-

Serverless computing has its proponents — Capital One and BBVA among them — but the service hasn’t yet proven it can fulfill general systems needs in banking.

November 2 -

The advocacy group argues that major core processors are not helping small banks keep pace with customers' technology demands.

November 1 -

The credit card company's filings mirror patents Bank of America, Barclays and TD Bank have submitted in the past two years that focus on how funds transfers and data security would augment blockchain technology.

November 1 -

Traditional financial institutions still have an advantage over challenger banks when it comes to building relationships with small merchants, despite scandals that have befallen megabanks.

October 30 -

One U.K. fintech hopes its cryptocurrency-based prepaid debit card will gain traction with bitcoin and ether enthusiasts here.

October 25 -

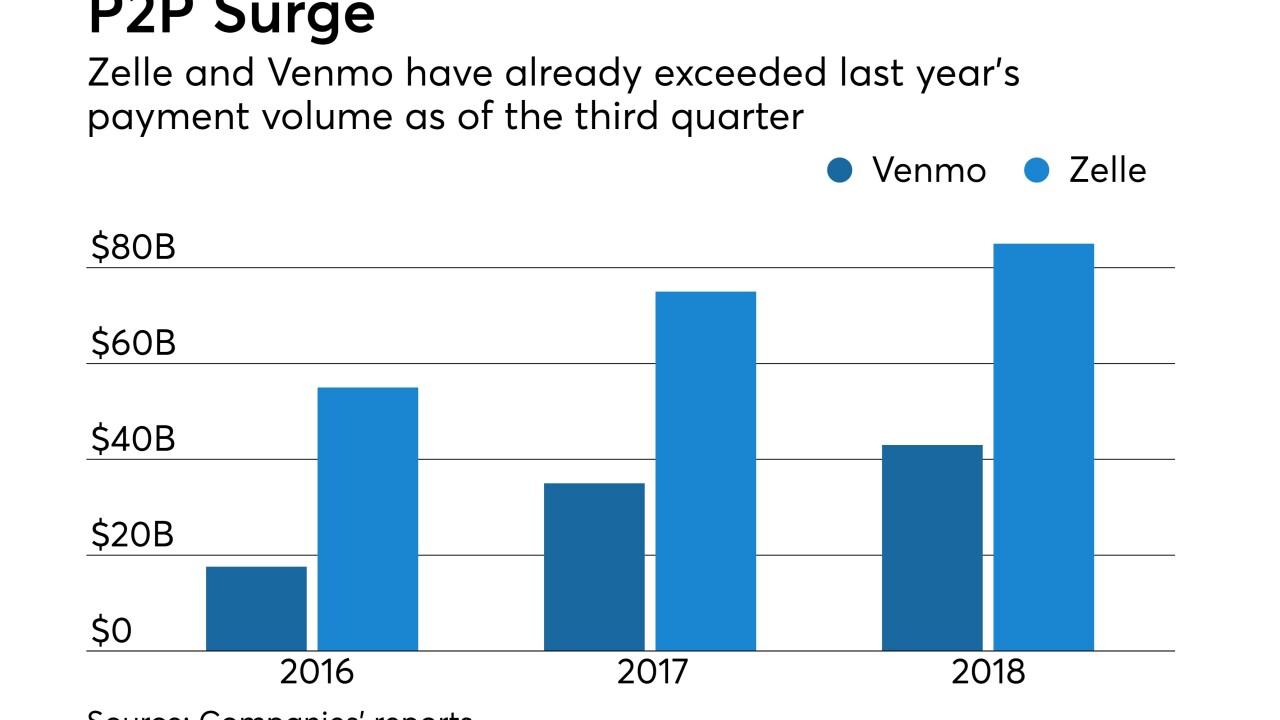

Zelle processed 116 million transactions during the third quarter as its payment volume jumped to $32 billion, while Venmo's volume increased 78% to nearly $17 billion.

October 23 -

The association has invited FIS, Fiserv and Jack Henry to join a committee tasked with helping smaller institutions modernize technology.

October 23 -

Zelle processed 116 million transactions during the third quarter as its payment volume jumped to $32 billion, while Venmo's volume increased 78% to nearly $17 billion.

October 23 -

A recent study concluded there are first-mover benefits for banks that embrace open banking. But many executives see its risks instead.

October 19 -

Banks need dedicated teams to shore up digital compliance efforts, officials at SourceMedia’s RegTech 2018 conference said.

October 16 -

Käthe Anchel is expected to help push Umpqua’s recent focus on what it calls the “human-digital” banking experience.

October 12 -

A $245 million funding round for the payments processor Stripe contributed to heavy venture capital investment in the third quarter.

October 12 -

Mike Cagney’s current venture, Figure Technologies, is offering consumers the ability to apply online for home equity loans and get funding in as little as five days.

October 10 -

New mobile payment player plans a white-label person-to-person offering for community banks.

January 6 -

Prepaid debit cards that come with celebrity endorsements over the years have showed little staying power while whipping up storm clouds of controversy.

January 5 -

Underwriters Laboratories plans to help customers guard against payment fraud and data theft.

January 4 -

Companies globally that provide such services will see some $55 billion in international remittances made through mobile devices by 2016, according to a December report from Juniper Research.

January 3 -

eBay's acquisition of BillSafe, which lets shoppers pay for purchases only after they receive a mailed invoice, shows its commitment to the instant-credit model. But observers warn that this model requires finely-tuned risk management to guard against fraud or excess delinquencies.

December 22 -

Most executives in the prepaid debit card market agree any future federal regulations that demand better disclosures on products are good for the industry. But if the government starts messing with fee structures, it could lead issuers to leave the market altogether.

December 20 -

Online payment company hopes to avoid the mobile coupon mistakes of daily-deal leaders Groupon and Living Social.

December 14