Miriam Cross is a Washington-based reporter covering bank technology and fintech at American Banker. Previously, she was an associate editor at Kiplinger's Personal Finance magazine.

-

Citigroup, First National Bank and Marqeta headlined some of the biggest changes in executive leadership in the banking, fintech and payments industries.

By Miriam CrossSeptember 30 -

Three of the companies that were part of the FTC's sweep, Operation AI Comply, charged consumers to open online storefronts that generated little money compared to what was promised.

By Miriam CrossSeptember 26 -

Thurlow has been the CEO at Reading for 18 years, and will finish her stint as chair of the American Bankers Association in October.

By Miriam CrossSeptember 26 -

Barker joined BNY in 2022 as global head of treasury services. In the first quarter of 2024, she started overseeing depositary receipts, a line of business that helps clients get listed on a stock exchange outside of their home country.

By Miriam CrossSeptember 24 -

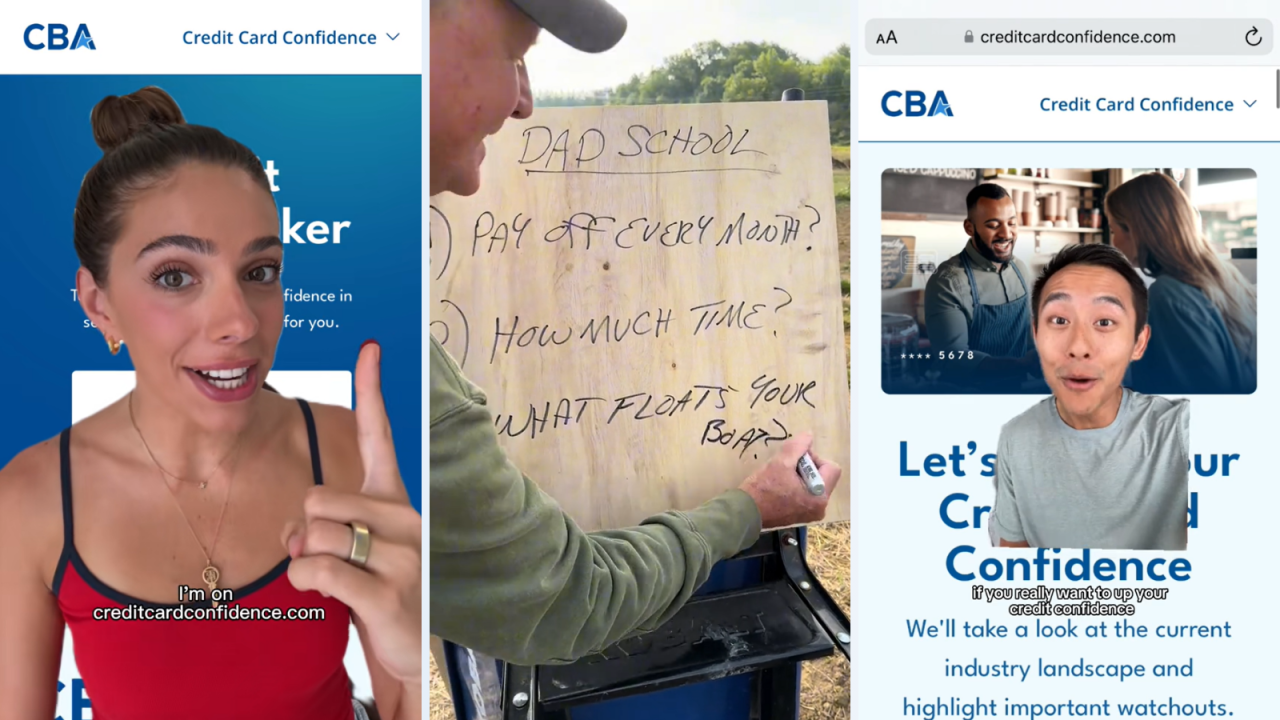

The Consumer Bankers Association launched its first campaign using social media influencers to promote credit card education, experimenting with a mix of personalities and refraining from specific card recommendations.

By Miriam CrossSeptember 18 -

The company, which counts JPMorgan Chase and TD Bank Group among its customers, has also appointed a new executive chairman.

By Miriam CrossSeptember 17 -

The New York community bank cited the contribution of BaaS to its core financial results, evolving regulatory expectations, and the cost of talent and technology needed to scale as factors in this decision.

By Miriam CrossSeptember 17 -

Community bankers have found that demonstrating efficiency, providing proper training and describing use cases can help get employees on board with AI products.

By Miriam CrossSeptember 13 -

The Treasury Department's chief AI officer said artificial intelligence can relieve the burden of mind-numbing activities such as anomaly detection and can spur employees to think more creatively.

By Miriam CrossSeptember 12 -

Banks are finding that they rarely save money off the top when they migrate applications to the cloud. The more substantial benefits are about productivity and speedier development.

By Miriam CrossSeptember 9 -

If banks want to create customer loyalty and support growth, they need to holistically focus on the human factors that ultimately influence business outcomes.

By Miriam CrossSeptember 4 -

Membership requirements, expense and the nonprofit ethos largely keep credit unions from participating in the banking-as-a-service space. But a few, such as North Bay Credit Union in California, have carved out a niche.

By Miriam CrossSeptember 4 -

SpringFour, which partners with banks and lenders to deliver financial resources to their end users, will join the C&R Software umbrella, where it hopes to expand into other markets beyond financial services.

By Miriam CrossSeptember 4 -

Truist, TAB Bank and MoneyGram headlined some of the biggest changes in executive leadership in the banking, fintech and payments industries.

By Miriam CrossAugust 30 -

Ally Bank is hosting a new series of virtual workshops where it hopes people will speak frankly about their emotions tied to money.

By Miriam CrossAugust 28 -

The cross-border payments company appointed its first chief digital officer in April 2023 in its push to design products more intentionally for consumers.

By Miriam CrossAugust 26 -

A minority of American Banker's Best Credit Unions to Work For report using AI. But such projects could help excite employees about their roles and eliminate routine work.

By Miriam CrossAugust 26 -

In a sea of generically named "First Banks of X" and "Community Banks of Y," financial institutions must decide if the painstaking rebranding process is worth the investment and risk to stand out.

By Miriam CrossAugust 22 -

The Salt Lake City bank recently completed what was arguably the first successful large-scale U.S. bank core transformation from an international core provider. Few banks are following in its footsteps.

By Miriam CrossAugust 21 -

Nonbanks that rely on sponsor banks to underpin their financial services may assume that "going direct" is safer after the Synapse bankruptcy. But banking-as-a-service middleware has its merits.

By Miriam CrossAugust 16