-

The digital lender and payments platform is tailoring its affinity banking services for a new market.

March 12 -

Digital-asset companies will try to develop a less adversarial relationship with the state's securities regulator, who stopped several startups from selling digital currencies as investments.

March 7 -

Crypto exchanges are adopting anti-fraud surveillance tools as they attempt to root out pump-and-dump schemes, insider trading and bogus orders.

March 1 -

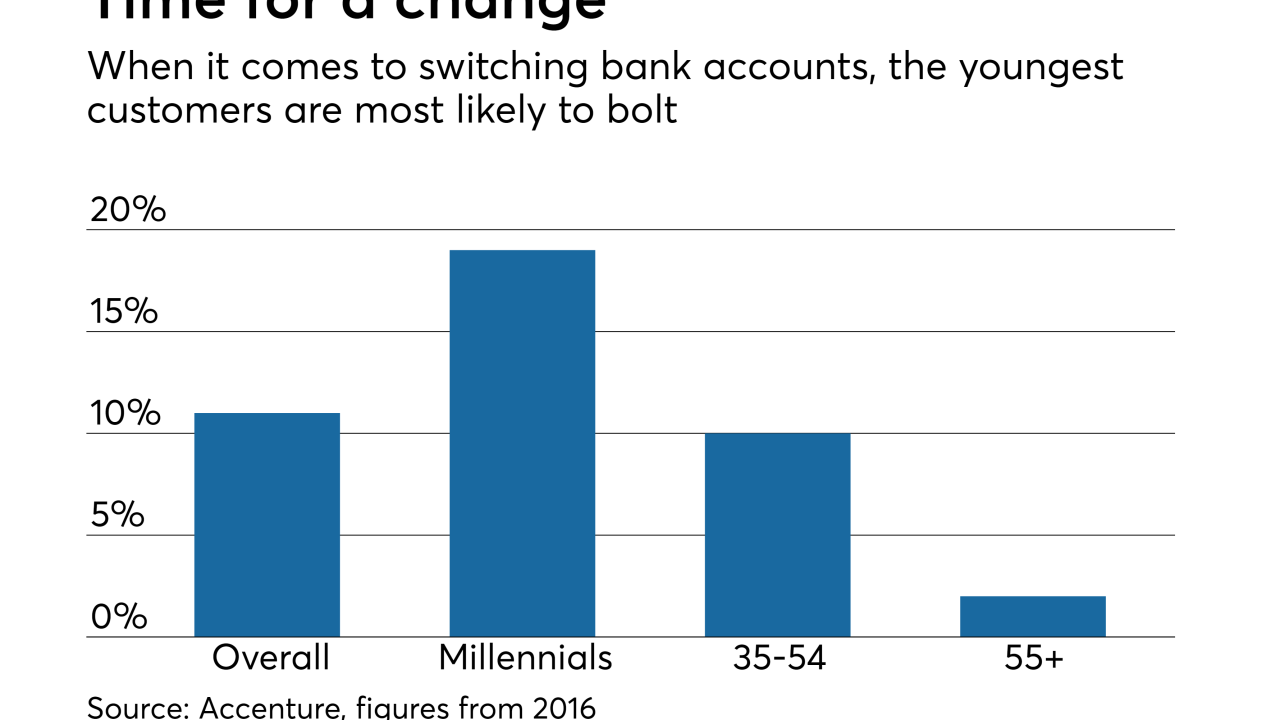

The drudgery of filling out forms and changing bills prevents many customers from swapping banks. One fintech has simplified that exchange, and banks are willing to pay it to deliver them new customers.

February 26 -

ComplyAdvantage, Cinnamon and Zoovu recently raised millions of dollars to fuel expansion of their automated risk management, data-scanning and customer service products geared toward financial services companies.

February 22 -

JPMorgan's blockchain effort could lead to solutions that overcome industry skepticism and regulatory concerns and perhaps attract more mainstream retail interest.

By Suleman DinFebruary 14 -

Barclays, Bank of America, TD Bank and other banks have filed multiple blockchain patents over the years, but have yet to publicly announce their plans for the technology.

February 14 -

Barclays, BMO, Citibank, Goldman Sachs and ING contributed to the online student lender, which last year made over $1 billion in loans.

February 14 -

OceanFirst in New Jersey shuttered more than a third of its branches but says nearly all the customers stuck with the bank because it trained employees to show customers how to go digital.

February 12 -

The automaker's finance arm joins Avant, OnDeck Capital and SoFi in the system, which is designed to help verify loan applicants' identities.

February 12 -

The bank says it has restored access, but it hasn’t explained how a fire-suppression system at one facility could cause a nationwide outage across all of its channels, or how its system as a whole could have been left so vulnerable to the incident.

February 8 -

Customers reported being unable to access online banking, mobile banking or their debit cards.

February 7 -

Among the lessons David Hijirida learned at the online giant: Companies are often so focused on competitors that they neglect their own customers.

February 1 -

The 35-day partial government closing was a stark reminder that many Americans live paycheck to paycheck, and financial firms need to help solve that problem, the mobile banking firm’s CEO says.

January 29 -

Many bankers say they’re more comfortable with using artificial intelligence behind the scenes, but others — including Synchrony and Wells Fargo — insist AI can be used to interact with customers if it’s deployed properly.

January 28 -

Spring Labs is spearheading a group of prominent fintech lenders to use a blockchain-based, peer-to-peer network to share consumer information to help with ID verification on loan applications.

January 24 -

Timothy Mayopoulos is back in the mortgage industry, becoming the new president of the digital mortgage technology developer Blend, months after leaving his post as Fannie Mae’s CEO.

January 22 -

The head of Fiserv hinted that it will pitch the point-of-sale platform Clover, which it would get in the First Data deal, to community banks as a way to defend their small-business market share from Square.

January 17 -

Efforts to build better connections to bank customer data, trade digital currency and explore artificial intelligence for security and compliance purposes were some of the biggest draws of fundraising for U.S. startups.

January 9 -

The strategies to foster innovation are changing to emphasize cost-effective effort and granting fintechs more control over development.

January 8