-

The country’s ratio of household debt to disposable income reached a record 171% in 2017.

March 13 -

The fear of data breaches has become a regular part of life, but many regs that help protect auto lenders were written before that threat originated. Here's how to protect yourself.

March 7 EFG Companies

EFG Companies -

The bank will allow its customers to apply for car financing online and receive a decision within minutes.

February 22 -

The Arizona-based online auto dealer has partnerships with 35 credit unions – and is looking to expand.

February 22 -

The subprime auto lender paid $2.9 million to Connecticut consumers and a $100,000 fine for miscalculating balances owed on repossessed cars and for charging improper fees. It says the settlement is part of an effort to clean up "legacy issues."

February 20 -

Popular will acquire $1.5 billion in auto loans amid questions about the potential for loan losses following Hurricane Maria. The deal also coincides with Wells Fargo's need to stay inside a growth cap imposed by regulators.

February 14 -

Sen. Elizabeth Warren, D-Mass., asked Wells Fargo's chief executive to address recent reports that the bank's efforts to compensate customers for unnecessary fees is falling short.

February 14 -

In some states, total mortgages outstanding are at all-time highs, but in others hard hit by the financial crisis they remain well below their 2008 peaks, the New York Fed said Tuesday in its quarterly report on household debt.

February 13 -

U.S. consumers are borrowing more than ever to buy homes and cars, pay for college and even finance every day purchases. Is it a display of confidence in the U.S. economy or are many households living far beyond their means?

February 11 -

Warburg Pincus has agreed to buy a majority stake in a mortgage and consumer loan origination and servicing platform owned by Fiserv.

February 7 -

Banks will have to show they can withstand “severely adverse” conditions; the office will be under the direct control of acting director Mick Mulvaney.

February 2 -

After reporting its fourth-quarter earnings, the subprime auto lender said it expects the new tax law to enable more car owners to stay current on their loans.

January 31 -

The Minnesota bank was able to realize a large net tax benefit in the same quarter it took a big charge to exit auto lending, so in the end its profits doubled.

January 30 -

The Detroit company recorded an 11% increase in car loans and leases originated during the fourth quarter, as well as a jump in yields. Ally appears to be benefiting from Wells Fargo's substantial retrenchment in auto lending.

January 30 -

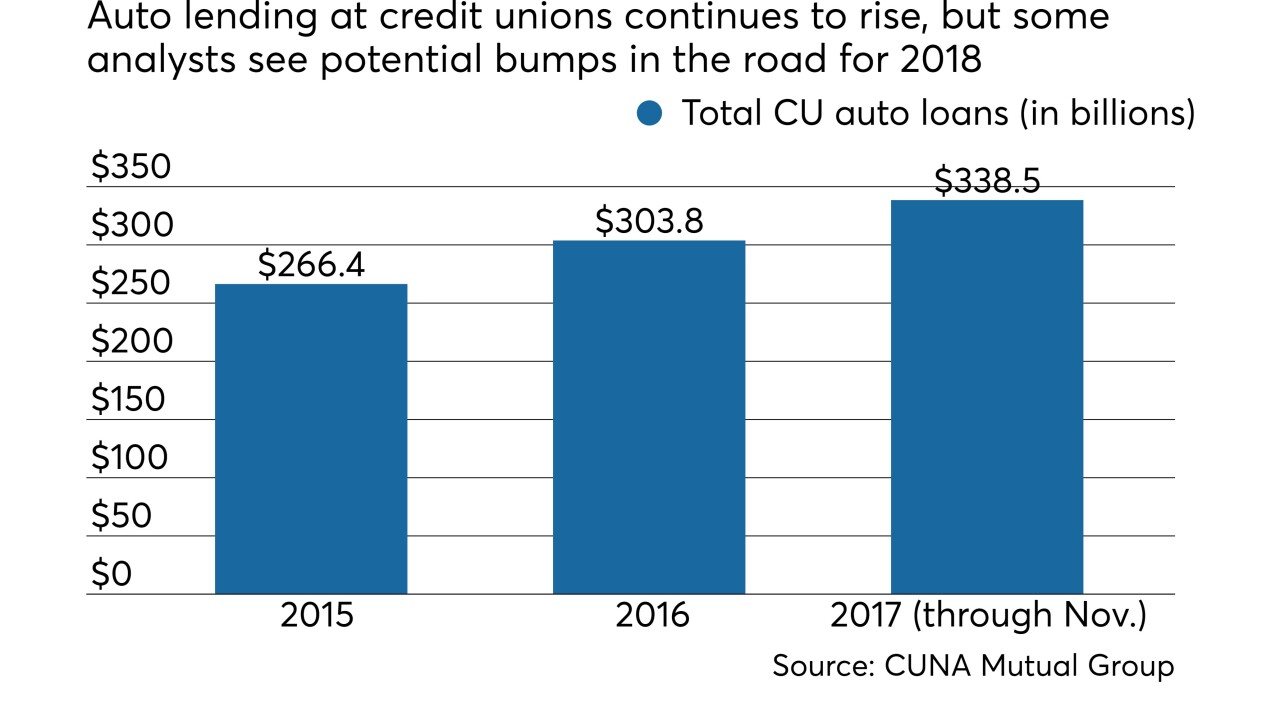

Long called the bread and butter of credit unions, auto lending will remain a key offering, but a number of factors could point to a slowdown in the year ahead.

January 29 -

The online vehicle-buying program has added 250 credit union partners since 2015.

January 25 -

It's the 13th year in a row that the CUSO has been able to give money back to its CU shareholders, capping a record-setting year for indirect auto loan growth driven by the firm.

January 24 -

Total loans rose 3% at the Minneapolis bank, but its net interest margin climbed 10 basis points. It also booked a one-time accounting gain of $910 million related to tax reform.

January 17 -

Weak loan growth, a $3.25 billion litigation accrual and other costs tied to the phony-accounts saga all added up to a messy fourth quarter for the San Francisco bank.

January 12 -

The agreement marks the latest example of the banking giant teaming with a fintech to speed up delivery of services to its customers.

January 11