-

Facebook calls an emergency meeting about its planned payments network; Well Fargo report says 200,000 jobs will be lost to robots and technology.

October 2 -

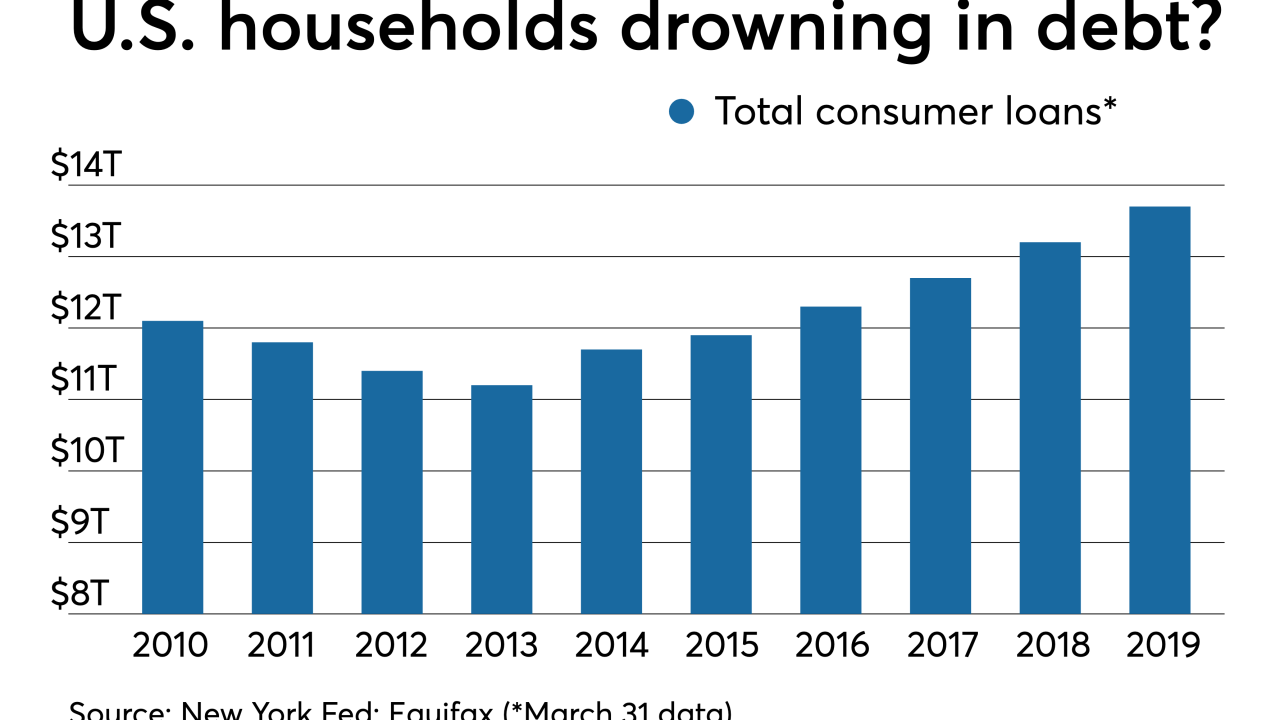

CUNA Mutual Group found that loan balances increased by 6.6% for the year ending in the second quarter.

September 20 -

A year after the major credit bureaus agreed to strip tax liens and civil judgments from consumers' credit files, a new study says it is hampering lenders' credit decisions. But proponents of the move insist it was the right call.

September 3 -

A subsidiary of Citizens Financial Group placed first in a recent J.D. Power ranking of car dealer satisfaction with noncaptive auto lenders. However, that group — primarily banks and credit unions — lagged other types of auto lenders.

August 29 -

The most recent Credit Union Trends Report from CUNA Mutual Group is “indicative that both the credit cycle and the U.S. business cycle are moving into their last stage before the next economic slowdown,” according to one economist.

August 20 -

With declining interest rates, credit unions that rely heavily on interest income from their investment portfolios may struggle.

August 16 -

Borrower debt continues to rise, late payments are up and interest rates are at their highest levels since at least 1994. A new report raises questions about the sustainability of the card industry's boom.

August 13 -

The industry faces additional risks when members take out auto loans and then list their new vehicles on apps for others to rent.

August 7 -

The hiring of Tim Wennes was one a series of leadership changes announced Wednesday by the holding company for the bank and the auto lender Santander Consumer.

July 24 -

The Democratic presidential candidate argued in a blog post that the U.S. could avoid a recession by canceling most student debt and authorizing regulators to more aggressively monitor leveraged lending.

July 22