-

In a state where laws are unusually favorable to high-cost business lenders, taxi drivers are not the only small-business people getting trapped in loans they can't afford to pay back. The question is, what are policymakers going to do about it?

May 24 American Banker

American Banker -

Online lenders now have close to 40% of the unsecured personal loan market, much of which is refinanced credit card debt. Some financial institutions' card portfolios are taking a hit.

May 24 -

Readers weigh in on the role of the Financial Accounting Standards Board, consider personnel changes at the Consumer Financial Protection Bureau, debate the viability of public banks and more.

May 23 -

Online lenders now have close to 40% of the unsecured personal loan market, much of which is refinanced credit card debt. Banks' card portfolios are taking a hit.

May 23 -

Biz2Credit is offering its Biz2X platform to all banks after gaining HSBC and Popular Bank as clients.

May 21 -

First Internet will gain lenders and servicing staff, along with offices in Chicago and Indianapolis, from the deal.

May 21 -

Although higher corporate debt could hurt the economy, Federal Reserve Chair Jerome Powell argued changes made since the last crisis will guard against a meltdown.

May 20 -

The Bay Area is a booming market with a limited number of smaller banks. The high premium Presidio is receiving from Heritage Commerce might spark more M&A activity.

May 20 -

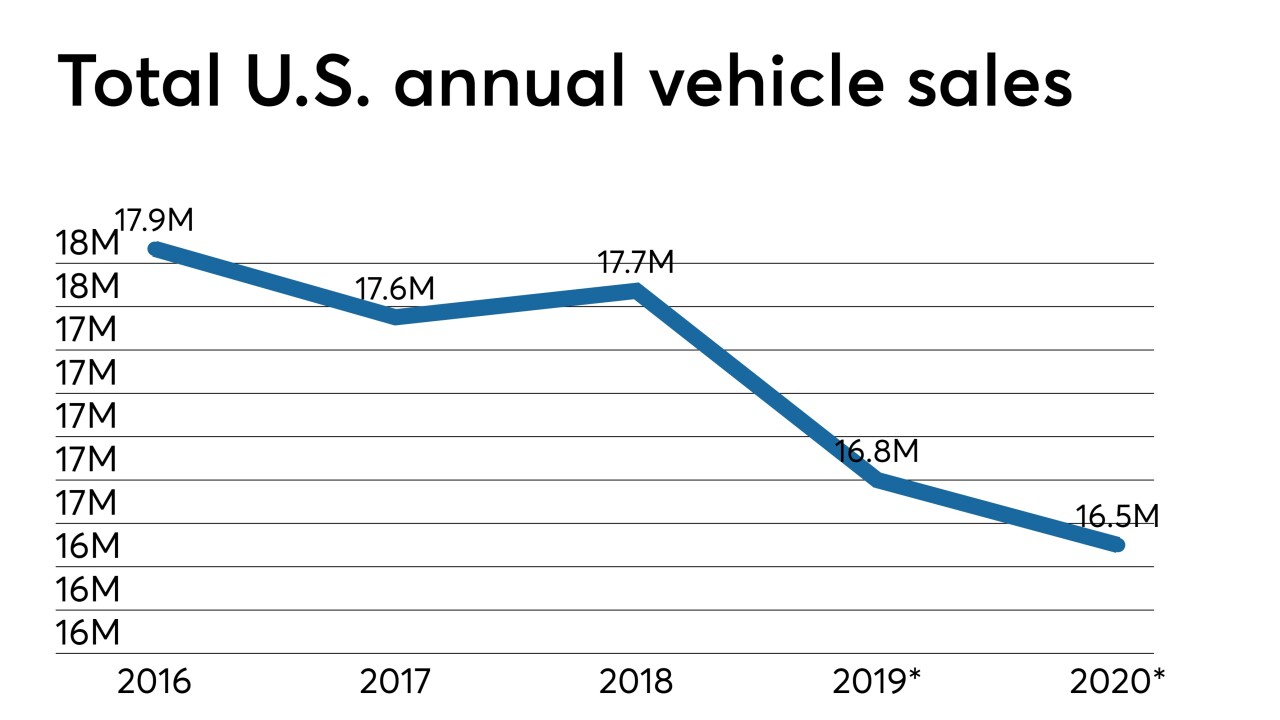

Two economists speaking during CU Direct's recent Drive conference in Las Vegas offered predictions on how a variety of economic factors could impact credit union auto lending portfolios in the not-too-distant future.

May 20 -

On Dec. 31, 2018. Dollars in thousands.

May 20