-

The Financial Solutions Lab, a joint initiative, has announced the winners of its annual competition to identify solutions to consumer financial challenges, this year focusing on startups dedicated to improving financial health in the workplace.

January 15 -

Robotic process automation is said to have a high return on investment, but adopting it on a large scale has proven challenging, especially at community banks.

January 11 -

In venturing into what's normally a province of large banks, nbkc in Kansas City, Mo., discovered innovative tax-management and other products that it could offer to its own customers or sell to other banks.

January 8 -

As consumers continue to migrate to banking apps, it may be tempting for banks to focus solely on improving that channel experience. But doing so would be making the same mistake as focusing only on cards or cash at the point of sale.

January 7 -

As consumers continue to migrate to banking apps, lenders may be tempted to focus solely on improving that channel. But new data suggests consumers aren't abandoning other platforms just yet.

January 4 -

Rushing to copy the Amazon experience, banks and fintechs are focused on simplifying financial services online. A Georgia Tech researcher says that approach is risky.

December 27 -

There are steps financial firms can take to protect their customers in the event a major wireless network is compromised, including reconsidering the use of SMS messaging for account authentication.

December 24 -

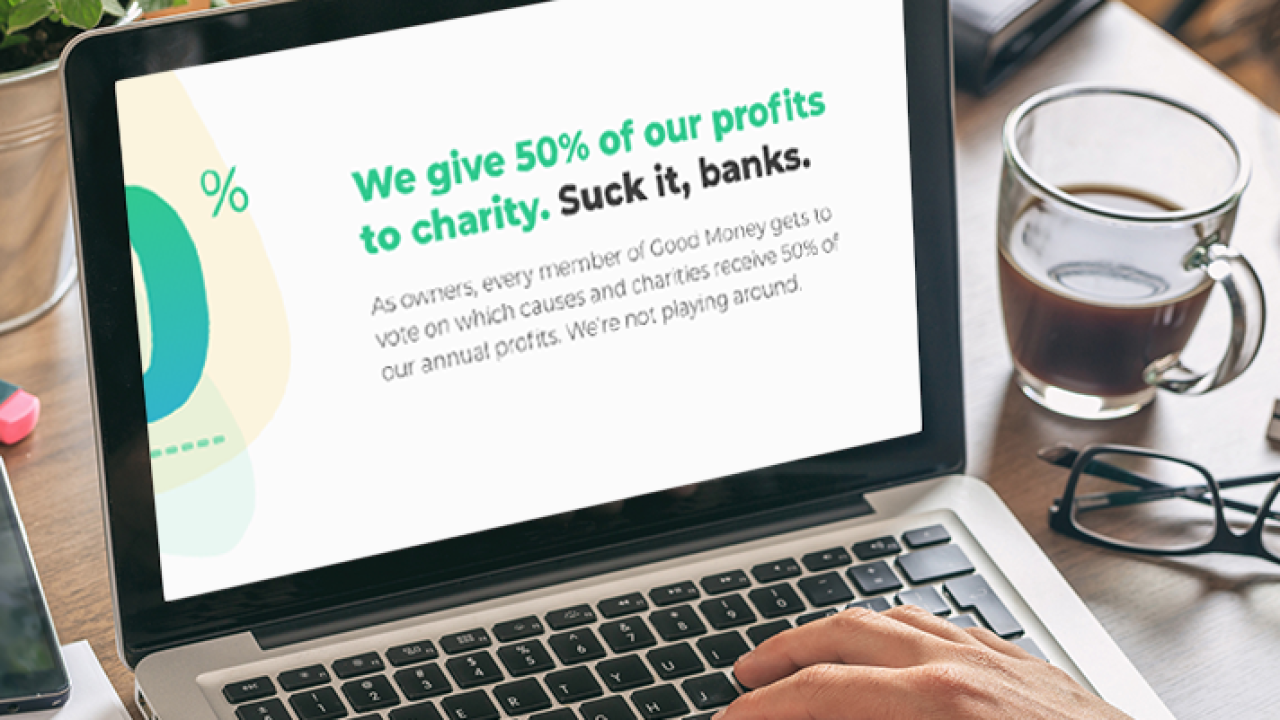

Good Money just raised $30 million and is a year away from launching, but already is raising concerns for its trash-talking of established players.

December 19 -

The banking software company has agreed to acquire Avoka, a software-as-a-service company that helps banks with customer acquisition.

December 12 -

Plaid, which moves consumer data between financial institutions and fintechs, could expand overseas as part of a broad growth plan, according to a venture investor.

December 11 -

Many banks remain wary of student loans given the government's dominance in the market, but some fintechs see untapped potential.

December 6 -

The Chicago bank's new partnership with AutoGravity mirrors others struck this year by JPMorgan Chase and U.S. Bank with providers of mobile apps that bundle the car-buying and lending processes.

December 5 -

Since banks are under constant attack by hackers, the startup XM Cyber is offering them a simulator that seeks to do its virtual worst in order to prevent a real breach.

December 5 -

The latest personal financial management tools provide a more passive approach for customers that analyzes patterns and suggest ways to fix issues.

November 28 -

The Omidyar Network has invested in five challenger banks. Tilman Ehrbeck, who is leading its financial inclusion efforts, says the firm will invest more in apps for gig workers and retirees next year.

November 16 -

Self Lender is launching a secured credit card next year in the hopes of attracting big-bank partners that can use it to comply with the Community Reinvestment Act.

November 15 -

The Spanish bank’s investment arm, Propel, is jointly working with the venture capital firm Anthemis Group to find promising startups.

November 14 -

Fifth Third Bank customers were swindled out of over $100,000, but not because the bank didn't have protection in place.

November 13 -

Credit Karma has agreed to buy a credit reporting company that TransUnion initially sought to develop as the fintech's British equivalent.

November 6 -

Promontory Financial Group CEO Eugene Ludwig says AI tools can remove the risks — and discrimination — involved in opening the U.S. financial system to newcomers.

November 6