-

The New York bank attributed the gains to its aggressive hiring of banking teams on both coasts and robust loan demand from private equity and venture capital firms.

By Jim DobbsJanuary 18 -

The Louisiana-based company is among a growing number of community banks that have taken on new talent in the wake of competitors' consolidation.

By Jim DobbsJanuary 11 -

Some community banks and credit unions worry that by hiring out-of-state workers to fill their many job openings, as other employers have done, they could erode community ties.

By Jim DobbsJanuary 10 -

The last three months of 2021 were strong for most lenders, which will report results soon. But the outlook for the coming months has been clouded by the spread of the newest coronavirus variant, which has many banks grappling with staffing shortages and branch restrictions.

By Jim DobbsJanuary 5 -

The new business line is part of a broader expansion plan the Pennsylvania bank announced in 2021.

By Jim DobbsJanuary 3 -

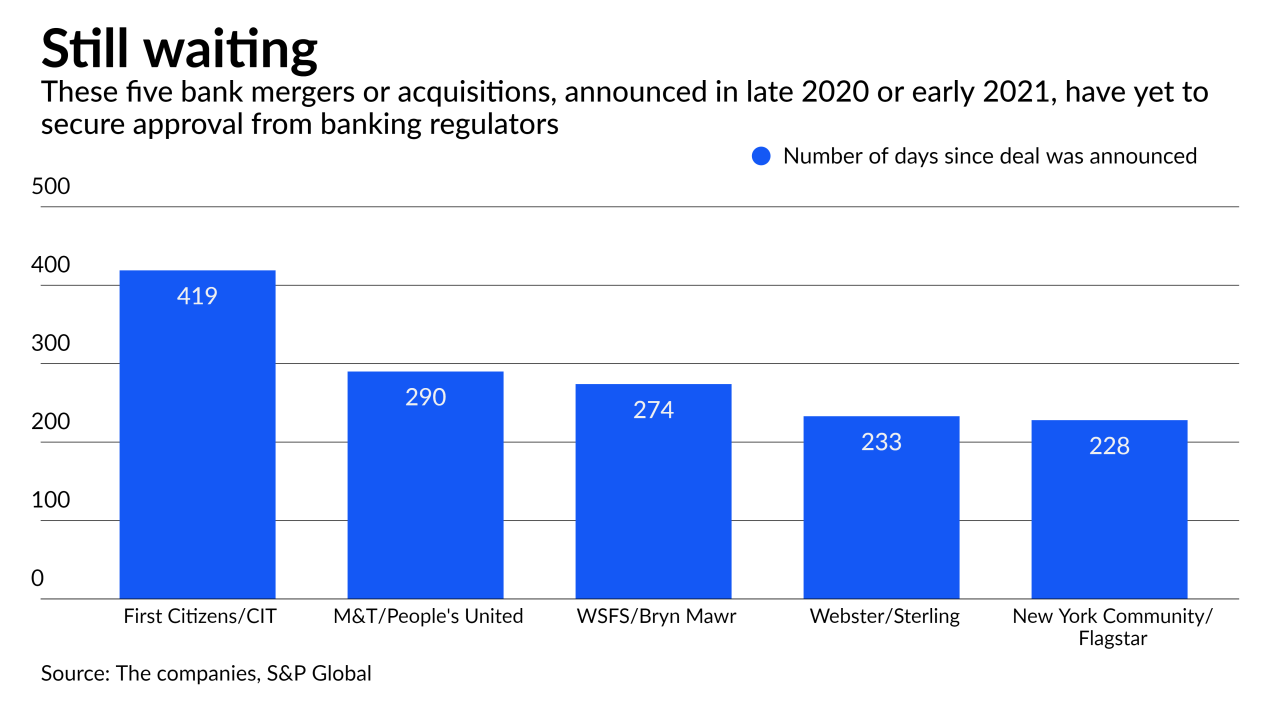

Industry fears that regulators were souring on bank mergers have eased somewhat after the Federal Reserve finally signed off on WSFS Financial’s acquisition of Bryn Mawr Bank and several other deals that had been awaiting the green light.

By Jim DobbsDecember 23 -

Eli Tinsley, the bank's chief banking officer, was promoted to president and chief executive.

By Jim DobbsDecember 21 -

The Oklahoma bank is eager to take the ground some competitors are ceding in oil and gas financing.

By Jim DobbsDecember 21 -

The Arkansas bank is working with 10 universities' athletic departments to create programs for women it hopes will one day join its ranks.

By Jim DobbsDecember 16 -

An investor who holds nearly 10% of Pacific Enterprise Bancorp shares urged others to oppose BayCom Corp’s $53 million acquisition offer, arguing that the price was too low. Despite this, a majority of both banks' shareholders voted in favor of the deal.

By Jim DobbsDecember 14 -

The National Association of Federally-Insured Credit Unions' new campaign highlights $243 billion in fines slapped on Wall Street banks. The group says it's responding to political attacks, but the banking industry says NAFCU is trying to distract from criticism of its tax exemption.

By Ken McCarthyDecember 13 -

The Atlanta bank said the deal will accelerate its small-business and commercial and industrial lending while expanding its presence in point-of-sale financing.

By Jim DobbsDecember 13 -

The $85 million acquisition of Metro Phoenix Bank would more than double Alerus Financial’s loans and deposits in the nation’s fifth-largest city.

By Jim DobbsDecember 9 -

Bankers say the Biden administration’s call for regulatory greater scrutiny of mergers and acquisitions is causing holdups and could slow dealmaking activity in 2022.

By Jim DobbsDecember 7 -

The new omicron strain is prompting more financial institutions to extend mask mandates in the workplace and remote work schedules.

By Jim DobbsDecember 2 -

The Denver company said it would pay $56 million for Legacy Bank in Colorado and pick up nearly $500 million of assets.

By Jim DobbsDecember 1 -

Borrowers expect the Federal Reserve to raise interest rates next year to contain soaring prices and are locking in favorable terms now, bankers say.

By Jim DobbsNovember 24 -

The buyer said it would enter two of Wyoming’s largest markets and expand in Nebraska and Colorado with the purchase.

By Jim DobbsNovember 22 -

Buying Spirit of Texas would give the Arkansas company access to the Austin, San Antonio and Houston markets and make it a bigger player in the fast-growing south-central U.S.

By Jim DobbsNovember 19 -

The retired Laurence Bensignor is prohibited from working for “any insured depository institution or any holding company of an insured depository institution” because of his failure to disclose key information about an alleged insider-loan scheme, the Federal Reserve says.

By Jim DobbsNovember 16