-

Capital One must reengage in settlement talks with lawyers for savings account holders after a judge found that an agreement between the two sides wouldn't provide adequate compensation to customers who were allegedly victimized by the bank.

November 7 -

The tentative settlement represents a step toward resolving an issue that hung over Capital One's acquisition of Discover. That blockbuster deal closed on Sunday.

May 19 -

New York Attorney General Letitia James is accusing Capital One of deliberately deceiving customers and obscuring higher interest rates. The lawsuit comes less than three months after the CFPB dropped a similar case against the bank.

May 14 -

The Consumer Financial Protection Bureau voluntarily dismissed a lawsuit against Capital One brought under the Biden administration alleging the bank failed to honor interest rate promises, costing consumers an estimated $2 billion.

February 27 -

The bank didn't give some existing customers the higher rates it was offering new customers, the agency alleged. The bank said it would fight the suit, which comes just days before the Trump administration takes over the regulator.

January 14 -

Houston-based Save, which lets consumers save and invest from the same account, closed on its most recent round of funding last month, led by BNP Paribas and joined by Webster Bank.

December 7 -

-

JPMorgan Chase’s fledgling digital bank is going after more customers in the U.K. with a new savings account.

March 28 -

In the short term, the Biden administration is asking the industry to help previously unbanked households access their funds. Longer term, some banks see a real opportunity in advising their customers on what to do with the large cash influx.

August 8 -

The two companies are the first banks to sign on to a philanthropic initiative from the asset manager BlackRock. The aim is to test ideas that make it easier for more households to establish financial safety nets.

May 20 -

During the pandemic-induced lockdowns, the Federal Reserve loosened a rule requiring banks to cap certain savings withdrawals at six per month. Some banks have since dropped ceilings and associated fees, while others have stood pat.

May 17 -

Ally, Huntington, KeyBank and others are reimagining automated savings tools challenger banks have made popular.

April 13 -

The New York company is seeding savings accounts offered by the challenger bank Goalsetter as a way to help minority communities as well as use technology to start building long-term relationships with young consumers.

March 23 -

PayPal is weighing a foray into stock trading and high-yield savings accounts as the firm pushes beyond its iconic checkout button.

February 12 -

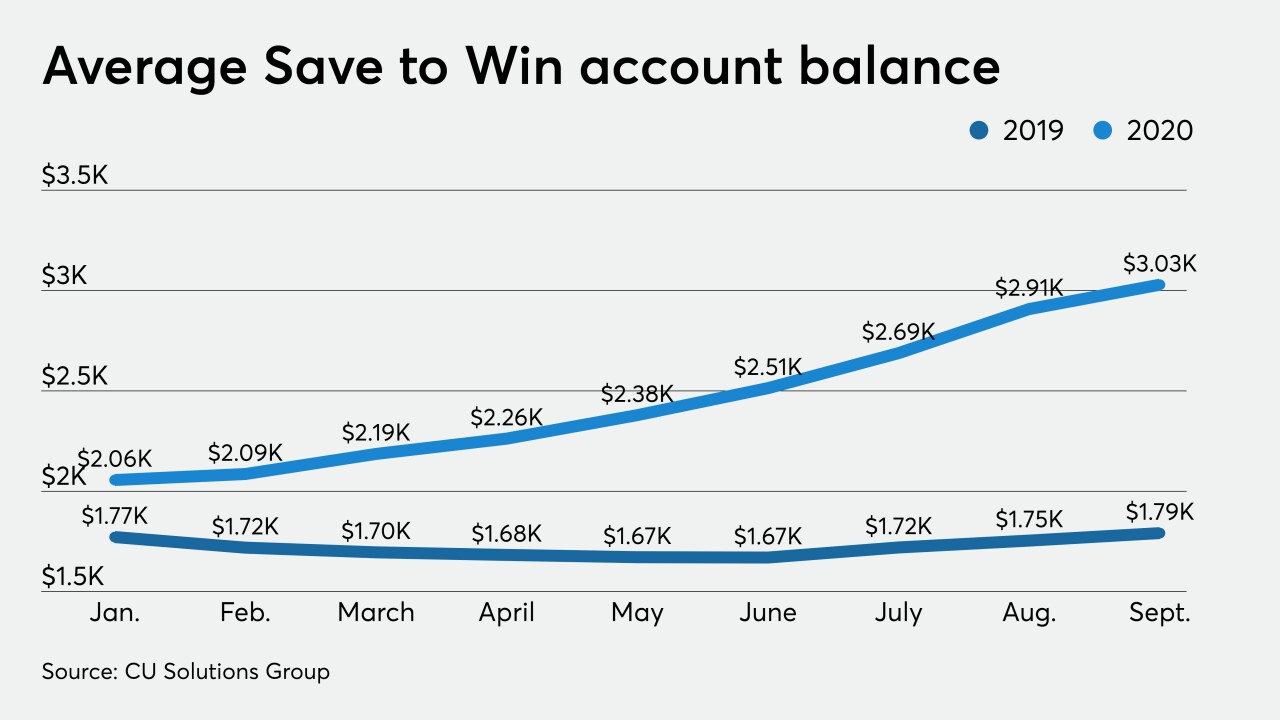

Many credit unions offer these accounts to help members improve their financial behaviors, but some in the industry are wondering how long the surge could last.

November 10 -

The Democratic nominee has not gone as far as some progressives in support of financial inclusion, but ideas such as postal banking, a government-run credit reporting system and universal bank accounts would likely gain traction under a Biden administration.

October 23 -

The industry can gain lifelong members in this demographic by validating their financial concerns as the economy struggles and offering guidance without judgment.

October 9 FindCreditUnions.com

FindCreditUnions.com -

At a time when some Americans are being tempted to pour their savings into risky investments, the son of a Wall Street veteran is encouraging them to set aside more money.

September 10 -

There are millions of U.S. consumers who don't have access to traditional financial services. One challenger bank's mission is to help them overcome the barriers to financial inclusion.

July 31 -

Congress and the FDIC are considering easing limits on banks' holdings of such deposits, a move that could inadvertently lead to more expensive failures.

July 6 Wells Fargo

Wells Fargo