Consumer banking

Consumer banking

-

Of the 90 honorees on American Banker's 2025 Best Banks to Work For list, 28 had between $3 billion and $10 billion of assets.

November 13 -

Several of the Best Banks to Work For 2025 are using artificial intelligence in ways that help their workforces.

November 13 -

Fintechs and banks approach innovation from different starting points. Noelle Acheson points out that this can be seen in their approach to payments, and now also in the approach to stablecoins.

November 13 -

Small banks made up the majority of honorees on American Banker's 2025 Best Banks to Work For ranking.

November 12 -

The Missouri-based community bank secured the top spot on American Banker's 2025 Best Banks to Work For list. Its mission and business strategy is all about love, executives say.

November 12 -

Ninety banks made American Banker's annual Best Banks to Work For ranking, which is now in its 13th year. Find out why the banks ranked 21st to 90th stand out.

November 12 -

American Banker's 2025 Best Banks to Work For ranking includes perennial winners and several newcomers. Here's how the leaders of the top 20 banks keep their employees happy.

November 12 -

A former member of Congress and current bank chairman calls on lawmakers to pass several reforms that would allow banks to take back market share that has been lost to nonbank competitors.

November 11 -

Barwick Banking Co. will have the wherewithal to accelerate its expansion in Georgia and Florida after a $50 million investment from a new venture capital platform.

November 10 -

The Pittsburgh-based bank said Friday that it will focus on building 300 branches in high-growth markets by 2030. It also minimized the prospects for another acquisition on the heels of its recent deal for Colorado-based FirstBank.

November 7 -

HoldCo Asset Management drops its pursuit of proxy battles with Columbia Banking System and First Interstate; Cape Cod's Mutual Bancorp prepares to acquire Bluestone Bank; Servbank HoldCo announces plans to acquire IF Bancorp; and more in this week's banking news roundup.

November 7 -

Crypto is slowly but surely being integrated into the banking applications consumers trust and use every day. It's not the crypto revolution purists imagined, but it's very good news for consumers and bankers alike.

November 7 -

Existing law already provides the tools that would allow an across-the-board upgrade in digital identity verification, with benefits to banks and consumers alike. Regulators are the roadblock.

November 7 -

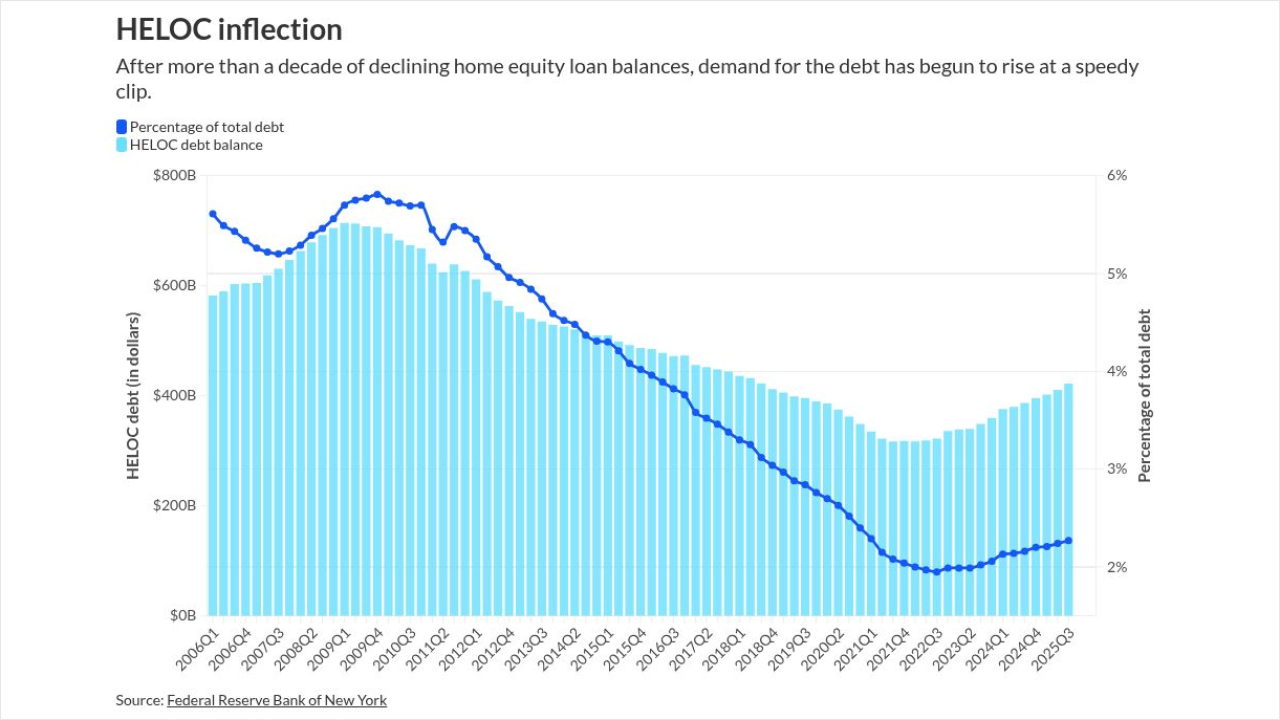

The volume of home equity lines of credit expanded for the 14th consecutive quarter, driven largely by fintechs and other nonbanks that are accounting for more and more of the business.

November 7 -

Analysts say the fintech must "grow like a fintech, but be profitable like a bank" as its capital base shrinks to its lowest level to date.

November 6 -

Jerry Plush had helmed the South Florida-based bank for nearly five years before agreeing to depart this week. News of the leadership change comes little more than a week after Amerant reported a 43% increase in nonperforming assets.

November 6 -

Policymakers must avoid looking at community banks as institutions of the past that no longer have a place or function in our financial system and stop prioritizing large banks and technology companies.

November 6 -

The Consumer Financial Protection Bureau is considering a proposal to reduce its oversight of auto finance lenders, saying the benefits of supervision may not justify the "increased compliance burdens."

November 6 -

At its first investor day in a decade and a half, the nation's second-largest bank pegged its guidance for return on tangible common equity at a slightly higher level than what it reported last quarter. Not all investors were impressed.

November 5 -

After more than a quarter-century as a regulator, Jason Sisack had planned to enjoy some time off before taking a new job. He reversed course once Carver, which is operating under an enforcement action, approached him.

November 4