Kevin Wack is American Banker's national editor, and is based in southern California. He was formerly the publication's consumer finance reporter and its Capitol Hill correspondent. Earlier, he worked on financial policy in Washington. He has also reported for the Associated Press and worked as the investigative reporter for the Portland Press Herald in Maine.

-

The recent decision involved sales taxes, but Wells Fargo recorded a net expense of $481 million under the assumption that it will also lead to higher state income taxes. Other banks may have to follow suit.

By Kevin WackJuly 18 -

The New York-based online lender is turning to two European banks to fund loan growth in its overseas markets.

By Kevin WackJuly 18 -

The appointment of David Solomon, who will take over for retiring CEO Lloyd Blankfein, has not altered the bank's aggressive plan to build a mobile phone-based bank for consumers in the U.S. and beyond.

By Kevin WackJuly 17 -

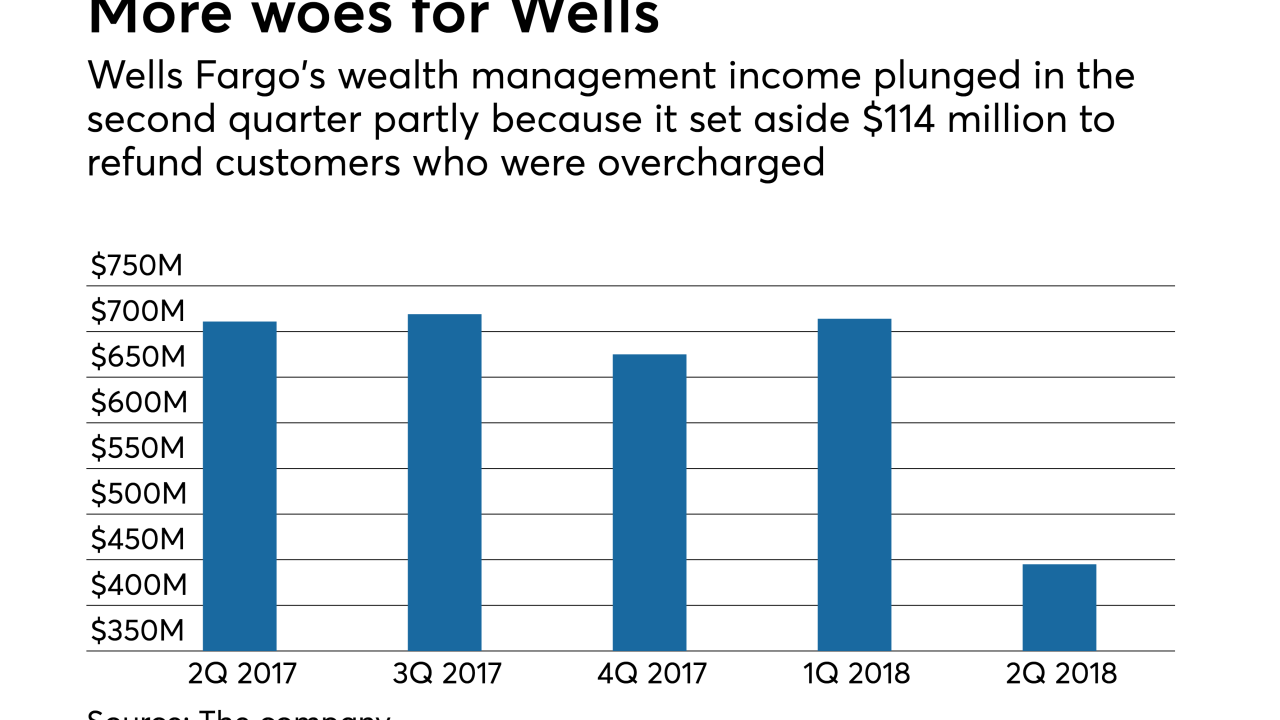

The unit’s profits plunged in the second quarter as the company contended with the fallout from overcharging wealth management clients. Was it a one-off or the beginning of a long-term problem?

By Kevin WackJuly 13 -

The Senate bill, designed to close a loophole in the state's interest rate cap and was closley monitored by the Ohio Credit Union League, must still be reconciled with a similar measure that was passed by the Ohio House of Representatives.

By Kevin WackJuly 11 -

The Senate bill, designed to close a loophole in the state's interest rate cap, must still be reconciled with a similar measure that was passed by the Ohio House of Representatives.

By Kevin WackJuly 10 -

Mayor Eric Garcetti signed an ordinance Monday that establishes new requirements for banks that want to do business with the city. The rules are thought to be the first of their kind nationally.

By Kevin WackJuly 10 -

A new court filing suggests that Stephen Calk was named to a 13-member economic advisory team in 2016 in exchange for approving a $9.5 million loan to former campaign manager Paul Manafort.

By Kevin WackJuly 6 -

A first-in-the-nation ordinance, passed by the city council in the wake of the Wells Fargo scandal, would require banks that want the city’s business to reveal if they have sales quotas for employees. It remains to be seen, though, whether Mayor Eric Garcetti will sign the measure into law.

By Kevin WackJuly 3 -

Under a consent order with Texas and seven other states, the Atlanta-based credit reporting firm agreed to shore up its information security efforts, but it will not have to pay any financial penalties.

By Kevin WackJune 27