Consumer banking

Consumer banking

-

Though the agency plans to give more credit unions authority to issue subordinated debt, limited investor appetite and other factors could hamper activity.

February 25 -

The FDIC’s Quarterly Banking Profile said lackluster net interest income, likely resulting from lower short-term interest rates, drove a decline in fourth-quarter and full-year earnings.

February 25 -

Giving more Community Reinvestment Act credit to such partnerships will help low-income communities, despite industry concerns.

February 25 -

Organizers of Gulf Atlantic Bank must raise $12 million in capital before opening.

February 25 -

NCUA board member Mark McWatters defended the agency's position on credit union-bank purchases and called out the ongoing sniping on both sides of the argument.

February 25 -

WSFS, in an effort to catch up with bigger rivals, plans to upgrade digital channels in three years instead of five.

February 24 -

Observers speculate that Intuit simply wants to enhance revenue and protect its tax software business, but the CEOs of each company say the deal would also give consumers more control of their overall finances.

February 24 -

The company revised its results to a net loss of $700,000 after deciding to record a $16 million loan-loss provision for the commercial loan.

February 24 -

The Canadian banking giant has the resources and the tech know-how to build a digital-only bank in the U.S., but can it set itself apart from the likes of Capital One, Ally, Citizens Bank and Goldman Sachs?

February 24 -

The Armed Forces Financial Guide covers information such as special pay, service benefits and long-term financial planning.

February 24 -

Intuit has agreed to buy Credit Karma for $7.1 billion. The move is seen as a way for Intuit to get access to more consumer behavior data, generate new sources of income and potentially protect a key business.

February 24 -

The company is buying a homebuilder finance portfolio with $47 million in loans and $80 million in commitments.

February 24 -

When small banks leave the community, it makes sense for credit unions to fill the void.

February 24 -

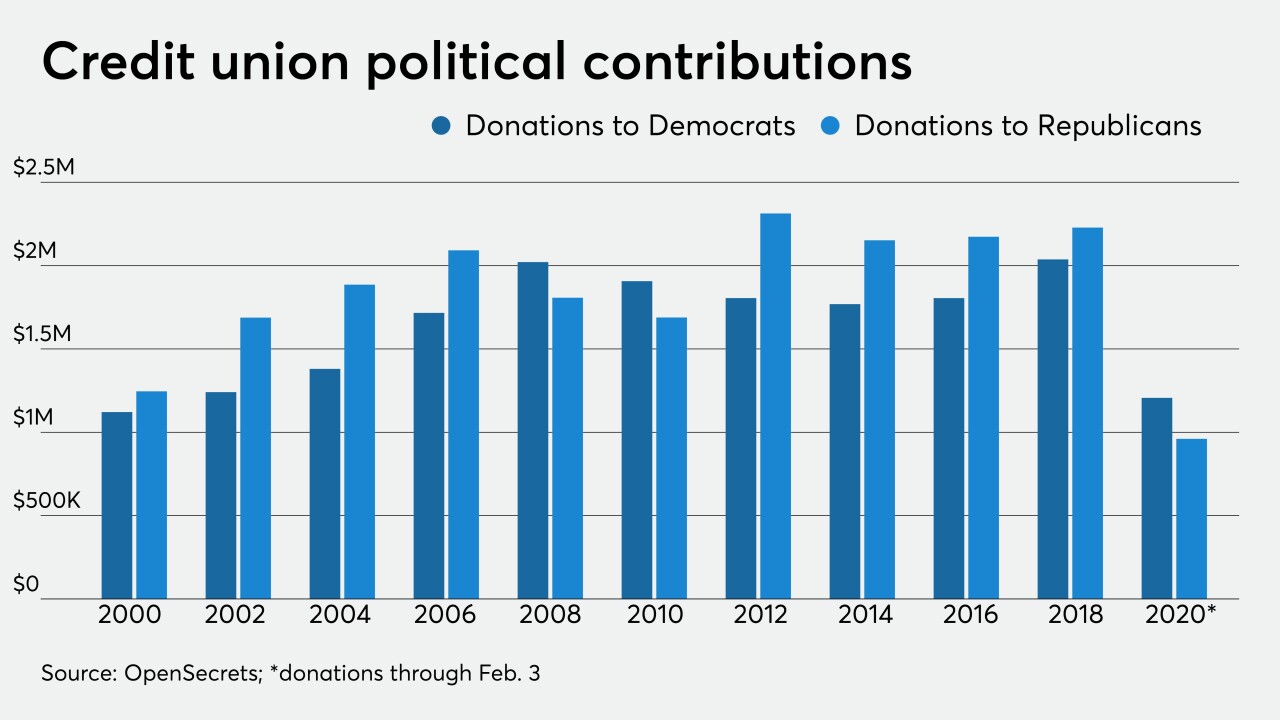

The industry loves to tout its bipartisanship, but it has very publicly embraced the Trump administration at times.

February 24 -

Bernie Sanders’ rise to front-runner status for the Democratic nomination worries many bankers, but their opinions diverge on his electoral chances and whether a Sanders presidency would pose a direct threat.

February 23 -

Community banks are entering the business as intermediaries to counter the pinch of low loan yields and intense competition on spread income.

February 23 -

The 10-digit penalty marks an important milestone for the bank, but individual ex-bankers may still be at risk and grueling hearings lie ahead for current leadership.

February 21 -

A deferred-prosecution agreement with the Justice Department spares the bank a potential criminal conviction — provided it cooperates with continuing probes and abides by other conditions.

February 21 - Finance and investment-related court cases

Tech firm accuses PNC of stealing trade secrets; online lender LendingClub agrees to acquire Radius Bank; questions arise whether regulators are turning more partisan; and more from this week's most-read stories.

February 21 -

Regions, Citizens, BMO and others are adopting principles IBM unveiled at Davos.

February 21