Miriam Cross is a Washington-based reporter covering bank technology and fintech at American Banker. Previously, she was an associate editor at Kiplinger's Personal Finance magazine.

-

Personalized advice, embedded finance and virtual branches are among the initiatives financial services companies have on their drawing boards for the coming year.

By Miriam CrossJanuary 4 -

First Premier Bank in South Dakota revamped its online sign-up process to allow customers to name the banker who referred them. This helps bankers overcome their reluctance about digital accounts and lets them start relationships with new customers.

By Miriam CrossDecember 30 -

The mission of the North Carolina company, founded by banks to archive digital images of checks, has evolved over the last 20 years. It is migrating to a public cloud to help it expand beyond check services.

By Miriam CrossDecember 22 -

PNC, Bank of America, JPMorgan, Wells Fargo and Citi have all introduced automated projections for commercial clients in recent months. Fintechs that cater to small businesses had pioneered the niche.

By Miriam CrossDecember 17 -

Asenso Finance and a community development financial institution, the National Asian American Coalition, have developed a loan aimed at borrowers with limited credit histories. The underwriting relies in part on alternative data and borrowers are required to take financial literacy courses.

By Miriam CrossDecember 15 -

The fintech, which provides crypto custody services to financial institutions and recently obtained a national trust bank charter, will use its Series D funding to increase the size of its team and strengthen its infrastructure.

By Miriam CrossDecember 15 -

Banks in Mastercard's True Name program, which allows transgender and nonbinary customers to get cards bearing their preferred name, often use those customers' legal names elsewhere. Three challenger banks have made adaptations to achieve greater consistency across all communication channels.

By Miriam CrossDecember 9 -

By acquiring First Sound Bank in Seattle, the fintech would control the strategic direction of the combined company and won't have to share revenue, CEO Luvleen Sidhu says.

By Miriam CrossDecember 6 - AB - Technology

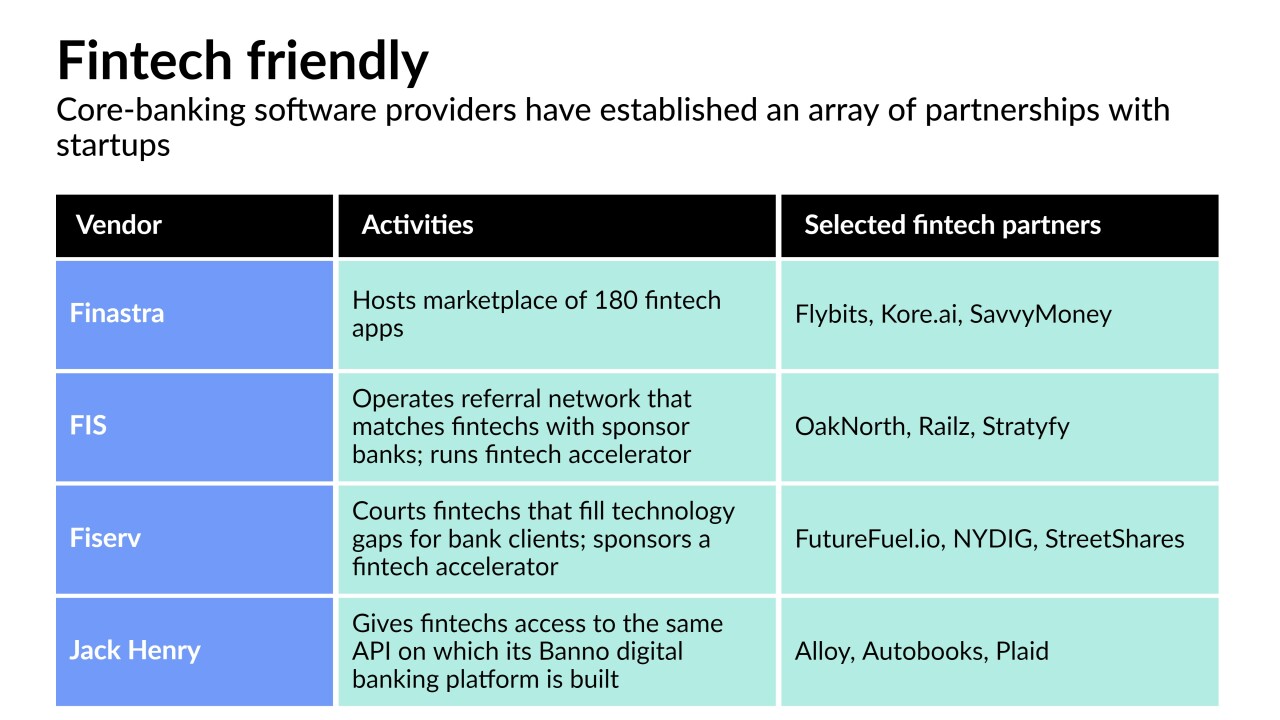

Fiserv, FIS, Jack Henry and Finastra, the top U.S. core banking software providers, are stepping up efforts to let banks plug innovative technology from younger fintechs into their legacy systems.

By Miriam CrossDecember 2 -

The New York Innovation Center aims to help central banks to explore cutting-edge financial technologies and ways for supervision to keep pace with them.

By Miriam CrossDecember 1 -

The regional banks are moving past old-school collection calls, instead using emails, texts and on-screen messages to urge delinquent customers to repay debt. Modern communications are said to be more efficient and in keeping with Consumer Financial Protection Bureau debt-collection rules set to take effect Nov. 30.

By Miriam CrossNovember 22 -

Lincoln Parks at Heritage Bank in Georgia built from scratch its social media following, a digital-only way to open accounts and (in 48 hours) a Paycheck Protection Program lending system. For these and other efforts, Parks is a runner-up for American Banker’s Digital Banker of the Year.

By Miriam CrossNovember 16 -

The way merchants handle payments is becoming just as important as the actual business they're in, says Jeremy Balkin, global head of innovation and corporate development at J.P. Morgan Payments.

By Miriam CrossNovember 12 -

Hispanic adults are underbanked compared with their white counterparts, according to the Federal Reserve. Challenger banks such as Tend and Viva First are reaching out to this population with bilingual services and low-cost money transfers.

By Miriam CrossNovember 4 -

Accrue Savings is introducing a savings account that is tied to specific retailers, allowing customers to gradually accumulate the amount they need to buy an item and earn cash rewards for making progress toward their goals.

By Miriam CrossNovember 3 -

FV Bank will let users hold crypto and traditional currencies in the same account. It says it can do that because it’s licensed in the U.S. territory as a bank and a digital-asset custodian.

By Miriam CrossNovember 1 -

These venture capital firms are investing in young companies that could help small financial institutions meet their growing technology needs.

By Miriam CrossOctober 26 -

The California bank is directing $30 million to Stride Funding, a provider of flexible student-payment options, to finance deferred tuition for participants in a technology upskilling program.

By Miriam CrossOctober 21 -

The bank says it's an investor in and will refer clients to Trovata, which gathers transaction data directly from multiple banks to automate cash reporting, forecasting and analysis for midsize and large companies.

By Miriam CrossOctober 19 -

JAM Fintop's Banktech fund, which is backed by community banks, has invested in Monit, a small-business predictive analytics company. Two of the banks have expressed interest in using its product.

By Miriam CrossOctober 12