Michael Moeser is an Austin, Texas-based senior content strategist for Arizent. He has over 25 years of payments and consulting industry experience working in executive roles at Visa, Capital One, McKinsey, Javelin Strategy, and Ondot Systems. He has an MBA in Entrepreneurship from DePaul University’s Kellstadt Graduate School of Business and a BBA in Finance from University of Michigan’s Ross School of Business.

-

COVID-19 has accelerated the end of cash and pushed digital payments to a new tipping point.

November 18 -

The accelerator has enabled Los Angeles-based fintech Be Money to relaunch itself as Daylight and bring to market a transgender-inclusive preferred name card.

November 18 -

The pilot leverages Keyno’s CVVkey technology that uses a dynamic card verification value 2 (CVV2) code to provide a higher level of security against fraud for online and mobile payments.

November 17 -

The pilot leverages Keyno’s CVVkey technology that uses a dynamic card verification value 2 (CVV2) code to provide a higher level of security against fraud for online and mobile payments.

November 17 -

Truist Financial Corp. has hired Sal Karakaplan to head its newly formed Enterprise Payments Group, which will be responsible for driving and executing a coordinated strategy across Truist’s various payments businesses.

November 16 -

The cross-border e-commerce market is set to pass the $1 trillion mark in 2020, providing a huge addressable market for Afterpay's buy now, pay later expansion.

November 12 -

In a bid to fuel online sales, Barclaycard is partnering with Amazon in Germany to offer installment lending to overcome the country’s low credit card ownership rates.

November 11 -

In a battle between two giants of ride-hailing and payments, Grab beat out Go-Jek to lead a $100 million fundraising round for the Indonesian government-backed e-wallet provider LinkAja.

November 10 -

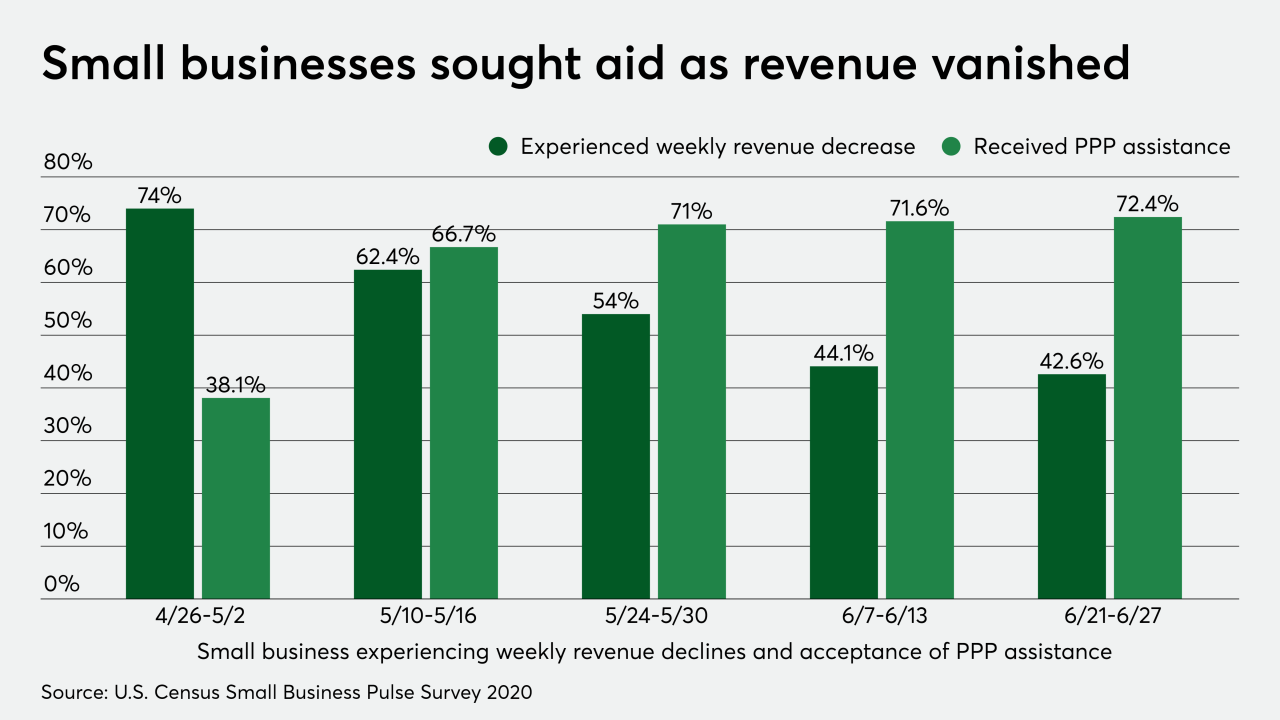

Michael Moeser, Senior Analyst at PaymentsSource, talks to Ginger Siegel, North America Small Business Lead at Mastercard, about how smaller shops are managing through the coronavirus pandemic.

November 10 -

It's not just payment habits that are changing, but the very nature of what people are willing to buy one another.

November 6 -

Crypto played a key role in Square's 140% year-over-year growth in revenue for the third quarter — and 212% growth in gross profit for the Cash App alone.

November 5 -

As the coronavirus pandemic unfolded in early 2020, Visa deployed street-level teams in 66 cities across the U.S. to meet with small-business owners to help them transition to a digital-first world.

November 5 -

São Paulo, Brazil-based payments fintech Conductor Technology has raised $150 million in a private equity round led by Viking Global Investors.

November 3 -

Michael Moeser, Senior Analyst at PaymentsSource, talks to Alex Fisher, Vice President of Retail at Afterpay, an Australian company, about the factors behind the growth of the global 'buy now, pay later' market.

November 3 -

Reflecting the rapid transition to digital payments, PayPal has reported its strongest growth in total payment volume and revenue in its history, coupled with strong growth for Venmo, its P2P app.

November 2 -

While gift cards are often marketed as an easy way to send money to friends and family, during the pandemic they're transforming into a more versatile tool of commerce that can overtake the use cases commonly associated with cash.

October 29 -

Amid the global explosion of e-commerce and demand for digital money transfers, Visa is acquiring YellowPepper to help drive tokenization and real-time payments in Latin America.

October 28 -

Michael Moeser, senior analyst at PaymentsSource, talks to Chris Lybeer, chief strategy officer at Revel, about the trends driving digital payments in the restaurant industry.

October 27 -

Mastercard and PayPal have added to an existing partnership by using Mastercard Send to support immediate access for debit transfers via PayPal's mobile in nine European markets.

October 27 -

Click to Pay is based on EMVCo’s Secure Remote Commerce (SRC) industry standard, acting as a form of guest checkout which alleviates the need for cardholders to manually enter personal and account information to shop at unfamiliar merchants.

October 27