-

The New Jersey bank is offering fintechs ways to stay compliant with consumer protection regulations.

December 7 -

To convince skeptical bankers about the benefits of distributed ledger technology, some suggest it needs to be separated from the volatile digital currency it underlies.

November 30 -

Building alliances with startups is the most affordable route for community banks that want to offer innovative services, but industry officials cautioned that they must be balanced with smart internal investments, too.

November 29 -

Proponents of real-time payments systems say banks must embrace them given consumer demand for more immediacy and transparency, even if criminals will try to exploit them.

November 28 -

As U.S. banks move toward faster payments, they should heed the lessons U.K. banks learned about criminals after launching their real-time transaction system, says Varo Money's fraud strategy leader.

November 27 -

The Wikibuy purchase follows acquisitions of a personal financial management provider and a firm that helps digital shoppers get price adjustments.

November 20 -

Neobanks create lots of buzz — and command the attention of venture capital firms — but there are questions about how big of a threat they pose.

November 20 -

The online-only bank hopes new leadership can help it overcome its rocky past three years.

November 14 -

A new group aims to foster collaboration between fintechs and state and federal officials in the fight against crime — without hindering legitimate business innovation.

November 9 -

Staffers at the bank's flagship, multilevel branch in Manhattan say wearable tech has proven ideal for discreet communication among each other to speed customer service.

November 8 -

Serverless computing has its proponents — Capital One and BBVA among them — but the service hasn’t yet proven it can fulfill general systems needs in banking.

November 2 -

The advocacy group argues that major core processors are not helping small banks keep pace with customers' technology demands.

November 1 -

The credit card company's filings mirror patents Bank of America, Barclays and TD Bank have submitted in the past two years that focus on how funds transfers and data security would augment blockchain technology.

November 1 -

Traditional financial institutions still have an advantage over challenger banks when it comes to building relationships with small merchants, despite scandals that have befallen megabanks.

October 30 -

One U.K. fintech hopes its cryptocurrency-based prepaid debit card will gain traction with bitcoin and ether enthusiasts here.

October 25 -

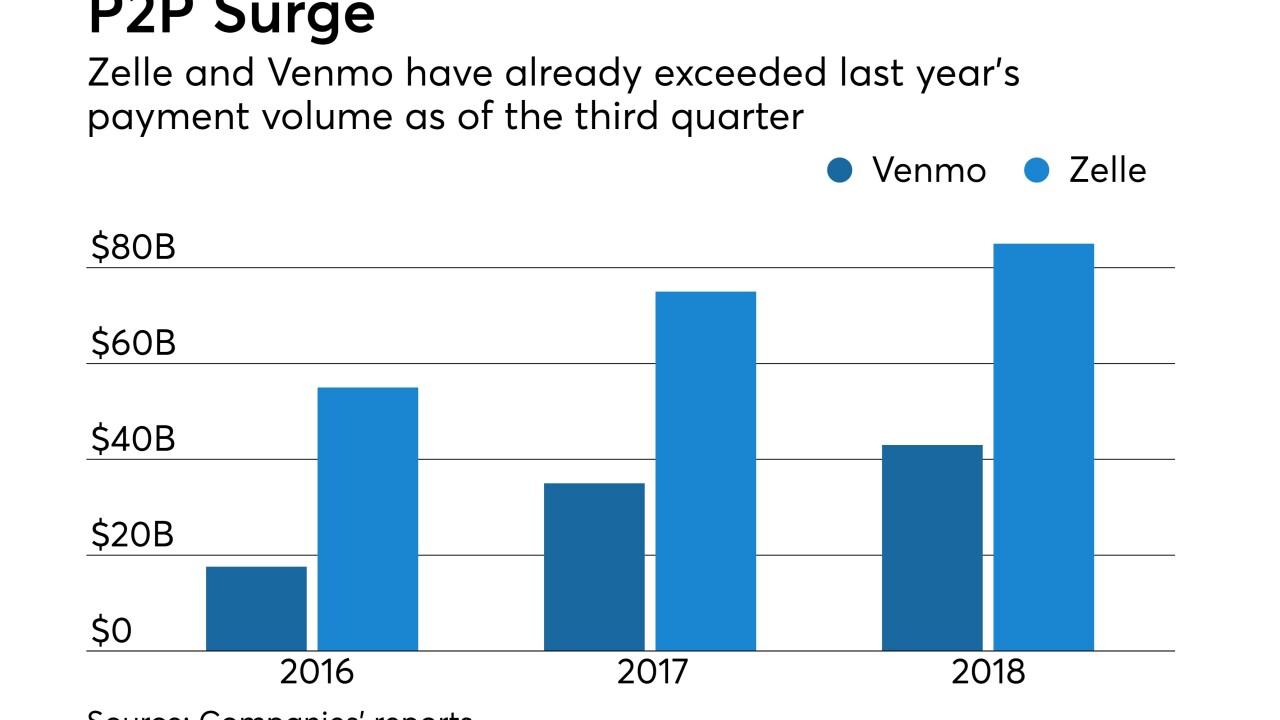

Zelle processed 116 million transactions during the third quarter as its payment volume jumped to $32 billion, while Venmo's volume increased 78% to nearly $17 billion.

October 23 -

The association has invited FIS, Fiserv and Jack Henry to join a committee tasked with helping smaller institutions modernize technology.

October 23 -

Zelle processed 116 million transactions during the third quarter as its payment volume jumped to $32 billion, while Venmo's volume increased 78% to nearly $17 billion.

October 23 -

A recent study concluded there are first-mover benefits for banks that embrace open banking. But many executives see its risks instead.

October 19 -

Banks need dedicated teams to shore up digital compliance efforts, officials at SourceMedia’s RegTech 2018 conference said.

October 16