-

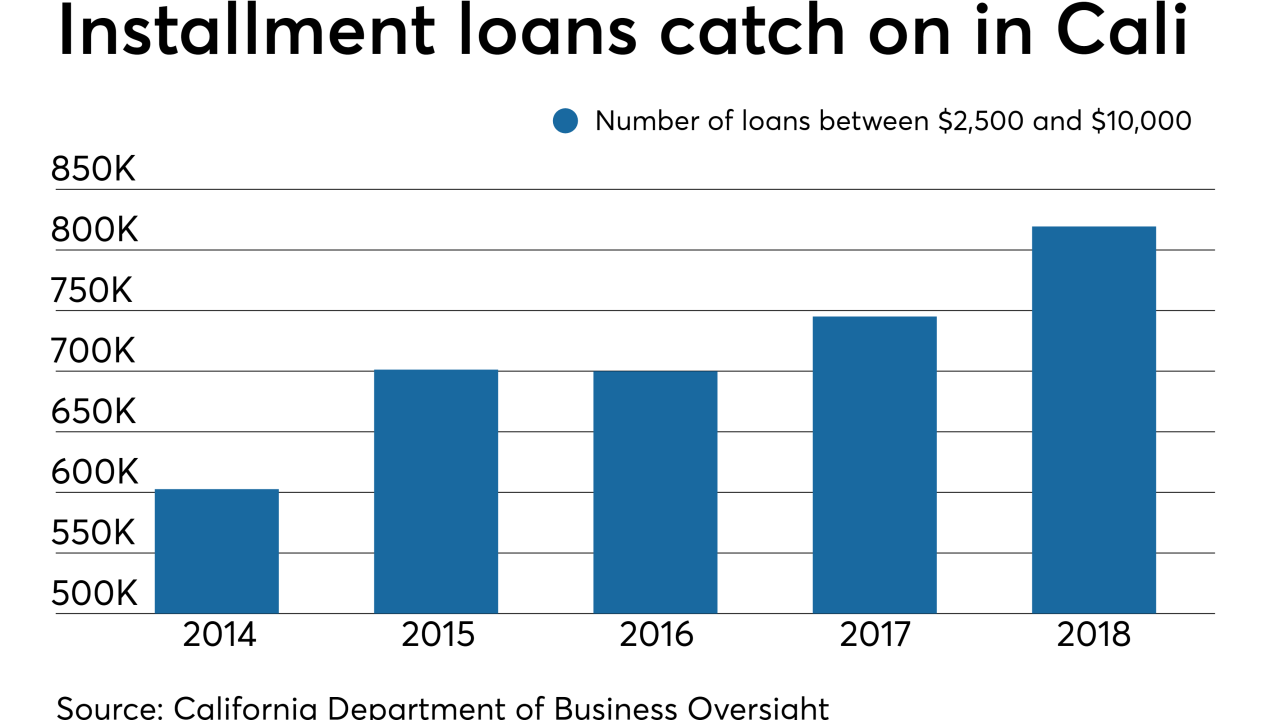

New data from the state shows that payday loans fell to a 12-year low in 2018. But the trend does not necessarily mean that consumers are paying less to borrow.

August 8 -

Fresh data from the Fed, FDIC and Bank of England shows that, directly or indirectly, banks are taking on more leveraged loans. But whether this puts their loan and securities portfolios at risk remains open for debate.

August 8 -

Mall landlords accustomed to offering rent reductions to ailing retailers are mulling a new strategy to forestall the industry's collapse: positioning themselves as lenders to tenants struggling to stay afloat.

August 7 -

The card company is buying the corporate-services businesses of Danish payments provider Nets A/S; the online lender’s stock plunged after it missed second quarter earnings expectations.

August 7 -

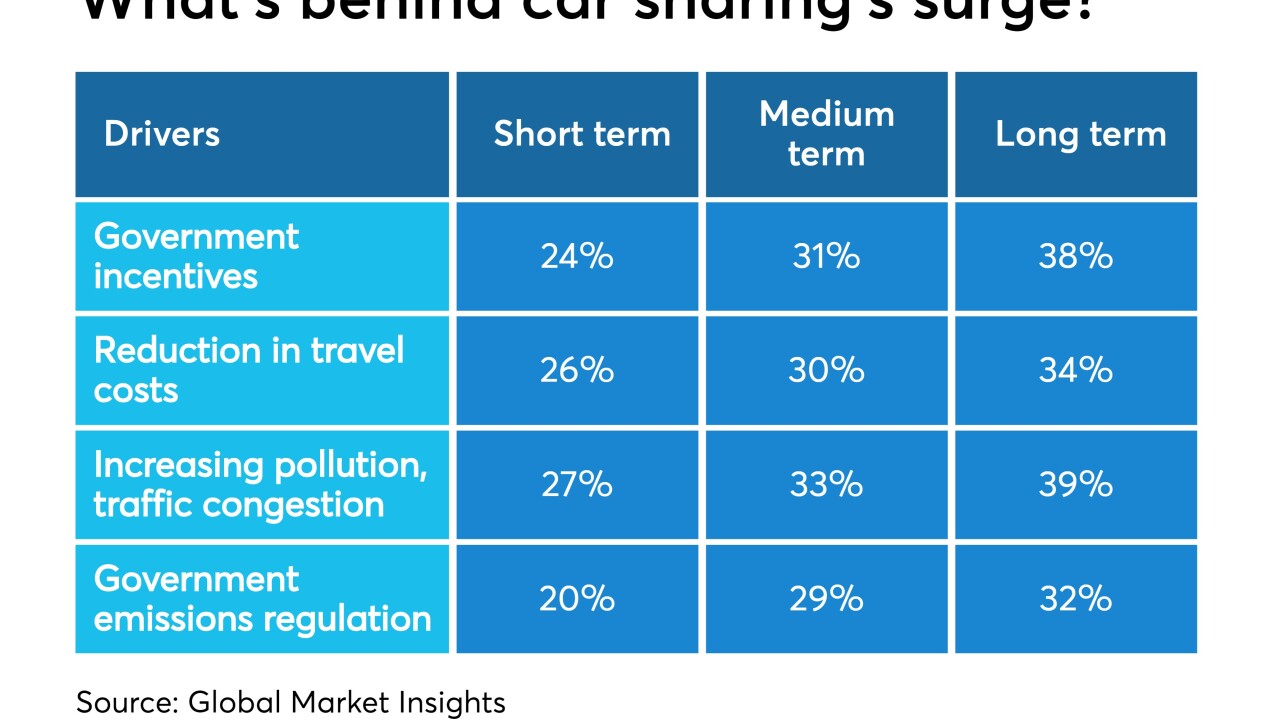

The industry faces additional risks when members take out auto loans and then list their new vehicles on apps for others to rent.

August 7 -

The San Francisco company forecast a modest profit in the third quarter because its cost-cutting plans are ahead of schedule. It's also starting a program to sell riskier loans to sophisticated investors.

August 6 -

The Upstart Network, the first and only startup to participate in the bureau’s program for promising digital platforms, claims that using nontraditional credit data items has helped loan volume and affordability.

August 6 -

The Atlanta fintech, whose shares have plummeted since it went public last year, also said it will stop providing financial guidance to its investors.

August 6 -

Krista Morgan, the founder and CEO of P2Binvestor, discusses her firm's bank deals and the tech driving its platform.

August 6 -

Credible Labs, which lets consumers shop for the best rates on student loans, mortgages and other credits, would be part of an evolving digital strategy at Fox after the multibillion-dollar sale of many of its traditional media assets to Disney.

August 5