-

The category shifted into high gear during the first quarter, but experts predict a severe slowdown based on a growing number of economic concerns.

June 26 -

During its first-quarter earnings call, the Detroit-based company's CEO said it is seeking to "protect the house" by dialing back the pace of car-loan originations and seeking to attract more super-prime borrowers.

April 19 -

The Spanish banking giant is doubling down on its U.S. operations, unlike other foreign-owned banks that have abandoned efforts to reach American consumers. It's doing so partly by better integrating its large auto lending business with its retail bank.

April 3 -

Car loans are among the bread-and-butter products for credit unions, but slowing demand and growing delinquencies are putting some pressure on the category.

March 7 -

Rising inventories and the specter of regulation may make it seem like the pandemic auto boom is over, but broader trends could make it a profitable business if banks do it right.

January 31 American Banker

American Banker -

It is rare for banks, especially large ones, to receive unsatisfactory ratings in their Community Reinvestment Act examinations. The San Antonio bank has now done it twice in a row.

January 26 -

The state of Colorado has reached a $4 million settlement with Canvas Credit Union and Bellco Credit Union after the companies were accused of failing to pay refunds of guaranteed automobile protection fees due to borrowers.

January 18 -

Though the Phoenix-based Carvana has seen its share price plummet and sales weaken amid macroeconomic headwinds, Ally CEO Jeffrey Brown predicted the used-car retailer will "get through this" and remain an important source of business.

December 6 -

Brown has been with the online lender almost since it was spun off from General Motors, helping it broaden its product offerings and take a stand on overdraft fees. Now he must help Ally confront a looming recession.

November 21 -

The Consumer Financial Protection Bureau claimed that Hyundai Capital America hurt borrowers by incorrectly reporting they were late on payments.

July 26 -

Credit unions enjoyed especially strong loan demand from car buyers — helping to push overall loan growth to twice the rate of what banks saw in the first quarter — following a lull stemming from pandemic-era setbacks.

June 15 -

Loans to car sellers plummeted earlier in the pandemic due to chip shortages that hampered vehicle production. But supply improvements since last fall have fueled the start of a rebound.

January 21 -

A lawsuit filed by Attorney General Maura Healey last year said Credit Acceptance Corp. in Michigan made predatory loans to Bay State borrowers and used deceptive practices to collect debt.

September 1 -

Subprime borrowers whose credit scores have risen since they bought their cars are increasingly looking for a better deal. Credit unions and small banks are seizing the opportunity, often with the help of fintechs.

August 25 -

The price for the 20% stake in Santander Consumer USA Holdings that Santander does not already own is significantly higher than what the buyer first offered in July.

August 24 -

Tanya Sanders, who joined the company in 2019, takes the reins as the division's loan growth is on an upswing. She will succeed Laura Schupbach, who is retiring after 26 years at Wells.

July 21 -

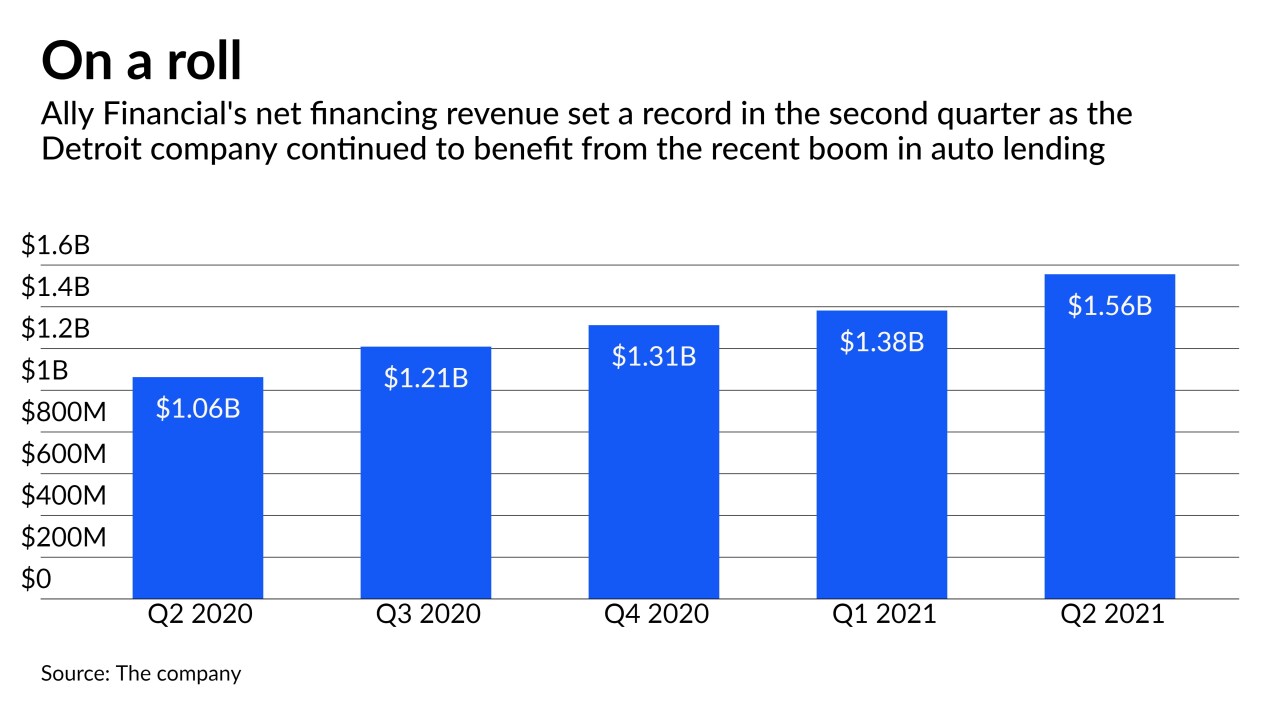

The Detroit company, one of the nation's largest car lenders, enjoyed a surge in profits during the second quarter, largely due to strong consumer demand for vehicles. But how long will the good times last?

July 20 -

The Spanish bank’s U.S. holding company said it will pay a premium to purchase the publicly traded shares in Santander Consumer Holdings. The proposal is subject to the approval of the auto lender’s board of directors.

July 2 -

Car sales are booming, but credit unions are financing fewer purchases of new vehicles as borrowers migrate to digital channels.

June 14 -

The nation’s largest mortgage lender plans to use a new partnership with the financial technology company AutoFi to sell more cars to its home loan customers.

May 5