-

Page views and sales results don't explain which customers do what, and why they do things (or don't do them), in online and mobile banking.

February 20 -

Banks want to encourage innovation by extending access to outside developers, but customer data remains vulnerable while in use by an application.

February 15 -

The Salt Lake City company, which connects small-business owners with lenders like JPMorgan and BofA, plans to use the funds to expand its partnerships and customer base.

February 12 -

As robotic process automation expands into day-to-day lending operations, IBM is teaming up with UiPath, a startup that specializes in the new technology.

February 12 -

Venture capital-backed fintech funding surged 120% in 2018. Following is a summary of fintech milestones and potential future moves for the industry.

February 10 -

A year after buying the artificial intelligence fintech Layer 6, TD Bank is "rewiring how the organization has worked," Gregory Braca says.

February 5 -

CrediFi helps bankers pursuing commercial real estate loan growth minimize the risk in lending to customers they historically haven't served.

January 29 -

The data aggregator has purchased Abe AI and plans to use the artificial intelligence firm's technology in a host of applications.

January 25 -

Una Fox will be in charge of using AI and other data-driven technology to figure out what customers want from digital banking and how they want it.

January 22 -

Fintechs are developing data-crunching, automated products that seek to help banks precisely calibrate capital levels. The banks' goal is to pass stress tests while maximizing returns to investors.

January 20 -

The Financial Solutions Lab, a joint initiative, has announced the winners of its annual competition to identify solutions to consumer financial challenges, this year focusing on startups dedicated to improving financial health in the workplace.

January 15 -

Robotic process automation is said to have a high return on investment, but adopting it on a large scale has proven challenging, especially at community banks.

January 11 -

In venturing into what's normally a province of large banks, nbkc in Kansas City, Mo., discovered innovative tax-management and other products that it could offer to its own customers or sell to other banks.

January 8 -

As consumers continue to migrate to banking apps, it may be tempting for banks to focus solely on improving that channel experience. But doing so would be making the same mistake as focusing only on cards or cash at the point of sale.

January 7 -

As consumers continue to migrate to banking apps, lenders may be tempted to focus solely on improving that channel. But new data suggests consumers aren't abandoning other platforms just yet.

January 4 -

Rushing to copy the Amazon experience, banks and fintechs are focused on simplifying financial services online. A Georgia Tech researcher says that approach is risky.

December 27 -

There are steps financial firms can take to protect their customers in the event a major wireless network is compromised, including reconsidering the use of SMS messaging for account authentication.

December 24 -

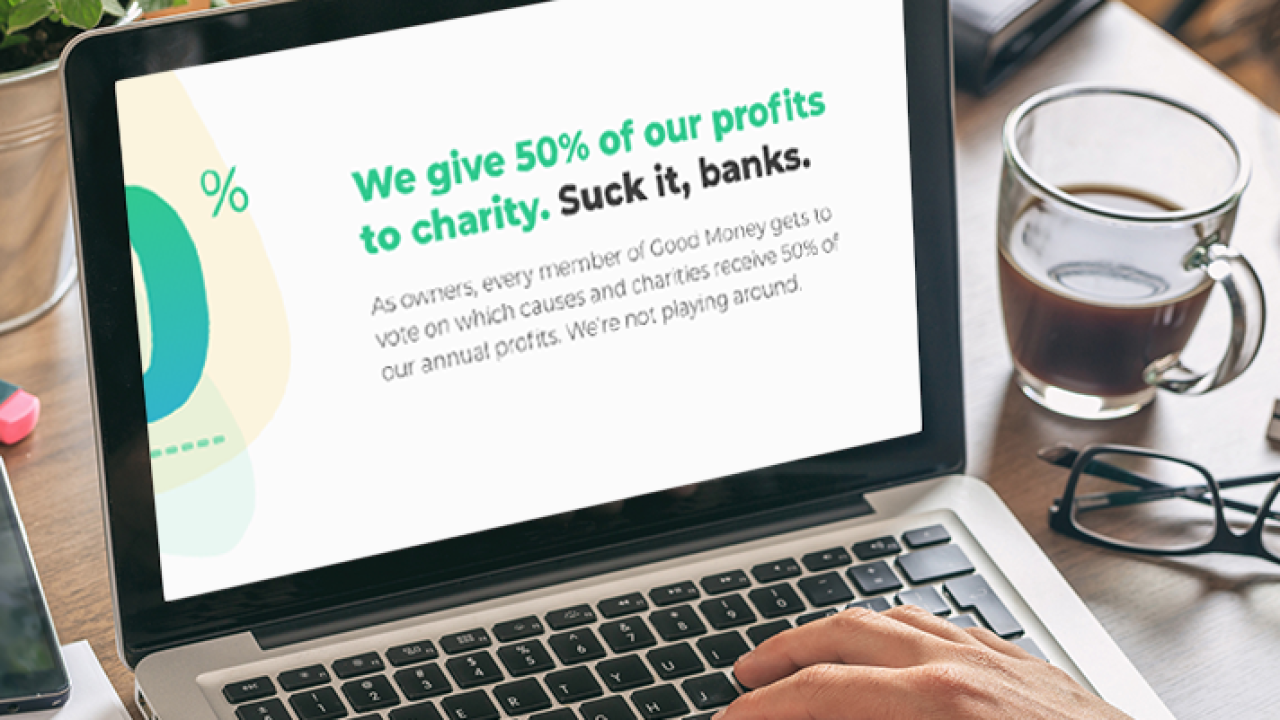

Good Money just raised $30 million and is a year away from launching, but already is raising concerns for its trash-talking of established players.

December 19 -

The banking software company has agreed to acquire Avoka, a software-as-a-service company that helps banks with customer acquisition.

December 12 -

Plaid, which moves consumer data between financial institutions and fintechs, could expand overseas as part of a broad growth plan, according to a venture investor.

December 11