-

More than $1 billion in coronavirus relief went to small businesses that received multiple loans and a congressional subcommittee analyzing the Paycheck Protection Program says it has seen evidence of fraud in thousands more loans.

September 1 -

The bank's five-year commitment will focus on providing more capital to small businesses and expanding access to affordable housing and homeownership.

September 1 -

The agreement between Colorado authorities, marketplace lenders and banks offers a way to structure partnerships without triggering the wrath of state regulators.

August 31 Hunton Andrews Kurth LLP

Hunton Andrews Kurth LLP -

New analysis from S&P found that only two of the of the top 20 credit unions that participated in the Paycheck Protection Program loans had assets of less than $1 billion.

August 27 -

The Minneapolis company’s partnership with the Black Business Investment Fund and other community development financial institutions is an example of how banks can fulfill multimillion-dollar pledges aimed at closing the racial wealth gap.

August 26 -

The former SoFi chief’s latest startup, Figure, has created what it says is a transparent marketplace for buying and selling assets. Some banks have embraced the technology, but other blockchain projects have stalled because lenders don't want rivals to see their data.

August 25 -

The bank — which said it has been upgrading its loan operations platform after a review it undertook last year — said it mistakenly transmitted the payments after an employee didn't manually select the correct system options in its loan operation software.

August 25 -

New York’s attorney general is investigating whether President Trump’s company inflated the value of his assets to secure favorable terms for loans, according to court filings. Testimony from his son Eric Trump is being sought as part of the case.

August 24 -

A group of eight Attorneys General filed suit against an FDIC final rule related to ‘rent-a-bank’ partnerships, mirroring a similar suit filed against the Office of the Comptroller of the Currency last month.

August 20 -

The CFPB is giving stakeholders until Dec. 1 to file comments on a potential overhaul to its rules related to the Equal Credit Opportunity Act, which prohibits discrimination in credit and lending decisions.

August 19 -

American Express isn't acquiring any loans in its deal for the online small-business lender. Here's what it is getting.

August 19 -

With big banks largely shunning the program, small banks see an opening to grab more market share in commercial lending.

August 19 -

American Express isn't acquiring any loans in its deal for the online small-business lender. Here's what it is getting.

August 18 -

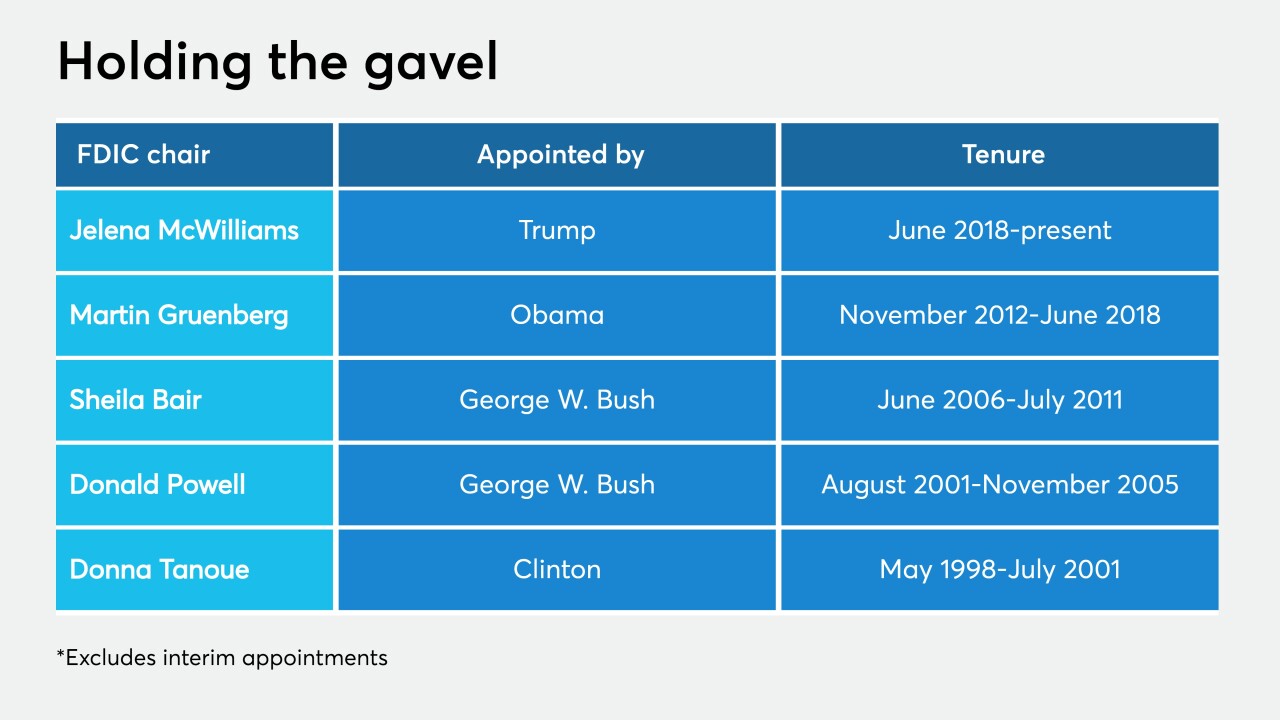

Jelena McWilliams's term as FDIC chair expires in 2023, and she cannot be removed by an incoming president. But if Joe Biden prevails, he may ask her to stay — and if she does, governing a Democratic-majority board would be a very different proposition.

August 18 -

The bank has begun briefing regulators about how it mistakenly sent payments to creditors of Revlon, the financially strapped cosmetics company. Citi has also filed a lawsuit against Brigade Capital Management seeking to recoup $175 million it sent to Brigade on Revlon's behalf.

August 17 -

Ulule is working with Bank of the West to build name recognition. It hopes to collaborate with other banks and credit unions as it vies with larger companies such as Kickstarter and GoFundMe.

August 13 -

Criticized assets are on the rise, especially in commercial portfolios, and may be the forerunner of a wave of loan losses later this year or next year unless economic conditions strengthen.

August 12 -

The Paycheck Protection Program has masked what has been a year of tepid demand and tightened lending standards. And bankers aren't expecting a rebound anytime soon.

August 12 -

A public-private partnership that has fewer rules and restrictions than the Paycheck Protection Program would save more small businesses.

August 12 Amount

Amount -

The head of the Federal Reserve Bank of Boston said the central bank had acquired stakes in 32 business loans as of Monday, four times the amount from two weeks earlier.

August 12

![“Much of the increase [in loans] has occurred recently, and I expect we will continue to see more activity as more firms are impacted by the pandemic,” said Boston Fed President Rosengren.](https://arizent.brightspotcdn.com/dims4/default/f6fc5c5/2147483647/strip/true/crop/4000x2250+0+208/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2F31%2F24%2F6942fc3a4ec4920c1f2aac8c5926%2Frosengren-eric-bl-081220.jpg)