Consumer banking

Consumer banking

-

Bankers say the federal tax exemption for credit unions costs U.S. taxpayers $2 billion each year. But eliminating it would prevent the not-for-profit financial institutions from channeling their savings into higher rates and lower fees that stimulate commerce — and generate additional tax income.

April 23 -

The Illinois companies agreed to merge in a transaction that is expected to close later this year.

April 23 -

Citigroup could fetch as much as $6 billion from the sale of retail banking assets in 13 markets across the Asia-Pacific region, Europe and the Middle East as the lender forges ahead with plans to fine-tune its global branch network, people familiar with the plan said.

April 23 -

The company promoted Bob Fehlman to become its president and hired Jay Brogdon from Stephens Inc. to succeed Fehlman as chief financial officer.

April 22 -

Ken Meyer, who will speak at American Banker's Digital Banking AI & Automation conference next week, says banks should be able to quickly catch up with big technology companies and financial services upstarts in the adoption of artificial intelligence without alienating customers or running afoul of regulators.

April 22 -

The Georgia company agreed to pay $84 million for a bank with nine branches and $715 million of assets.

April 22 -

The deal would be Independent's sixth since 2015 and would continue a wave of consolidation among Boston-area banks.

April 22 -

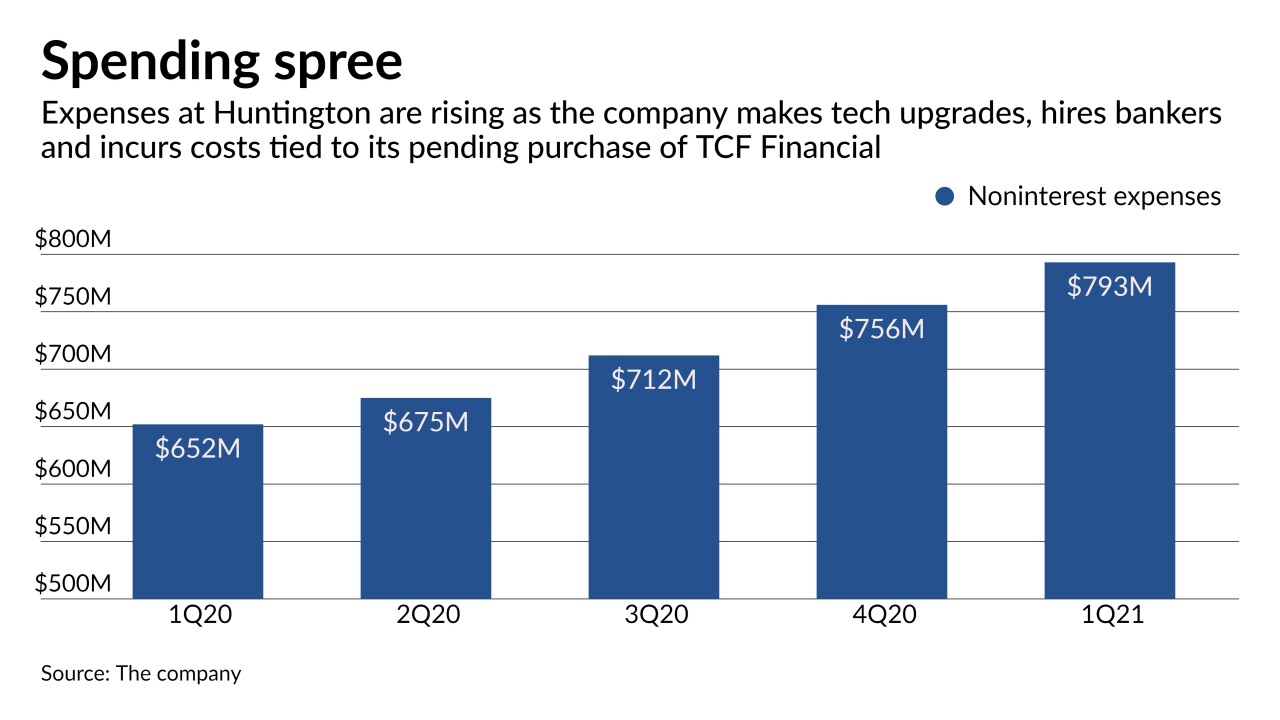

The Ohio regional took advantage of an unexpected boost in interest income in the first quarter to upgrade its digital platform and recruit bankers in wealth management, capital markets and Small Business Administration lending.

April 22 -

The Maryland company is closer to addressing claims it lacked sufficient controls under its previous management.

April 22 -

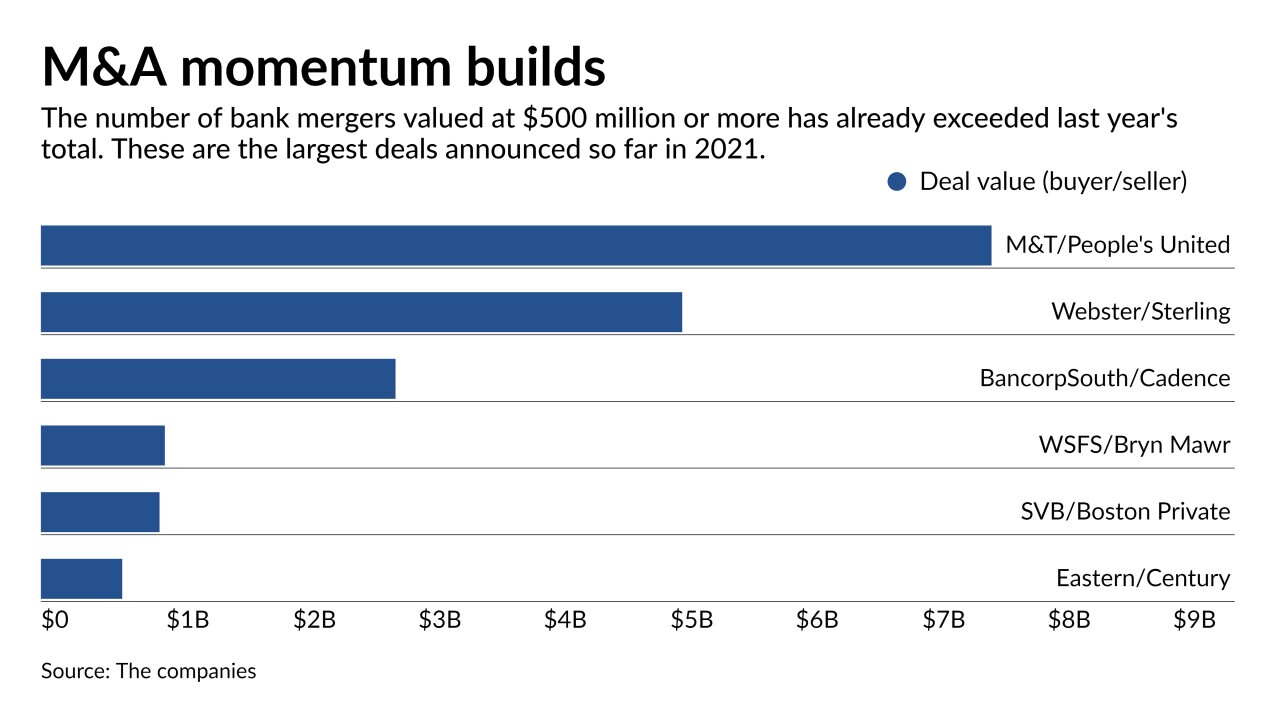

Clarity on credit quality has bankers ready to strike deals after a lengthy pause. A steady rise in stock prices has also given potential buyers the financial wherewithal to pursue acquisitions.

April 21 -

The Ohio company has opened just 32 of 120 new branches it plans in the region by 2022, but those offices are making a sizable contribution to growth.

April 20 -

Queensborough National Bank and Trust in Georgia is one of several banks aiming to recruit tech-savvy interns through a network of universities and fintech companies.

April 20 -

The company plans to shutter five locations, or roughly 12% of its network, next month.

April 20 -

Rhodium BA Holdings said it has proposed paying a higher price to disrupt the banking company's proposed sale to DLP Real Estate Capital.

April 20 -

Wells Fargo wants to use the real-time payments network being developed by the Federal Reserve for 24/7 liquidity management. The online-only First Internet Bank aims to use it to help customers manage their bills and cash flow.

April 19 -

Year to date through Dec. 31, 2020. Dollars in thousands.

April 19 -

Funds affiliated with HPS Investment Partners plan to buy Marlin Business Services for $282 million.

April 19 -

Trabian Technology, which builds digital products and mobile applications, is the latest in a series of technology-related purchases by MVB.

April 19 -

The company paid Driver Opportunity Partners nearly $10 million for the shareholder's stock and to resolve a longstanding legal battle.

April 19 -

The Maryland company recently raised $345 million to form the subsidiary and fund growth opportunities for its bank.

April 19