John Reosti is a reporter covering community banks in particular and the financial services industry in general. He also focuses on the Small Business Administration, the National Credit Union Administration Board and issues connected to the CECL accounting standard.

-

The Arkansas bank is selling two South Carolina branches to a credit union just two weeks after announcing plans to divest its branches in Alabama.

By John ReostiJuly 16 -

Greater Nevada Credit Union, like a number of community banks, agreed to sell its Paycheck Protection Program loans to avoid having to navigate the complicated forgiveness process.

By John ReostiJuly 15 -

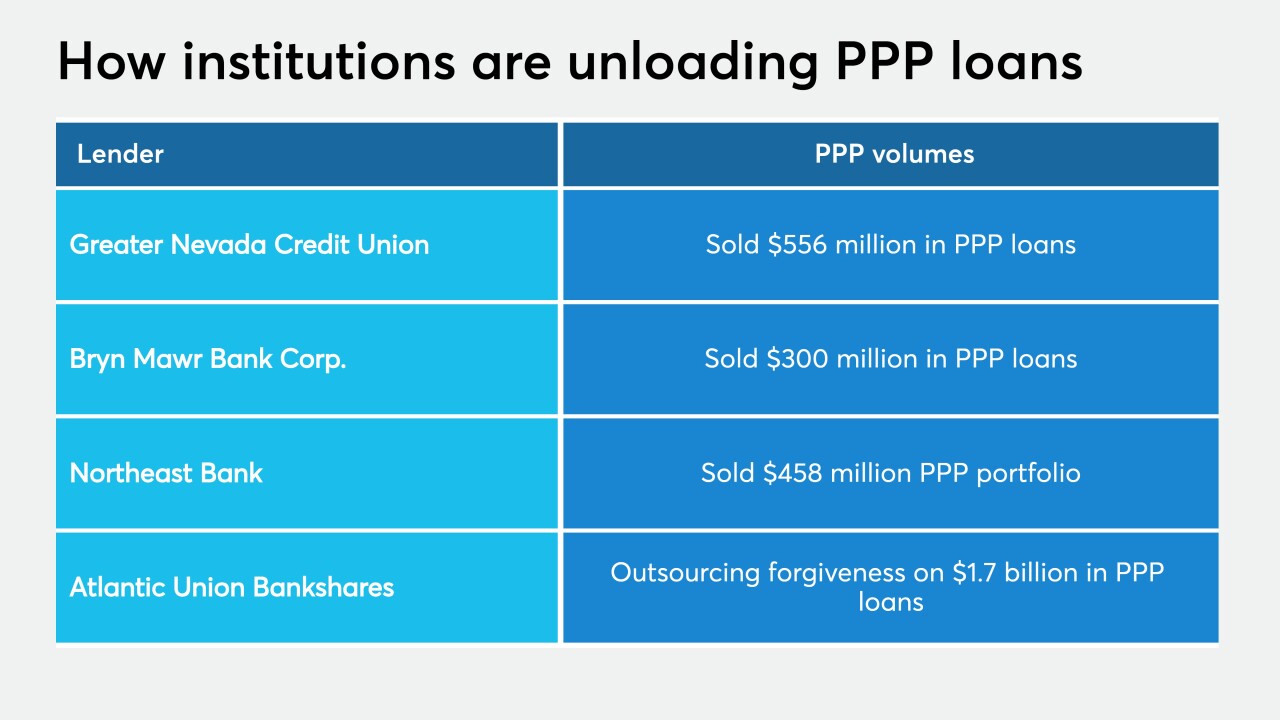

A growing number of lenders are unloading loans made through the Paycheck Protection Program.

By John ReostiJuly 15 -

Pedro Bryant will oversee a $3 million effort to fund small businesses in disadvantaged communities.

By John ReostiJuly 14 -

For all banks' claims that credit unions pose a threat to their commercial lending market share, they've accounted for just 2% of volume in the Paycheck Protection Program.

By John ReostiJuly 13 -

For all banks' claims that credit unions pose a threat to their commercial lending market share, they've accounted for just 2% of volume in the Paycheck Protection Program.

By John ReostiJuly 10 -

Russell Golden, who just stepped down from the Financial Accounting Standards Board, says he wants to be remembered for encouraging open discourse over new rules and efforts to simplify financial accounting.

By John ReostiJuly 7 -

The New York-area companies' $489 million agreement runs counter to recent merger pacts built around branch cuts and more tech spending.

By John ReostiJuly 5 -

Lenders are selling their Paycheck Protection Program loans or hiring outside companies to navigate the process in an effort to reduce risk and avoid overloading their employees.

By John ReostiJune 30 -

Eric Luse, who co-founded the Luse Gorman law firm, helped Community Bank Shares of Indiana create the first MHC in the early 1990s.

By John ReostiJune 29 -

The Loan Source, the nonbank lender buying the Paycheck Protection Program loans, has similar deals in place with other lenders.

By John ReostiJune 26 -

Nearly 900 institutions are set to receive a payout related to the demise of Southwest Corporate FCU, but the agency could ultimately return as much as $2.5 billion tied to the corporate credit union failures of 2009 and 2010.

By John ReostiJune 25 -

The movement encouraging investment in banks run by African American management teams gained huge momentum in recent weeks, but a spat between one of those lenders and an activist investor highlights the potential downside.

By John ReostiJune 24 -

The Paycheck Protection Program put a premium on speed in processing and funding loans.

By John ReostiJune 23 -

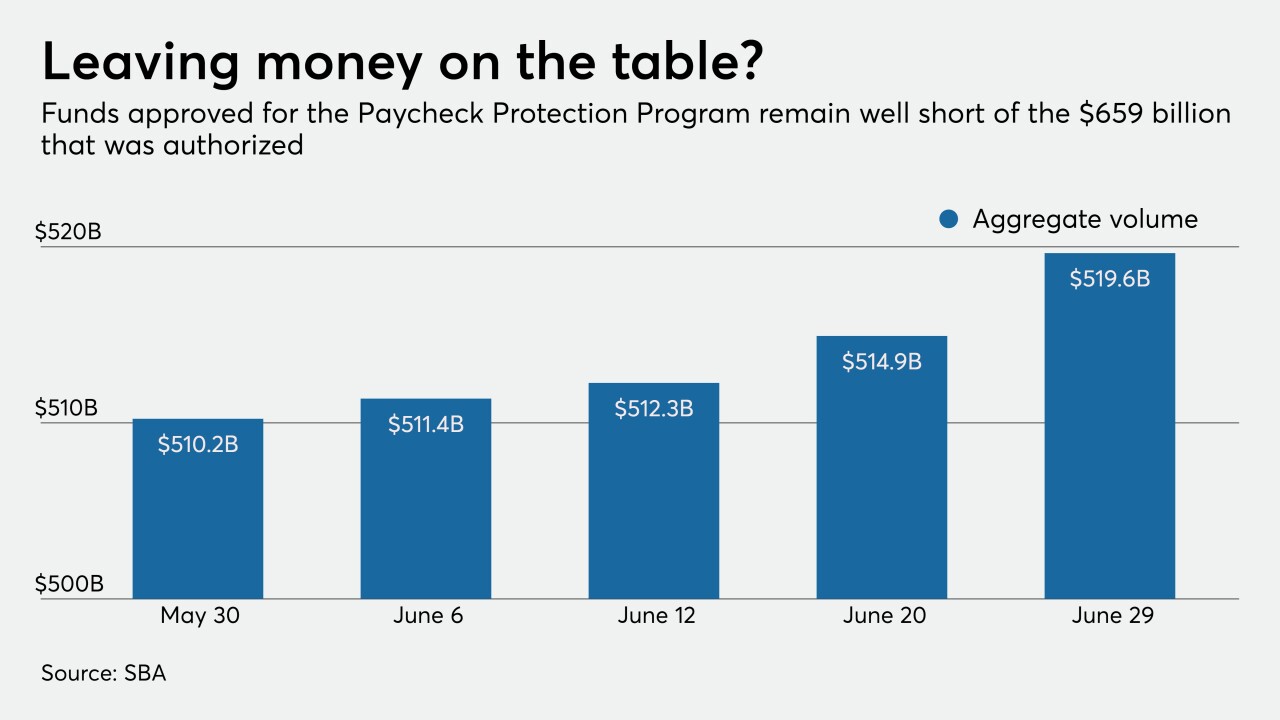

Activity in the Paycheck Protection Program has waned, but some argue that many small businesses, especially those owned by minorities, will miss out if the June 30 application deadline isn't extended.

By John ReostiJune 19 -

Shelter-in-place orders have given homeowners the time to pursue upgrades and repairs, and banks are seizing the opportunity to help finance the projects.

By John ReostiJune 16 -

Uwharrie Capital in North Carolina and Valley National in New York used their community connections to seek out small companies in need of loans from the Paycheck Protection Program. They found plenty of them.

By John ReostiJune 12 -

Activity in the Paycheck Protection Program has slowed in recent weeks, but Customers Bancorp and Fountainhead Capital continue to pursue loans aggressively in hopes of developing long-term borrower relationships.

By John ReostiJune 9 -

The challenger bank OakNorth has been peddling its lending platform to U.S. banks for a year. When it saw COVID-19 on the horizon, it retooled to include a ratings system predicting how borrowers will be affected by the pandemic.

By John ReostiJune 5 -

Bankers said legislative fixes to the small-business rescue program should help more borrowers secure loan forgiveness, though new demand will likely remain tepid because the process is still extremely cumbersome.

By Paul DavisJune 5