Kevin Wack is American Banker's national editor, and is based in southern California. He was formerly the publication's consumer finance reporter and its Capitol Hill correspondent. Earlier, he worked on financial policy in Washington. He has also reported for the Associated Press and worked as the investigative reporter for the Portland Press Herald in Maine.

-

The OCC said that branches in New York, Los Angeles and Chicago will be required to take certain corrective actions, but it did not hit the Japanese-owned bank with any financial penalties.

By Kevin WackFebruary 22 -

The company will shutter the offices it inherited when it bought EverBank in 2017 and focus on lending to existing customers through digital channels. U.S. Bank will assume the leases on about 25 properties.

By Kevin WackFebruary 21 -

The results suggest that consumers who buy Green Dot cards are using them with greater frequency or for longer periods of time than they have in the past.

By Kevin WackFebruary 20 -

Congressional investigations are often rushed affairs that fail to dig beneath the surface. But the hiring of a veteran investigator who has tangled with Deutsche in the past suggests that this politically charged inquiry is likely to be thorough.

By Kevin WackFebruary 20 -

The online consumer lender trimmed its losses in the fourth quarter and says an adjusted, non-GAAP metric suggests it's on the path to getting out of the red later this year.

By Kevin WackFebruary 19 -

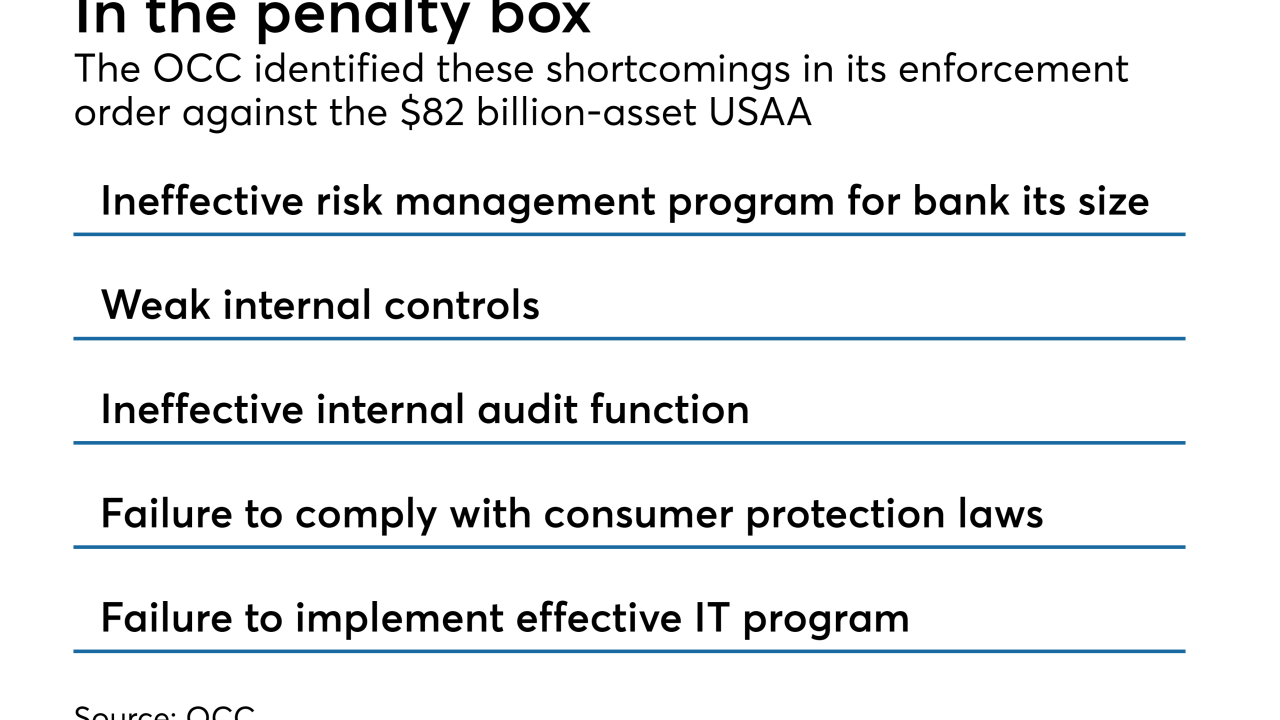

The enforcement action from the OCC comes on the heels of a CFPB consent order that said USAA reopened customers' accounts without consent and neglected stop-payment requests.

By Kevin WackFebruary 15 -

They all agree that legislation is needed, but the two approaches being offered are exposing tensions.

By Kevin WackFebruary 14 -

New research from the New York Fed found that banks with more than $50 billion of assets originate more subprime car loans than small banks and credit unions do.

By Kevin WackFebruary 12 -

The installment lender, which bills itself as an alternative to payday lenders, targets underserved communities and operates through a network of retail partners.

By Kevin WackFebruary 12 -

The stars aligned for the two longtime rivals to join forces, and some observers speculate that other regional banks will need to strike similar partnerships if they hope to remain competitive. But others say such deals are rare because they're hard to pull off.

By Kevin WackFebruary 7