John Reosti is a reporter covering community banks in particular and the financial services industry in general. He also focuses on the Small Business Administration, the National Credit Union Administration Board and issues connected to the CECL accounting standard.

-

American State would be the largest bank buyout for Equity, which has acquired 17 banks since 2003.

By John ReostiMay 17 -

Michael Butler relied on partnerships with tech startups in areas such as checking and mobile banking to turn Radius into a digital-only bank before its sale to LendingClub. As the new CEO of Grasshopper Bank, he plans to strike similar deals to expand beyond business lending.

By John ReostiMay 14 -

Princeton Portfolio Strategies Group would become the sixth asset management business that the New Jersey banking company has bought since 2014.

By John ReostiMay 13 -

The Pennsylvania company will offer commercial loans and treasury management services after hiring bankers in Dallas and Orlando.

By John ReostiMay 12 -

The change reflects the name of the Susser family, which bought the bank in 2018.

By John ReostiMay 12 -

The Denver company, which has branches in El Paso, will gain more locations in cities such as Dallas and Austin with the pending purchase.

By John ReostiMay 12 -

Less than two years after shutting down its biggest business amid fraud allegations, the Michigan company has sold branches, settled a shareholder lawsuit and returned to profitability under turnaround specialist Thomas O’Brien.

By John ReostiMay 7 -

The head of government guaranteed lending at WSFS, Caruso aims to parlay the bank's success with Paycheck Protection Program lending to better serve early-stage small businesses.

By John ReostiMay 5 -

The Paycheck Protection Program has about $8 billion remaining, with those funds earmarked for community development financial institutions, minority depository institutions and other mission-driven lenders.

By John ReostiMay 5 -

With the Paycheck Protection Program likely winding down at the end of the month, many lenders are seeing heightened demand for the Small Business Administration’s 7(a) and 504 loans.

By John ReostiMay 3 -

The Arkansas bank is turning to asset-based lending and loans to venture capital and other investment groups to help fill a void created by a shortage of new, big-ticket commercial real estate deals.

By John ReostiApril 28 -

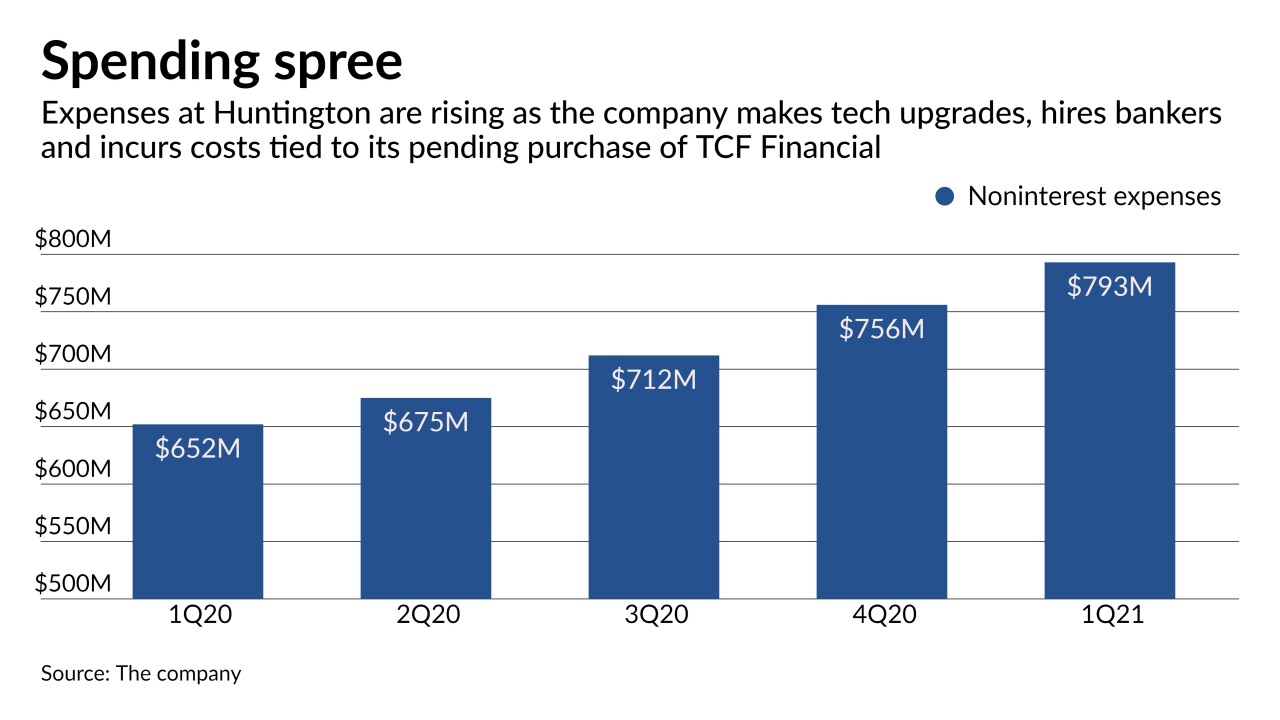

The Ohio regional took advantage of an unexpected boost in interest income in the first quarter to upgrade its digital platform and recruit bankers in wealth management, capital markets and Small Business Administration lending.

By John ReostiApril 22 -

The legislation, led by Sen. Ben Cardin, D-Md., would qualify many farmers, ranchers and self-employed Americans for more Paycheck Protection Program funds.

By John ReostiApril 21 -

The Cleveland company had a strong quarter for investment banking as midsize companies raised capital to fund growth initiatives. Executives expressed confidence that such activity will translate into more loans over the second half of 2021.

By John ReostiApril 20 -

The Connecticut company has struggled to put deposits from its health savings account business to work across the Northeast. Buying Sterling Bancorp for $5 billion will provide Webster with new opportunities in a number of business lines, including asset-based lending and equipment finance.

By John ReostiApril 19 -

The Arkansas company, once a prolific acquirer, last bought a bank in 2017 but now has three M&A deals in the works as it seeks new sources of growth.

By John ReostiApril 16 -

The San Francisco company has now backed 11 minority-owned banks as part of a $50 million pledge it announced last year.

By John ReostiApril 13 -

When it was launched a year ago, the program was criticized for glitches and a focus on larger borrowers. Since then technical improvements have been made, smaller loans have been prioritized, and other changes favored by lenders have been implemented.

By John ReostiApril 13 -

The Mississippi company has never done a deal this large. But buying Houston-based Cadence would take it into high-growth markets and reduce both companies' concentrations in sectors such as energy, dining and hospitality.

By John ReostiApril 12 -

Valley National wanted to become more customer friendly, while Washington Federal needed more commercial clients. The leaders of those companies recently discussed the tough decisions they made to bring about much-needed change.

By John ReostiApril 9