-

In a reversal from five years ago, six of the eight biggest U.S. banks by branch count now offer the loans, which observers see as safer alternatives to payday loans.

February 1 -

Rising inventories and the specter of regulation may make it seem like the pandemic auto boom is over, but broader trends could make it a profitable business if banks do it right.

January 31 American Banker

American Banker -

North Carolina-based First Citizens blamed a rise in problem credit on certain office loans that it acquired in the CIT Group merger. Connecticut-based Webster also expressed caution about the segment, which has been impacted by remote work policies.

January 26 -

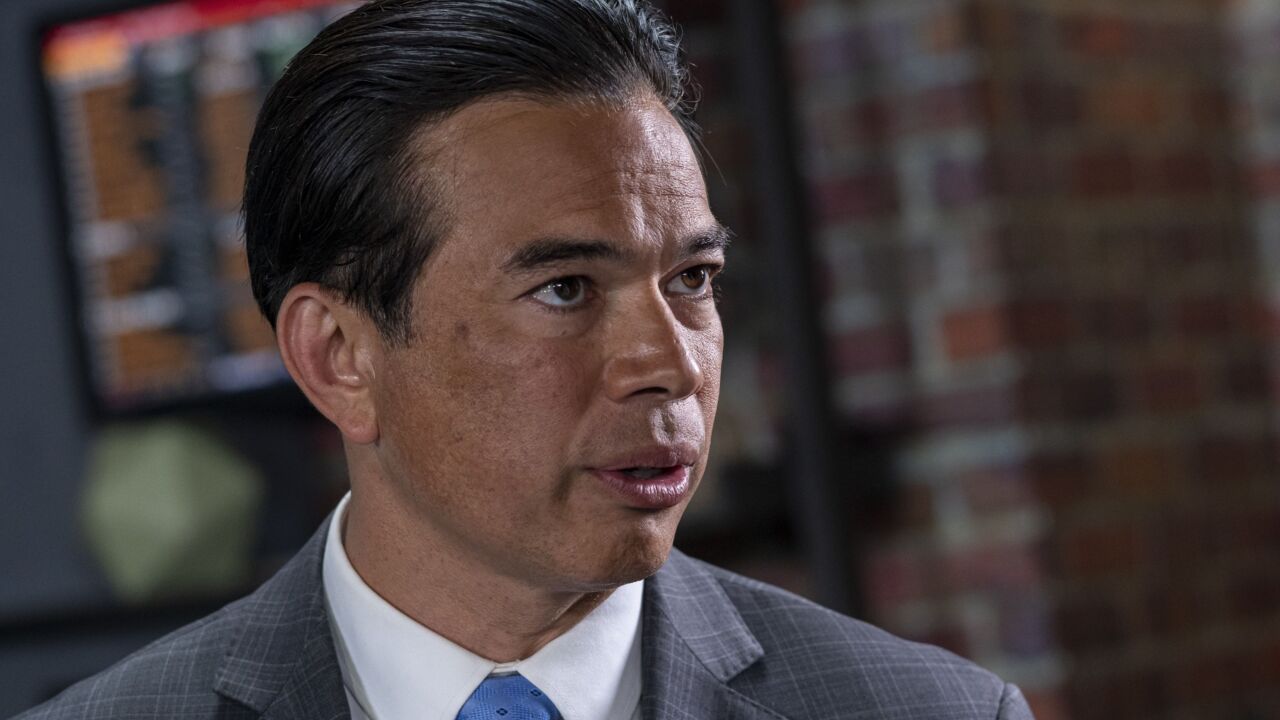

California Attorney General Rob Bonta is standing by the state's commercial financing disclosure law, urging more protections for small-business financings and arguing that federal consumer law does not not apply to commercial lending.

January 24 -

The lending software and shared services provider was created by bankers for bankers.

January 24 -

A new Risk Management Association survey found that 84% of small lenders cite credit quality as a leading worry for 2023 because of the likelihood of a recession.

January 8 -

The Tupelo, Mississippi-based institution hasn't made a bank deal since 2018, but it has acquired two asset-based lenders in the past 10 months.

January 5 -

Commercial loans at federally insured credit unions increased 25% to $132.2 billion in the third quarter of 2022, even though many institutions are facing a tough job market. Their answer is to find strong candidates within their own ranks.

December 27 -

Banks and other lenders revived special-purpose credit programs after racial-equity protests in 2020 prompted them to reexamine their services for historically underserved groups. Now they're taking those initiatives nationwide.

December 27 -

The Paycheck Protection Program proved successful in providing small-business owners with funds to keep workers employed — but it was also a magnet for criminals. Here is a rundown of fraud probes, prosecutions and potential long-term consequences for commercial lending.

December 23 -

In a new survey, executives at banks and credit unions registered the highest level of anxiety about a forthcoming data-collection rule in small-business lending.

December 16 -

The Small Business Administration must be prepared to effectively oversee any new lenders it allows in its flagship 7(a) loan guarantee program to guard against fraud and other risks, Democrats and Republicans on the Senate Small Business Committee warned.

December 14 -

The institution's Impressia Bank will be dedicated to the professional and financial advancement of women business owners and entrepreneurs.

December 13 -

Citing a congressional report, SBA says it will investigate PPP operations at several fintechs, community banks and other participants. The review raises questions about plans to open up the agency's flagship loan-guarantee program to more nonbanks.

December 8 -

New York and California are among the states that have laws requiring lenders to make certain disclosures to small-business borrowers. The Consumer Financial Protection Bureau has reached a preliminary determination that a federal statute does not preempt those state laws.

December 8 -

-

With the final piece of its regulatory puzzle in place, Newtek, a business development company and the nation's No. 3 SBA 7(a) lender, plans to complete its acquisition of National Bank of New York City in January.

December 2 -

The Canadian banking giant reached a five-year deal with community groups that includes $40 billion in investments to underserved groups. BMO aims to close its acquisition of San Francisco-based Bank of the West before the end of the year.

November 28 -

The case involved a customer who was charged $100,000 in legal fees when he tried to pay off a commercial mortgage early. After the borrower waged a nearly decadelong legal fight, a Florida court ordered the bank to reimburse a portion of the fees.

November 22 -

The $683 million-asset credit union opened a loan production office in Enfield dedicated exclusively to mortgage and business lending.

November 21