-

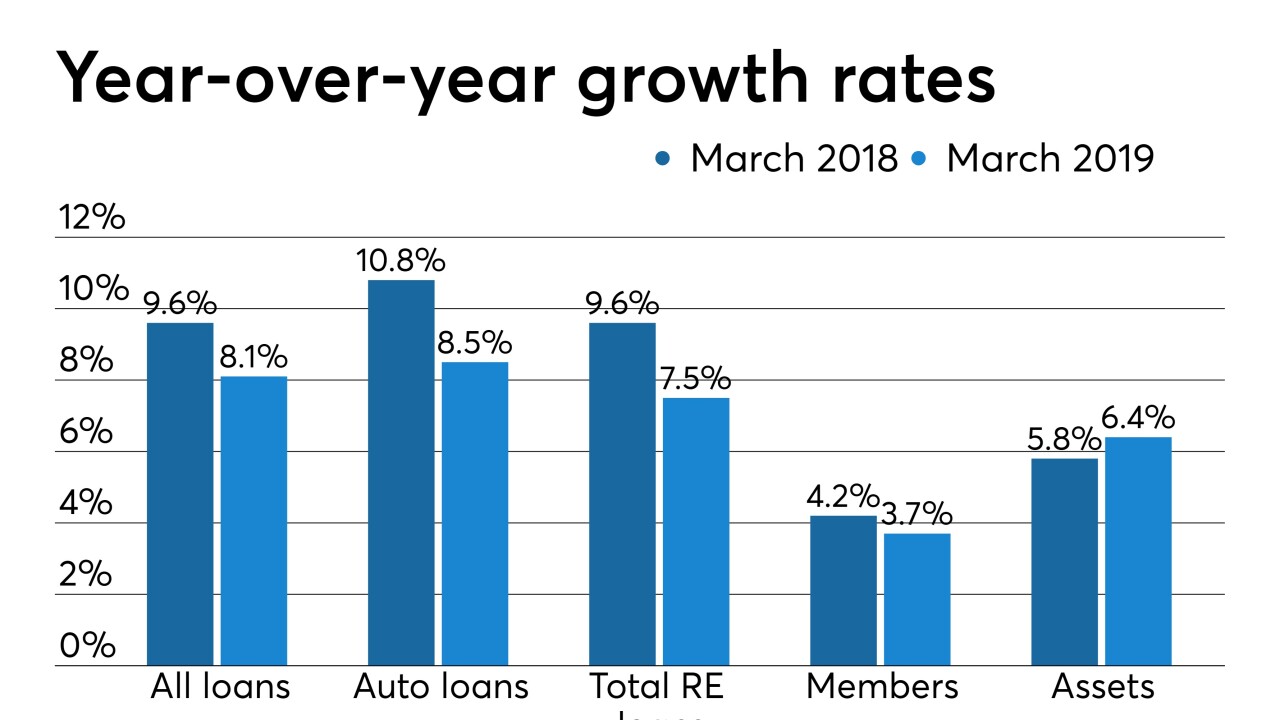

A new study from CUNA Mutual Group shows CUs ended March with tepid growth in membership and auto and real estate loans compared with a year earlier.

May 17 -

The first day of CU Direct's annual Drive conference included insights from dealers, executives at online car-buying platforms and more.

May 16 -

From availability issues to regulatory hurdles and changes in marketing strategies, dealers say there is plenty credit unions can do to improve relations between the two sides.

May 16 -

More than half of all states don’t have an electronic system to track car titles and liens, which increases the potential for fraud and costs for lenders.

May 15 -

It’s no coincidence that with more than half of consumers ages 20 to 29 now holding credit cards — up from 41% in 2012 — 90-day delinquency rates are at a seven-year high, according to the New York Fed.

May 14 -

It’s no coincidence that with more than half of consumers ages 20 to 29 now holding credit cards — up from 41% in 2012 — 90-day delinquency rates are at a seven-year high, according to the New York Fed.

May 14 -

If credit unions hope to capture America's largest potential consumer base, they're going to have to do a better job of explaining their value proposition.

May 3 EFG Companies

EFG Companies -

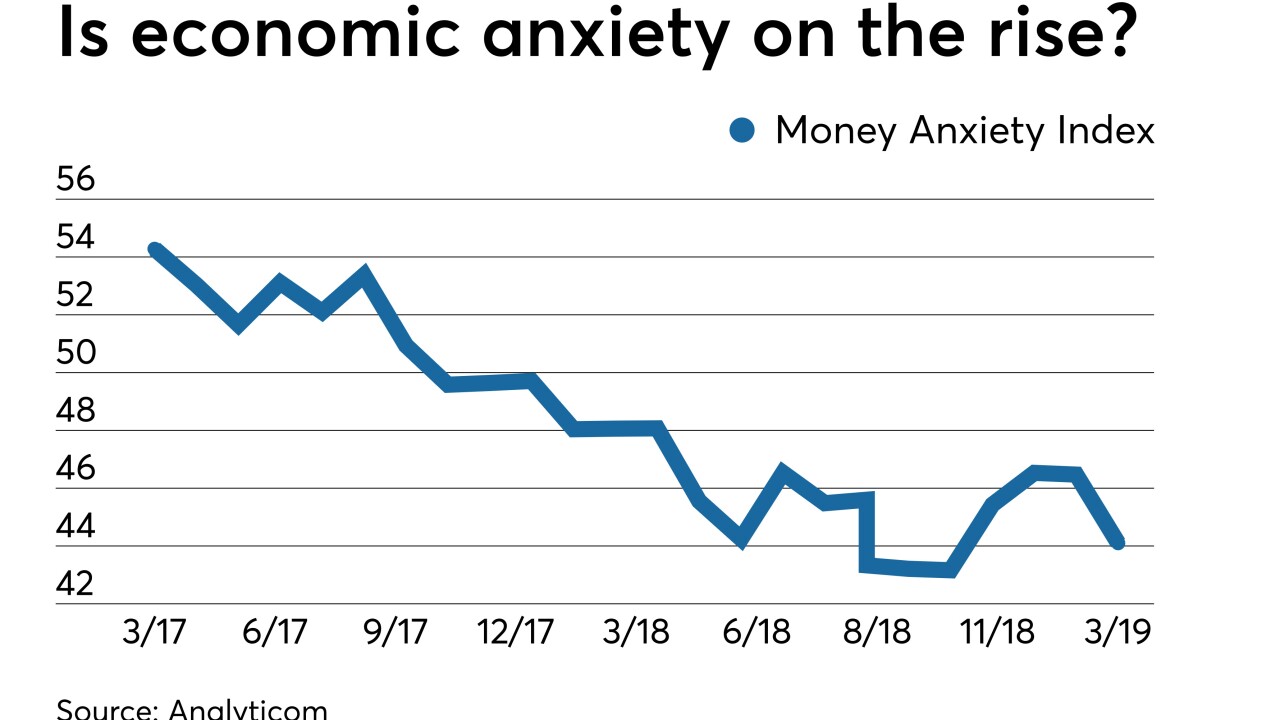

The Money Anxiety Index, a measure of consumer saving and spending habits, has started rising off a 50-year low. The economist who created it says that means another slump is nearing, and that banks should use the intel in pricing deposits and making other decisions.

May 2 -

Democratic lawmakers made clear at a hearing Wednesday that they do not intend to abandon the issue following the GOP's repeal of regulatory guidance last year.

May 1 -

The surge in originations during the first quarter more than offset a decline in demand for new leases.

April 30 -

The Boston company gained the mortgage platform when it bought First Choice in 2017.

April 30 -

The strong growth in commercial lending made up for more modest gains in credit card and auto lending, its two largest business lines.

April 25 -

Credit union share of the credit card market is at a record high but there are concerns that this debt could begin to sour if the economy turns.

April 25 -

Measures of loan performance were generally better than expected at Ally, American Express, Synchrony and Sallie Mae. Their 1Q reports suggest that consumers remain able to meet their obligations despite a long run-up in debt.

April 18 -

During the National Credit Union Collections Alliance conference, experts shared best practices on several topics, including navigating member bankruptcies and positioning auto loans for a downturn.

April 18 -

CUNA Mutual Group's February trends report showed that growth in auto loans, mortgages and membership had slowed.

April 17 -

About 100 financial institutions are owned by or work with Native Americans, yet traditional banking services remain out of reach for many in this demographic.

April 15 -

2018 was mixed bag for credit unions in the Wolverine State, with membership and lending still seeing positive numbers but down from previous years.

April 12 -

More consumers were late in paying two major types of loans in the latest figures from the American Bankers Association, but it appears to be a relatively isolated problem.

April 11 -

Rates have risen, car prices are up and sales are expected to drop by nearly a half-million units this year, but institutions can take steps to ensure minimal impact.

April 3