-

A recent fraud case shines a spotlight on the many communication disconnects caused by disjointed software systems common at larger banks. Here's what happened to one American Banker editor.

January 9 -

The financial services industry is relying on outdated methods of detecting and fighting fraud. With the assistance of artificial intelligence, criminals are penetrating vulnerable systems. It's time for collective action.

November 4

-

An apparent increase in large-scale borrower fraud and the hot environment for bank mergers were the key themes as banks discussed their third-quarter results.

October 22 -

Amid growing deepfake threats and successful biometric bypass attempts by fraudsters, the bank added an extra layer of security to strengthen the authentication process.

October 16 -

Alan Childs pleaded guilty to using straw borrowers and falsified loan records to help a timber businessman secure millions in fraudulent loans.

September 18 -

Bankers are concerned about stablecoins gaining traction due to the passage of the GENIUS Act, and also continue to sound the alarm about the failure to resolve check fraud disputes, according to the latest quarterly survey from IntraFi.

July 30 -

Pulaski Savings Bank's failure will cost the FDIC's Deposit Insurance Fund 57.6% of its total assets.

June 25 -

The CEO of First Northwest Bancorp is promising to fight a lawsuit claiming the lender helped a client perpetrate a Ponzi scheme that bilked a hedge fund out of more than $100 million.

June 16 -

Two bankers detailed how artificial intelligence is transforming fraud detection and incident response for their institutions. The technology lets analysts ask datasets direct questions.

June 4 -

Brian Minick, who is in charge of cybersecurity for the bank, shared important cyber insights at an American Banker conference this week.

June 3 -

A string of senior resignations and scrutiny over share sales rocked Bank of America's local operations last year.

April 15 -

A new survey shows banks overwhelmingly support state laws that let them pause transactions to prevent elder financial abuse, despite shortcomings.

March 31 -

Scambaiting, which started as a genre of YouTube content, is now a full-blown tech tactic — with support from Australia's biggest bank.

March 27 -

Digital channel usage, account reconciliation and physical check safety are a few of the areas banks can advise customers on to help fight a rise in fraud.

March 19 -

The card network said it saved would-be victims $350 million in the first year after it combined several crime-fighting units.

March 17 -

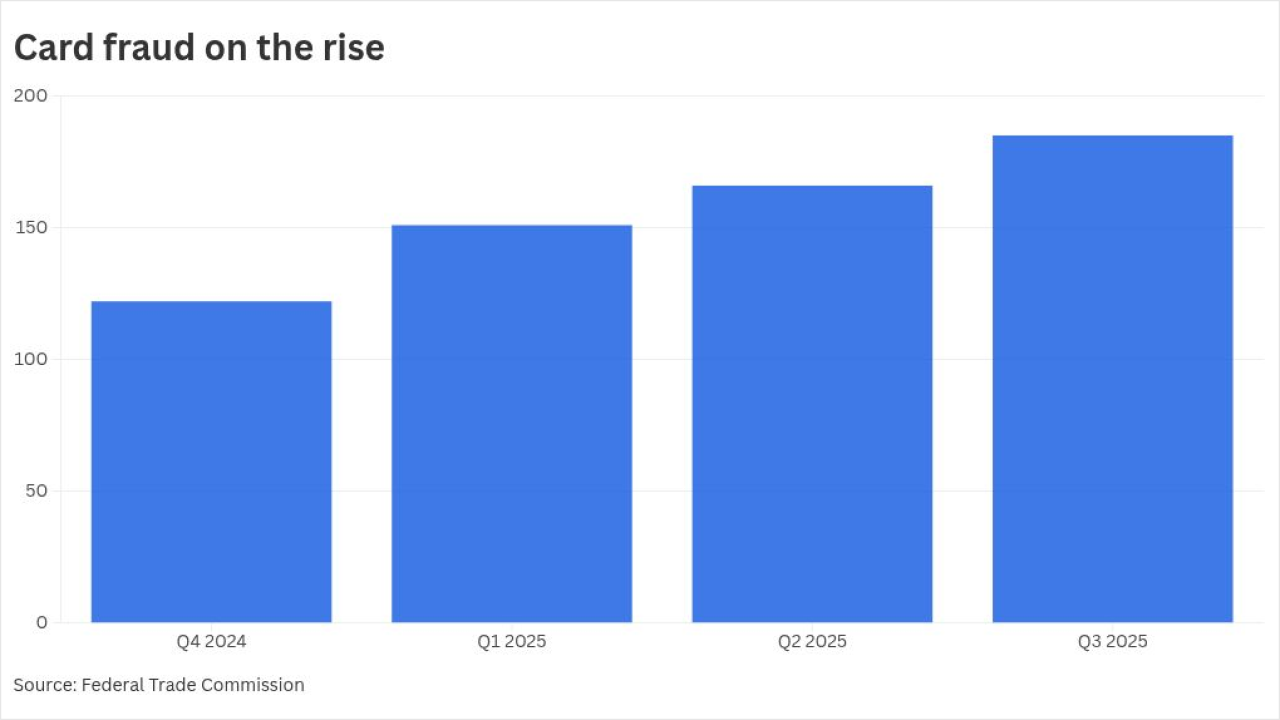

Both consumers and banks reported that the rate of fraud and scams has steadied, according to Fincen and FTC data, but the total cost continued rising.

March 13