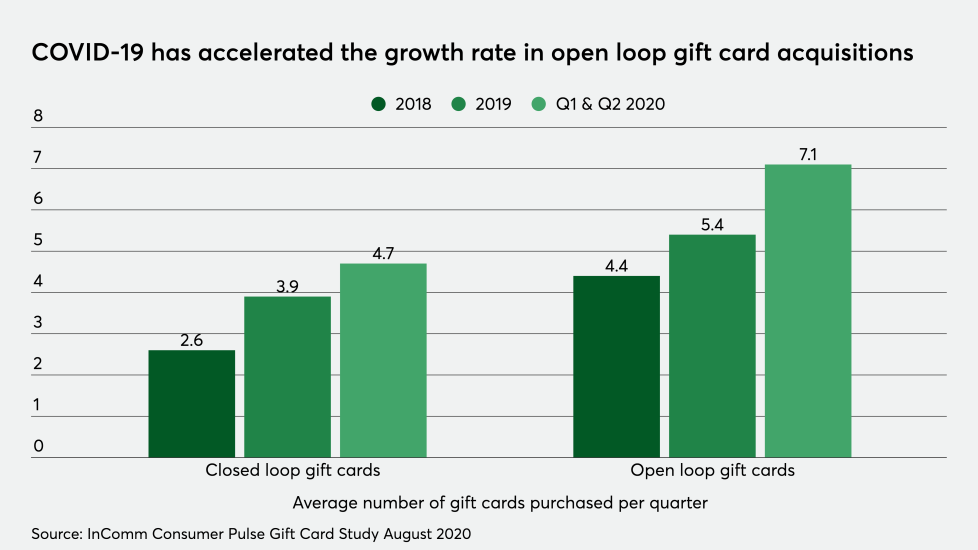

Even as the coronavirus pandemic hammers retail stores, the global gift card market was valued at $619.25 billion in 2019 and is projected to reach $1.92 trillion by 2027, growing at a CAGR of 14.9% from 2020 to 2027, according to

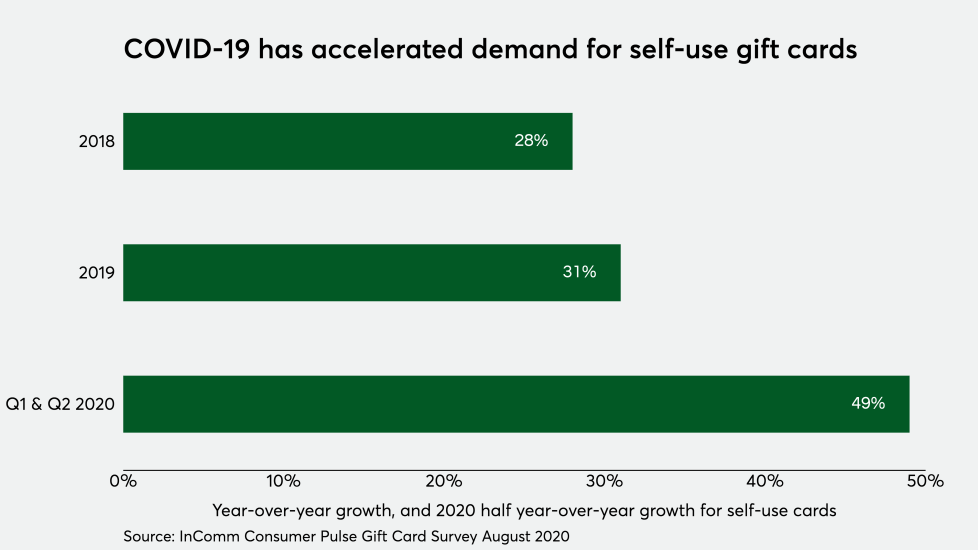

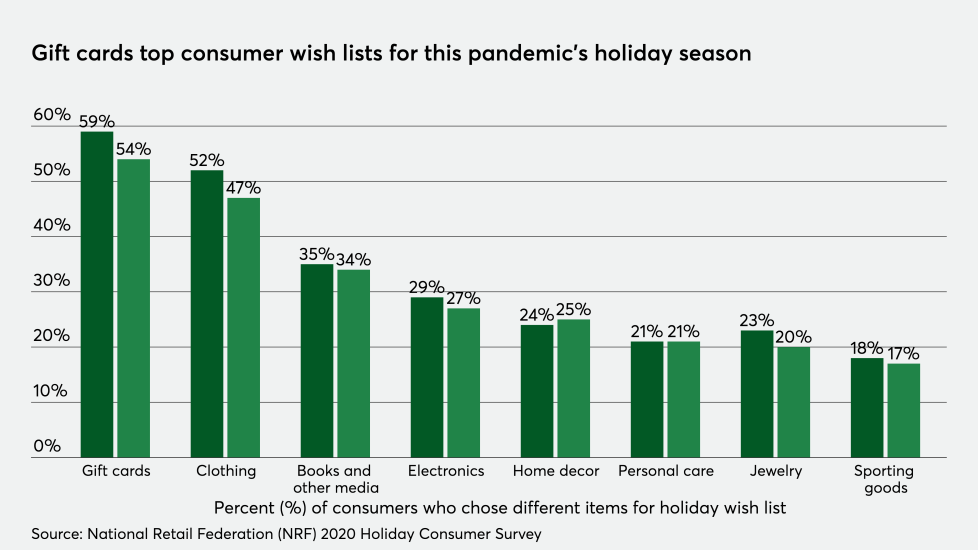

While gift cards are often marketed as an easy way to send money to friends and family, during the pandemic they're transforming into a more versatile tool of commerce that can overtake the use cases commonly associated with cash.

The next six charts reveal insights into the market dynamics of the gift card market and how it is evolving given the COVID-19 pandemic.