-

HoldCo Asset Management, which gains two board seats from a standstill agreement, had expressed disappointment that the Boston company hired a CEO instead of pursuing a sale.

By Jim DobbsMarch 8 -

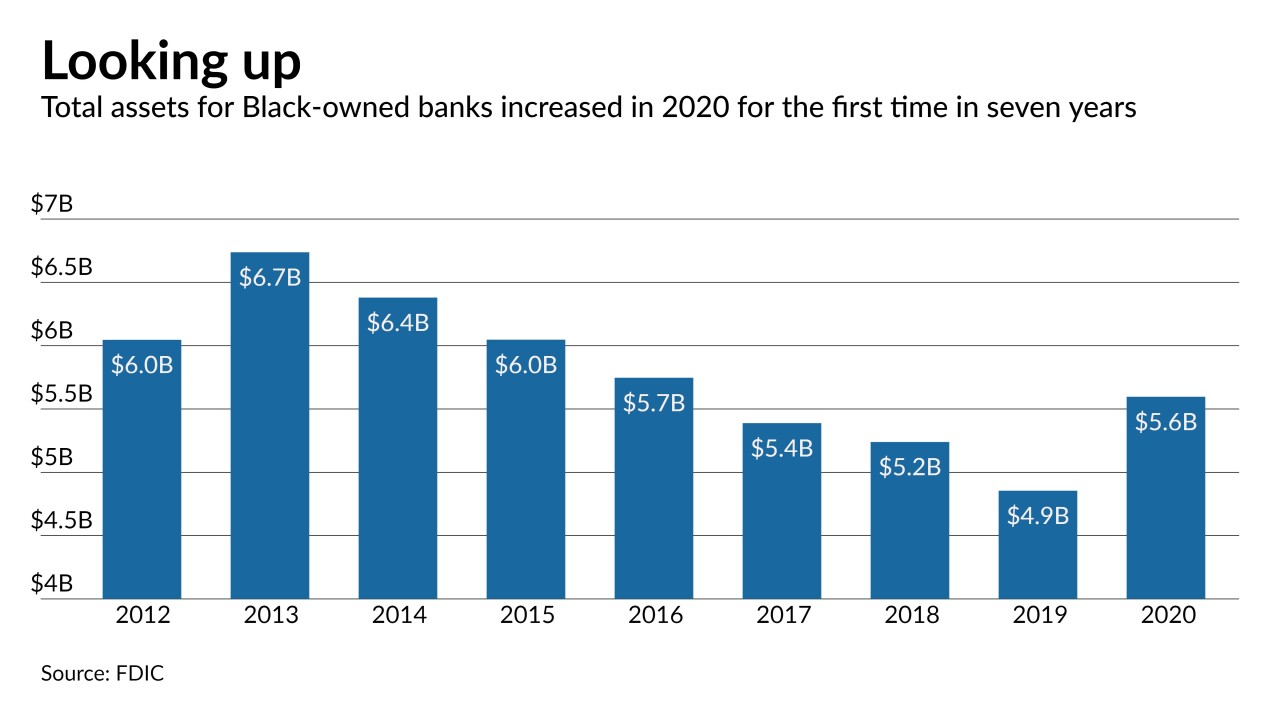

Six startups that seek to cater to Black and Hispanic consumers outside the financial mainstream are attracting heavy interest from investors. However, the new banks will vie with megabanks eyeing those same customers and with established minority-owned institutions suddenly brimming with new capital.

By Jim DobbsMarch 4 -

Community banks, which for years have relied heavily on commercial real estate lending, have been tightening underwriting standards, conducting more frequent loan reviews and stepping back from certain subsectors to minimize their credit exposure.

By Jim DobbsFebruary 28 -

Soybean, corn and wheat are trading at their highest levels since 2014, meaning farmers are more likely to catch up on loan payments and pursue expansions that require them to take out more loans.

By Jim DobbsFebruary 25 -

The founder of Commerce Bank in New Jersey and Metro Bank in the United Kingdom has served as Republic First's chairman since 2016.

By Jim DobbsFebruary 24 -

Hildene Capital, which is pressuring CIB Marine to issue subordinated debt to redeem preferred stock, has nominated two individuals to stand for election to the company's board.

By Jim DobbsFebruary 24 -

HoldCo Asset Management wrote in a letter to the Boston company's chairman that it also wants the board to consider share repurchases to improve shareholder value.

By Jim DobbsFebruary 9 -

When its proposed sale to Suncoast Credit Union fell through, Apollo Bank decided to step up commercial lending and revamp its digital offerings in anticipation of an economic rebound in South Florida.

By Jim DobbsFebruary 8 -

The paucity of distressed-loan sales indicates that most bankers are confident about the underlying health of their portfolios even as the pandemic lingers and loss reserves remain elevated.

By Jim DobbsFebruary 3 -

For now, banks say they have no plans to curtail lending to oil and gas firms, but recent moves by the new administration — including a halt in drilling on federal land and an effort to stop the Keystone XL Pipeline — could cause them to re-evaluate their long-term commitment to the fossil fuel industry.

By Jim DobbsJanuary 31 -

The Federal Reserve said its decision to accept input for several more weeks reflects the logistical challenges presented by the coronavirus pandemic.

By Jim DobbsJanuary 29 -

Stock Yards Bancorp in Louisville says it would pay $190 million in cash and stock for Kentucky Bancshares.

By Jim DobbsJanuary 27 -

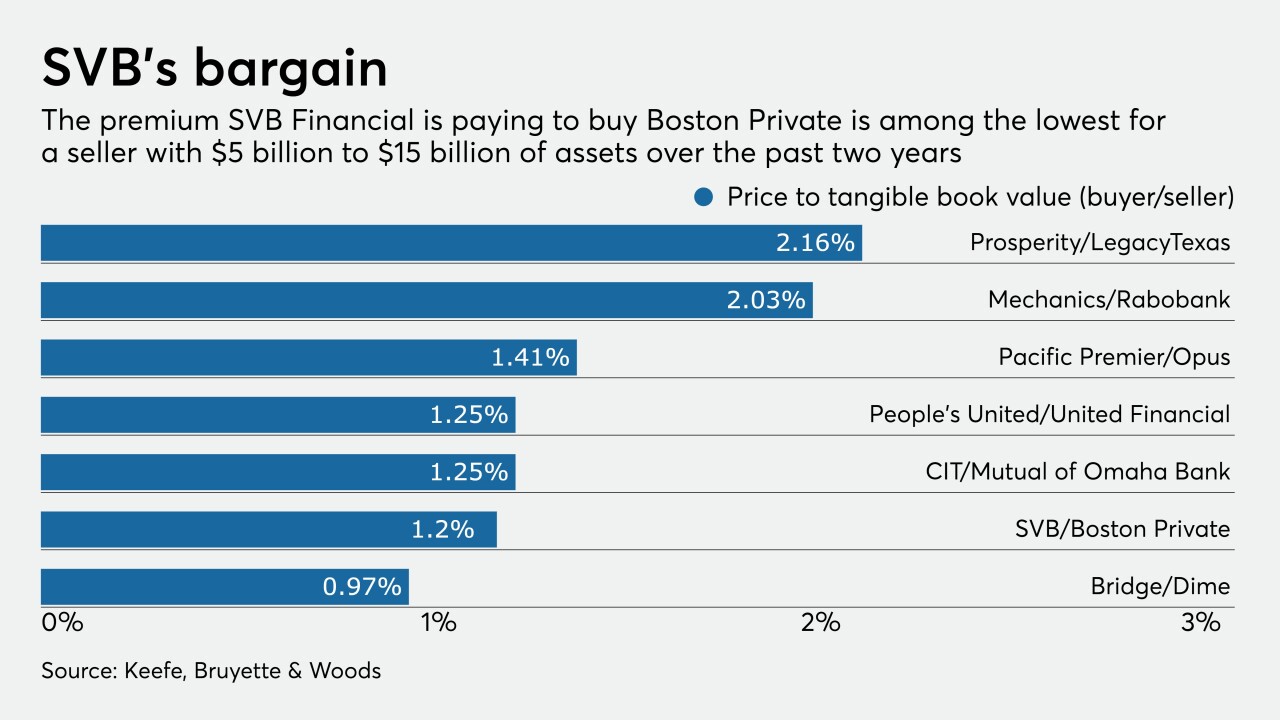

The investment fund HoldCo Asset Management said the $900 million price tag of the agreement with SVB Financial Group “substantially undervalues” Boston Private Financial Holdings.

By Jim DobbsJanuary 27 -

Mergers and acquisitions were largely on ice in 2020, but banks' mounting need to control expenses and invest heavily in technology could spur a comeback this year.

By Jim DobbsJanuary 24 -

Pandemic-induced shifts in how people work and bank will allow the Tennessee company to shed more branches and office space. It now projects it will slash expenses by an additional $30 million a year.

By Jim DobbsJanuary 22 -

Payments activity “snapped back” in the fourth quarter and should lift revenue the next few quarters, CEO Brian Moynihan said.

By Jim DobbsJanuary 19 -

Robert Kafafian says he's hearing more MOE chatter now than at any time in his decades-long career as a consultant. He cited smaller banks' need to cut costs, improve tech offerings and compete with bigger lenders.

By Jim DobbsJanuary 13 -

Bank stocks have climbed because of expectations that the change of power in Washington will hasten vaccine distribution and speed the economic recovery. The boost could give executives more flexibility to pursue acquisitions or make other strategic moves.

By Jim DobbsJanuary 11 -

HoldCo Asset Management wants more details about the banking company’s pending merger with SVB Financial. The shareholder's concerns center on payouts to the seller's management team and questions about the sale process.

By Jim DobbsJanuary 6 -

Acquiring Boston Private could put the parent company of Silicon Valley Bank years ahead of schedule in catering to the investment needs of high-tech and biomedical clients, whose industries have thrived during the pandemic.

By Jim DobbsJanuary 5