Credit unions may not be

And with spring already here and the heaviest auto-buying season of the year approaching quickly, credit unions may need to diversify their portfolios as they begin preparing for a changing landscape.

As of January, new auto loan balances at credit unions were up 10.7 percent year-over-year, according to CUNA Mutual Group. But that figure has been steadily decelerating from about a 22 percent pace in January 2014. Meanwhile, used car loans at credit unions increased by 9.2 percent in January 2019, another deceleration from the past few years. And the firm is anticipating nearly a half-million fewer cars will be sold in the U.S. this year, projecting 16.8 million units in 2019 compared with 17.27 last year.

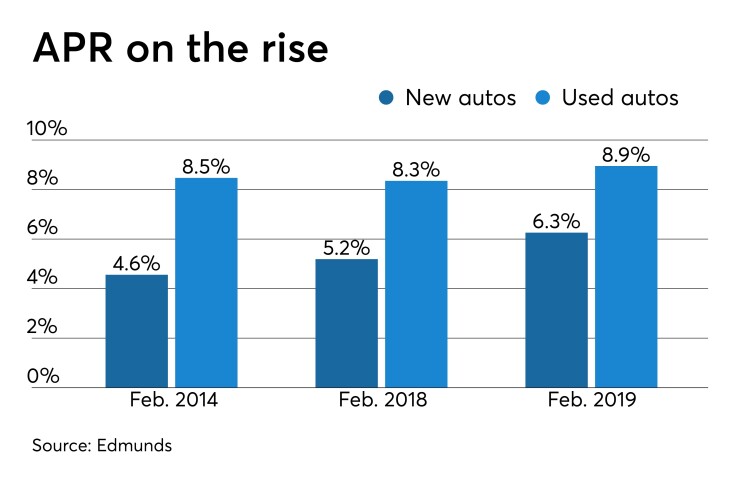

Making things more precarious is the prospect of rising interest rates. Edmunds, an automotive data company based, recently revealed that the average APR on new autos came in at 6.26 percent in February – the highest level since February 2009 and more than a full point higher than where things stood in February 2018.

Curt Long, chief economist and VP of research at the National Association of Federally-Insured Credit Unions, said he expects growth in auto loan volumes to slow this year for all lenders, including credit unions. “With the Fed pausing rate increases, that’s a positive,” he noted. “But there are a lot of headwinds at the moment. Even if the Fed doesn’t hike [rates],

Moreover, other headwinds – including higher vehicle prices and a slowing economy – could pose challenges for credit union auto loans. And Howard Bufe, president of the credit union service organization CU Evolution, noted that the high purchase volumes of recent years could be nearing an end. “After consumers played catch-up on purchasing autos after the recession in 2008-2009, purchasing has slowed,” he said. “With consumer confidence potentially being on shaky ground [amid fears of a looming recession], there will be those that postpone new car purchases for a while.”

The broader financial market right now means there’s plenty that could contribute to a slackening pace in the auto-lending space, noted John Caddell, manager of credit and lending at CO-OP Financial Services, and that should have credit unions concerned.

“Considering the flooded used auto market and typically higher rates on used autos versus new, any more rate hikes could mean a downturn in volumes for credit unions,” he said.

But Caddell is not worried about the slowing growth rate of auto loan volumes at credit unions since they typically offer rates that are lower than banks. “I haven’t heard any of our credit union partners express major concerns over auto lending volumes,” he added.

Be prepared

David Jacobs, VP of consumer lending at the $3.1 billion-asset Coastal Credit Union of Raleigh, N.C., noted that his credit union hasn’t experienced a slowdown yet but is working hard to ensure relationships are in place to keep a pipeline of business coming in if a wider slowdown does occur.

“As car volumes slow, we need to ensure that we are providing top-level service to our dealer partners and offering as much value and availability that is needed to win the business,” he said.

Edmunds data shows the average amount financed for a new vehicle has risen by roughly 30 percent since 2014 as consumers gravitate towards more expensive trucks and SUVs. Still, Caddell believes credit unions have answers for members concerned about rising vehicle prices.

“Credit unions have adopted longer term offerings for higher-priced autos,” he explained, noting that some institutions have extended loan terms to as long as 84 or even 96 months. “This is key since the market has been dominated by large vehicle purchases. Some credit unions have done away with term limits and will offer higher terms regardless of the dollar amount, and this has helped them be more competitive.”

But Jacobs noted that consumers’ income levels are not growing at the same pace as auto prices, thereby presenting a headwind for credit union auto loan business, especially in the event of a recession or a steep increase in gas prices.

“This is an area that we are monitoring heavily, as there is a higher demand on extended terms, therefore more consumers are upside down in their car purchases as they roll negative equity into their new car loans,” he said. “This creates more severity risk which must be calculated into pricing for future loan offerings.”

Some analysts suggested this environment may be an ideal one for credit unions hoping to push used car lending.

“With the rising cost of new autos, used autos become more attractive and affordable for the consumer,” said Bufe, pointing out that used cars make up 59.7 percent of the industry’s overall auto portfolio.

Jacobs explained that traditionally Coastal CU has always been able to capture more used auto loans than new loans. “The captives will often offer incentivized rates and/or rebates that are extremely difficult to compete with,” he said. “From a unit perspective, approximately 75 percent of our business is on used units. With that being said, this does create an opportunity for us on the direct side, for possible refinances if a consumer decides to take a rebate they may be at a higher rate point and we can refinance them into a lower payment.”

And, he added, if auto lending does slow down, Coastal could find other opportunities by offering aid such as unsecured loans to help with car repairs or maintenance.

Bob Child, chief operating officer at CU Direct, suggested credit unions use intelligent risk-based pricing and strong analytics to support sound underwriting in their auto loans and automating as much of the process as possible in order to drive down cost of acquisition and operations to improve margins.

And CUs must ensure they have the tools in place to approve loans as quickly as possible, noted Caddell.

“This means being available to underwrite loans after hours and weekends when most consumers are car shopping,” he said. “Buyers want an answer now and will typically take the first approval that they receive. That’s why it’s important for credit unions to have quick service levels in getting back to loan applicants. Otherwise, the credit union risks losing the deal.”