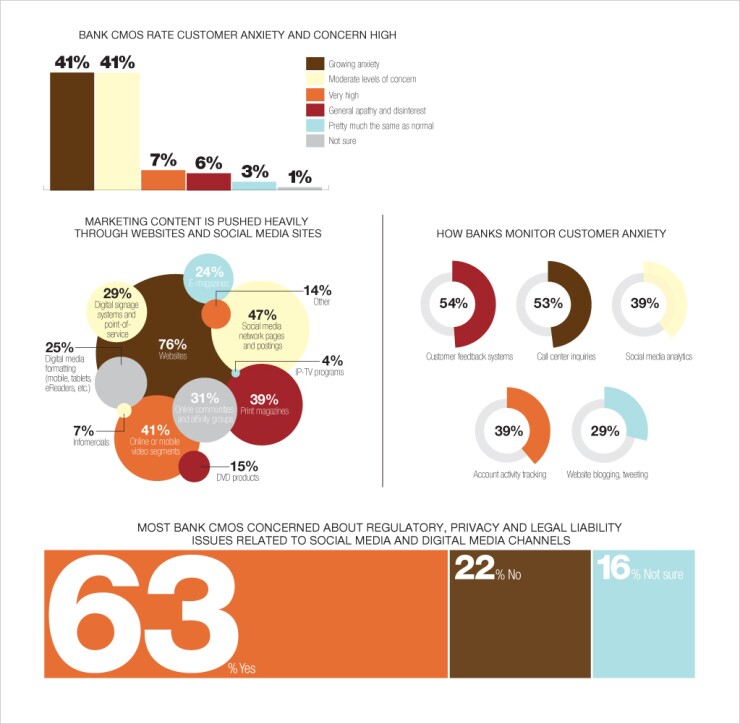

Banks' IMAGE issues are improving overall as the industry gets farther away from the subprime crisis. For example, the 30 banks included in American Banker's annual bank reputation survey, conducted by the Reputation Institute, scored higher with consumers this year than last year. Yet customers' anxiety levels are still moderate to high, say bank marketers surveyed by the CMO Council.

As banks try to win back the confidence of their customers post financial crisis, they're heavily using social media sites and video segments to get their point across.

They are addressing concerns through a variety of channels including websites, social media network pages and postings, online or mobile video segments and print magazines.

Eighty-two percent of respondents say they plan to increase the adoption and use of new channels of digital content delivery, community, and interaction. This preference for digital is due to factors such as lower production costs (59 percent), quicker turnaround (56 percent), better measurement and tracking (53 percent) and the adaptive, flexible nature of digital delivery (50 percent).

The bank marketers report feeling somewhat inadequate in their use of such online channels, though. "Only 19 percent of those surveyed feel their banks are properly structured and equipped to leverage the depth, timeliness, reach, richness and interactive nature of digital channels of customer engagement," the CMO Council report states.

The marketing executives surveyed are tracking the effectiveness of their digital messages by measuring customer acquisition (66 percent), reaction and response levels (62 percent) and loyalty and retention rates (55 percent).

"When a new channel is implemented, we test the response to determine how the new format is helping the bank perform against our set goals for new sales and retention. [This helps us] learn more about what our customers want [so we can] work to engage them through their preferred media channels," said Dan Marks, chief marketing officer at First Tennessee Bank, in the report.

120 bank executive members of the CMO Council responded to the survey.