Now might be a good time for management teams to rethink their investment strategy.

That was the message from investment experts as the stock and bond markets have gyrated wildly in recent weeks.

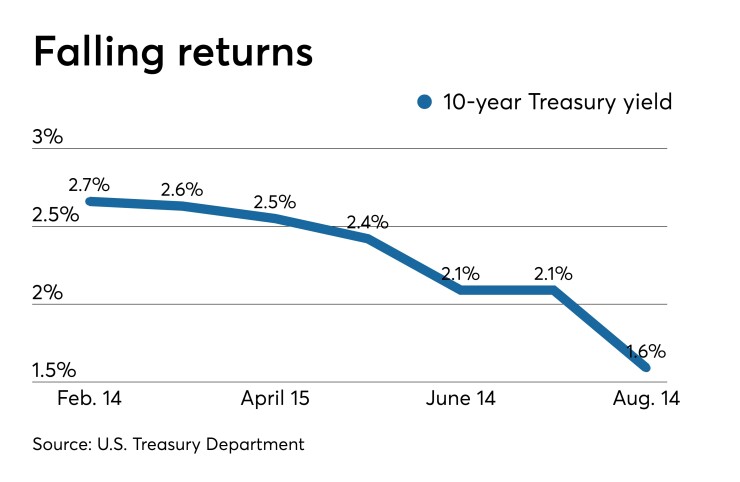

Credit unions have not seen an investment environment like this one in more than a decade. Recent events – including the Federal Reserve Board cutting its benchmark interest rate, the ongoing U.S.-China trade war and the return of an inverted treasury yield curve – have many credit unions experiencing pressure on what they are earning from their investment portfolios.

“Until now, they have been investing in a rising-rate environment, and that has changed,” said John Kirby, investment officer for Catalyst Corporate Federal Credit Union in Plano, Texas. “With rates falling, credit unions need to consider looking ahead to lock in current yields.”

All of this can be especially difficult for smaller credit unions that struggle to make loans and rely more heavily on their investments for interest income. The credit union industry saw a 1.8% increase in loans during the first quarter, and this figure is expected to show slight improvement in the second quarter, said Brian Turner, president and chief economist of Meridian Economics.

But the catch is most of this increase comes from credit unions with at least $500 million in assets, Turner said. These institutions are seeing loans grown at a 7% annualized rate. Those CUs hold 78% of industry assets, but account for only 11% of credit unions.

“This suggests that the remaining 89% of credit unions, or the 89-percenters, collectively experienced an 18% annualized decline in loans,” Turner said.

This leads to “upward pressure” on cash and investment portfolio assets to help sustain earnings, Turner said.

Fortunately, he said, the prevailing inverted yield curve and investment pricing spreads have helped somewhat. Average agency security yields are between 2.13% to 2.35% for three- to four-year terms, while average mortgage-backed security yields are between 2.20% to 2.40% for comparable durations. Overnight cash rates remain north of 2.20%.

By comparison, the average A-paper vehicle loan and 30-year mortgage loan rates are 3.72% and 4.11%, respectively, with three-year and eight-year durations attached. Turner said this reflects a 218 basis point pricing spread associated with vehicle lending – or the value derived by taking on the credit risk. This compares with an average of only 55 basis points in value during 2018.

Therefore, he said, the value of investing in vehicle loan originations not only brings higher yields in today’s market, it also provides a wider pricing spread to absorb potential risk exposure. The same can be said for mortgage loans, whose relative pricing spread has averaged about 190 basis points over longer durations, compared with about 150 basis points in 2018.

“Both vehicle and a portion of fixed-rate mortgage loan originations are appropriate during this point in the prevailing economic and interest rate environment,” Turner advised.

The $2.4 billion-asset Catalyst Corporate, through its subsidiary CU Investment Solutions, is suggesting that CUs look at four-year or five-year maturities, as their balance sheets will allow, to avoid reinvestment risk. If rates continue to fall then an investor would be unlikely to reinvest cash flows at a rate comparable to what they previously earned, Kirby said.

Change in strategy ahead

Alex Casillas, president and CEO of My Credit Union in Redwood City, Calif., said his credit union has been holding a 30-year, $1 million investment at 8% that will be coming due in October. He said this investment has “helped us tremendously over the past few years,” but now comes the challenge of finding something to replace that locked-in income.

As rates were increasing in recent years, Casillas said that the $31 million-asset My Credit Union has been putting more investment dollars in five-year CDs, which he said is “long-term for us.” The most likely scenario at this point is it will be putting the $1 million in commercial real estate participation loans come October.

“Now that the Fed reduced the rate, I do not know how much longer our investment strategy will hold up,” Casillas said. “We have been very conservative in auto lending, so we are looking at expanding our underwriting to approve more B- and C-level loans.”

My Credit Union earned about $584,000 in total interest income for the first half of the year, according to its latest call report. About a quarter of that came from interest earned on investments. Overall, it earned about $2,400 through June 30, compared with a loss of almost $6,700 for the same period in 2018.

Pay attention to collateral

Catalyst Corp’s Kirby suggested credit unions should be looking for higher-yielding sectors.

For instance, credit unions that prefer fixed maturities should consider bullet alternatives, such as Freddie Ks and DUS bonds, which are mortgage-backed securities. For amortizing securities, there is greater risk of prepayment as mortgage holders refinance to take advantage of lower rates. Collateralized mortgage obligations and mortgage-backed securities pools may have higher yield, Kirby said.

Still, credit unions need to be wary of the MBS collateral they are buying.

“Pay attention to loan size, servicers and the geographical location of the mortgages,” Kirby said. “Those are the biggest contributors to prepay speeds.”

Turner of Meridian Economics said the problem for most credit unions is attracting new demand for auto and mortgage loans. For small credit unions, the challenge is even greater as larger credit unions have entered smaller markets and undercut under cut rates on consumer loans. That’s lead to historical levels of monthly loan principal run-off.

“This has left most small market credit unions with limited supply of A- and B-paper loans, but the lion’s share of D- and E-paper applications – something that should not be allowed to continue for the stability of the industry,” he asserted.

Credit unions that struggle with making loans have a higher allocation of cash and investment assets. Turner pointed out the current return on cash and three-year duration investments is approximately 2.13% to 2.40%, or roughly 131 basis points below whole loan rates and likely below prevailing portfolio yields. In comparison, the investment CD market continues to yield higher rates: 2.30% to 2.50% for comparable durations.

“Some credit unions may consider selling a portion of their investment portfolio with gains attached and reinvest into today’s market,” Turner counseled, adding this could support current earnings without adversely impacting longer-term income streams.