Ken McCarthy is a reporter at Credit Union Journal, and a former reporter for American Banker and S&P Global Market Intelligence.

-

The National Credit Union Administration backed off measures that would have let credit unions sign up members in areas where they have ATMs and online services, but no branches. The move was seen as a partial victory for banks, though the matter could ultimately be decided by Congress.

By John ReostiNovember 18 -

Tina Dix, the chief executive of OUR Credit Union in Royal Oak, will step aside in July. The $365 million-asset credit union has retained a search firm to find her successor.

By Ken McCarthyNovember 16 -

Bob Gallman has worked in the credit union industry for more than 45 years and has been at the helm of the league since 2017.

By Ken McCarthyNovember 12 -

The expectation that people will want social distancing and ever-expanding digital banking options well after the pandemic passes is informing branch architecture at banks and credit unions.

By Ken McCarthyNovember 12 -

Michigan State University Federal Credit Union would be one of the first credit unions to pay eligible players on the MSU team to use their name, image and likeness in exchange for endorsements.

By Ken McCarthyNovember 11 -

Kevin Jones, the longtime leader of MidFlorida Credit Union — one of the largest credit unions in Florida — will retire March 1. He will be succeeded by S. Steve Moseley, who was MidFlorida’s president for the past four years.

By Ken McCarthyNovember 9 -

Wellby, Powered by JSC Federal Credit Union has named Martyn Pell as its president and CEO. He most recently was chief lending officer at Coastal Federal Credit Union in North Carolina.

By Ken McCarthyNovember 8 -

The $457 million-asset Heritage Credit Union in Deforest has agreed to merge with the $3.7 billion-asset Connexus Credit Union in Wausau, forming a company with more than 420,000 members.

By Ken McCarthyNovember 5 -

Financial institutions say it would require them to overhaul their payments technology, deprive them of revenue and force them to pass added costs on to merchants and consumers.

By Ken McCarthyNovember 4 -

The $8.7 billion-asset credit union has cut its charge for overdrafts from $25 to $5, following similar reductions by other financial institutions.

By Ken McCarthyNovember 2 -

Since the pandemic began, many members of small credit unions have defected to banks that offer better digital products and services. The credit unions are focusing on in-person banking or catering to small businesses and other niches to rebuild their customer base.

By Ken McCarthyNovember 1 -

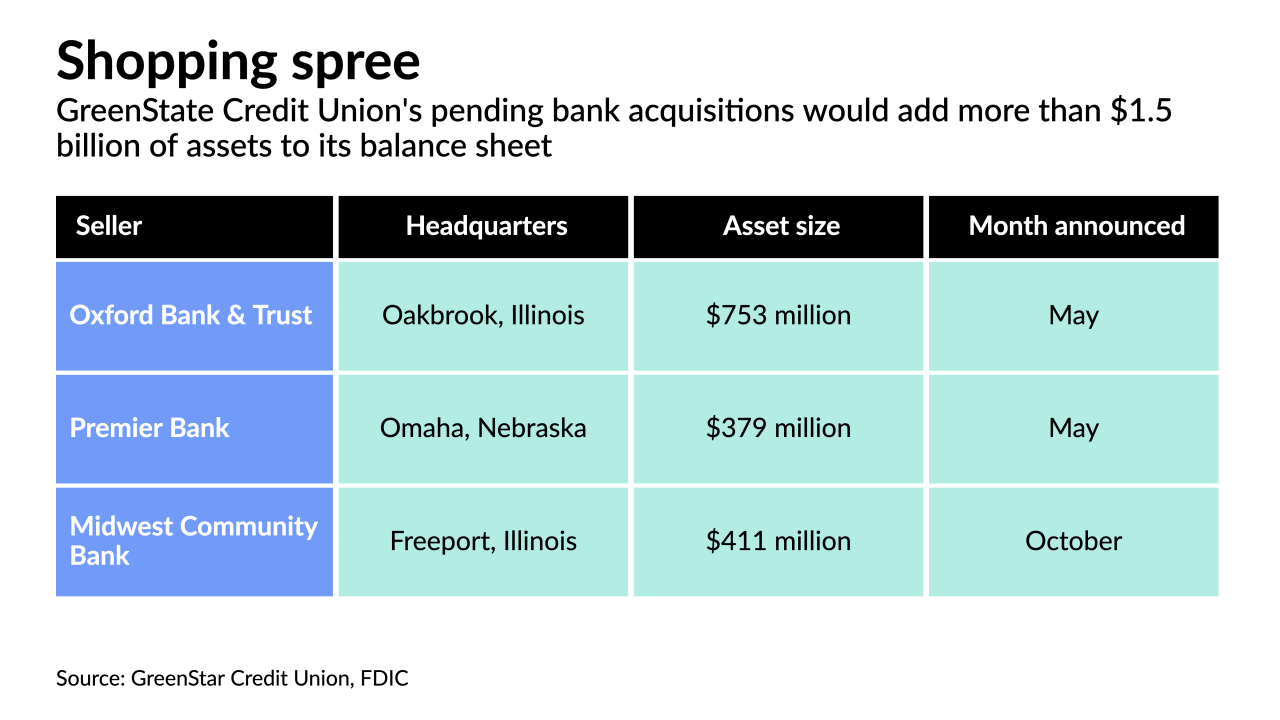

GreenState Credit Union has announced three bank deals this year. Its CEO says purchasing banks can be easier than merging with rival credit unions, though the state's banking regulator has made it difficult to do so within Iowa.

October 28 -

The National Credit Union Administration has approved Capital Federal Credit Union in Lubbock, Texas, to serve people of color and underserved communities in its state.

By Ken McCarthyOctober 27 -

The Concord-based credit union has hired Anthony Emerson as its next president and chief executive. He was most recently leader of IC Federal Credit Union in Massachusetts.

By Ken McCarthyOctober 27 -

Brett Noll was most recently CEO of Securityplus Federal Credit Union in Baltimore.

By Ken McCarthyOctober 26 -

Both Florida State University Credit Union and Florida Department of Transportation Credit Union are based in Tallahassee.

By Ken McCarthyOctober 26 -

Mark Drinnon succeeds Beverly Boling, who retired from the CEO role in September.

By Ken McCarthyOctober 25 -

The National Credit Union Administration's board made a quick adjustment to its subordinated debt rule after critics warned it could harm lenders that serve minority communities.

By Ken McCarthyOctober 22 -

The National Credit Union Administration adopted a rule that allows credit union service organizations to offer a wider range of loans over the objections of agency Chairman Todd Harper, who said it risks deposit insurance losses.

By Ken McCarthyOctober 21 -

The industry generally likes a National Credit Union Administration plan that would count Treasury funds as secondary capital. But it opposes the exclusion of 30-year investments under the the Emergency Capital Investment Program, which credit unions say are essential to revitalizing Black and Hispanic communities.

By Ken McCarthyOctober 20