up to the financial crisis.

By Ian McKendryOctober 28 -

Several large banks have already embraced standards released Tuesday by a consumer advocacy group laying out how institutions can offer safe, entry-level financial services.

By Ian McKendryOctober 27 -

The Federal Deposit Insurance Corp. recently held meetings with state regulators in which agency officials emphasized that they are open to new applicants, responding to criticism that the standards for granting deposit insurance have been too high.

By Ian McKendryOctober 26 -

A faster than expected recovery following the financial crisis may mean that small banks see a significant reduction in premiums as early as the first quarter of next year, while larger institutions later face a surcharge required by the Dodd-Frank Act.

By Ian McKendryOctober 22 -

Furthering efforts to bring virtual currency mainstream, cryptocurrency companies and trade groups are teaming up to create a forum to aid law enforcement in weeding out criminal activity.

By Ian McKendryOctober 22 -

The Federal Deposit Insurance Corp. is set to vote Thursday morning on a proposal that would force big banks to bear the assessment burden of growing the agency's federal reserves to a new minimum.

By Ian McKendryOctober 22 -

In the wake of regulators conserving a credit union that allegedly was involved in a bitcoin money laundering operation, cryptocurrency companies are trying to demonstrate a commitment to cleaning house.

By Ian McKendryOctober 22 -

Furthering efforts to bring virtual currency mainstream, cryptocurrency companies and trade groups are teaming up to create a forum to aid law enforcement in weeding out criminal activity.

By Ian McKendryOctober 22 -

Comptroller of the Currency Thomas Curry praised the House for passing a bill to raise the asset threshold to qualify for an 18-month exam cycle to institutions with less than $1 billion of assets, and urged the Senate to follow suit.

By Ian McKendryOctober 19 -

Comptroller of the Currency Thomas Curry praised the House for passing a bill to raise the asset threshold to qualify for an 18-month exam cycle to institutions with less than $1 billion of assets, and urged the Senate to follow suit. Meanwhile NCUA, which already has the authority to extend its exam cycle has steadfastly refused to do so.

By Ian McKendryOctober 19 -

WASHINGTON The Federal Deposit Insurance Corp. announced that its board will meet Thursday to discuss a plan to increase the required ratio of federal reserves to insured deposits.

By Ian McKendryOctober 16 -

Bankers are increasingly concerned that an optional cybersecurity assessment tool released by regulators this summer could soon become mandatory.

By Ian McKendryOctober 16 -

Financial instituitons are increasingly concerned that an optional cybersecurity assessment tool released by regulators this summer could soon become mandatory.

By Ian McKendryOctober 16 -

Outside experts have been left wondering what kinds of controls firms that offer daily fantasy sports contests are putting in place to prevent them from becoming money laundering hubs and how careful banks should be when doing business with them.

By Ian McKendryOctober 9 -

The Federal Deposit Insurance Corp. has a new Chief Information Officer.

By Ian McKendryOctober 8 -

The New York State Department of Financial Services gave a third virtual currency company the green light to begin operations in the state.

By Ian McKendryOctober 6 -

The New York State Department of Financial Services on Monday gave a third virtual currency company the green light to begin operations in the state.

By Ian McKendryOctober 5 -

A bank failure in Georgia and then another in Washington state late Friday were estimated to cost the Federal Deposit Insurance Corp. nearly $25 million.

By Ian McKendryOctober 2 -

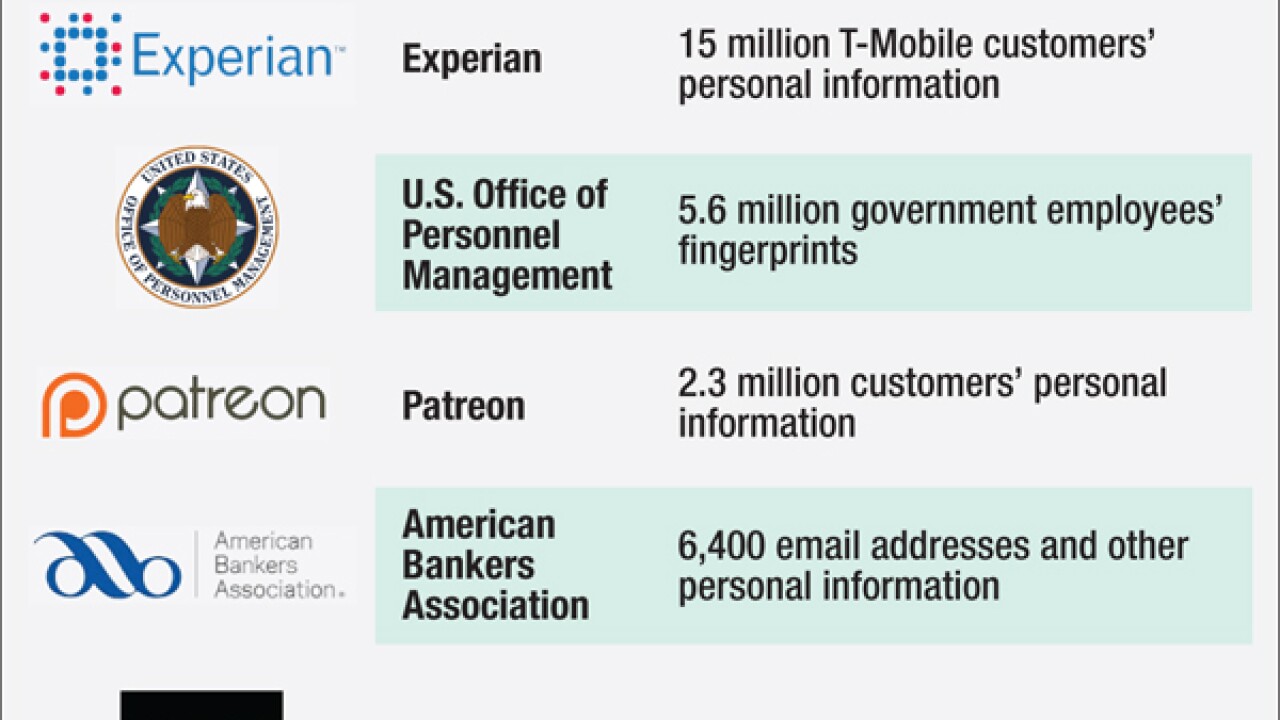

Compared with other recent breaches, the theft of 6,400 user email addresses and passwords on the American Bankers Association's website might seem like small potatoes. But experts said the attack the first in the association's history was still significant and could have implications for banks.

By Joe AdlerOctober 2 -

A new survey reveals a wish-list for anti-money laundering specialists to help ease their process of assessing customer risk, a major concern as mobile technology and virtual currency play a larger role in the payments market.

By Ian McKendrySeptember 30