-

Not a penny of the $1 billion fine against Wells Fargo will end up in the hands of customers harmed by practices flagged by regulators.

April 27 -

Record originations on "better-yielding" used-car loans helped drive a 14% increase in its first-quarter profit. But Ally's shares were down Thursday on concerns of rising deposit costs.

April 26 -

The firm reported that its new credit union clients — representing an aggregate of more than 450,000 members — signed on for GrooveCar's online vehicle-buying program.

April 26 -

Acting Consumer Financial Protection Bureau Director Mick Mulvaney announced a trio of significant changes to the CFPB.

April 24 -

No individuals have been named in connection with the bank’s recent misdeeds, which resulted in a $1 billion fine, even as some senior leaders stand to gain from the government’s tax cut.

April 24 Public Citizen

Public Citizen -

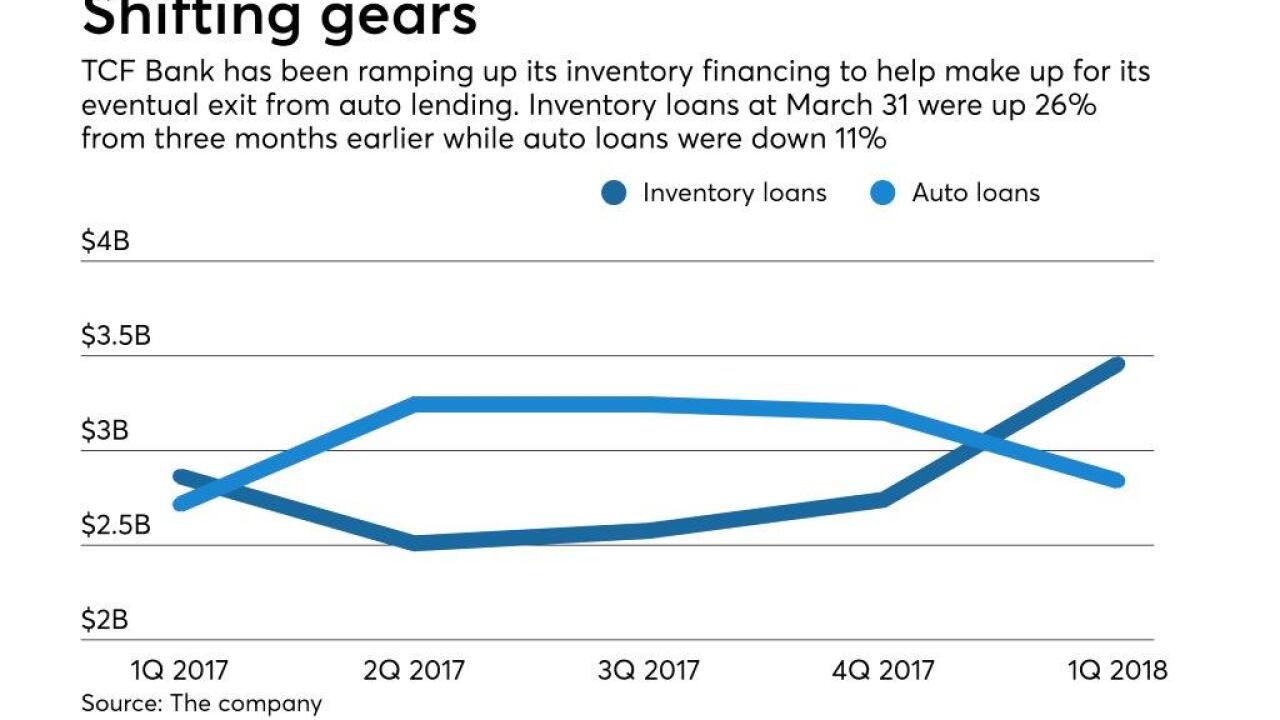

The move toward more asset-based finance shows how CEO Craig Dahl, in his second year at the helm, is reshaping the Minnesota company after its surprise exit from auto lending last year.

April 23 -

The legislation would prohibit the CFPB from penalizing institutions that rely in good faith on guidance from the bureau.

April 23 -

The issues at Wells Fargo extend beyond the fines; Ally Financial's auto finance chief departs; ICBA chief Cam Fine signs off; and more from this week's most-read stories.

April 20 -

The eight credit unions represent a “reach increase” of nearly 7 million consumers and combined assets of over $1.7 billion.

April 20 -

The latest fine from regulators was leveled against the bank on Friday. But it's far from the only penalty it has paid in recent years, and more may be on the way.

April 19