-

The Arkansas bank is turning to asset-based lending and loans to venture capital and other investment groups to help fill a void created by a shortage of new, big-ticket commercial real estate deals.

April 28 -

Mike Daniels has been president and CEO of Nicolet's bank since 2015.

April 28 -

The Dallas company will pay nearly $54 million for a 49% stake in a lender that operates in 10 states.

April 28 -

The $56 million acquisition will extend Southern California Bancorp's footprint north of Los Angeles.

April 28 -

Profits slumped last year and many investors are now voicing their displeasure with the compensation awarded to senior leaders. A nonbinding “say on pay” vote taken Tuesday passed narrowly, but Chairman Charles Noski indicated that the board will take the results into account when designing future pay packages.

April 27 -

Citigroup said a full review conducted after the lender mistakenly sent $900 million to a group of investment firms concluded the bank didn’t need to claw back any pay from executives.

April 27 -

The Missouri company announced the deal just five months after buying Seacoast Commerce in San Diego.

April 26 -

The merger would create a company with nearly 400 branches, 87 loan production offices and $87 billion of assets.

April 26 -

The proposed acquisition is the second deal in as two days to involve an Atlanta-based seller.

April 23 -

The Illinois companies agreed to merge in a transaction that is expected to close later this year.

April 23 -

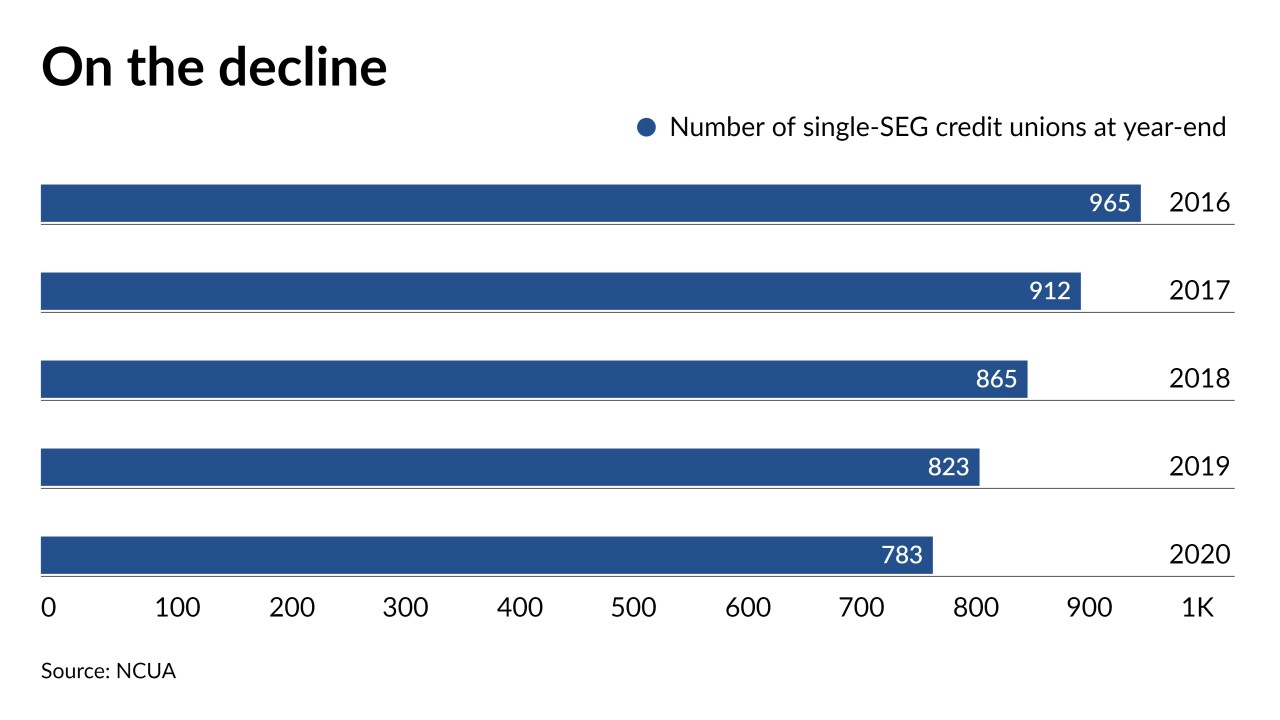

Regulators recently eased field-of-membership rules to promote growth of federal credit unions. A handful of institutions are taking advantage of the changes to recruit more members, but some may find the process too cumbersome.

April 22 -

The Georgia company agreed to pay $84 million for a bank with nine branches and $715 million of assets.

April 22 -

The deal would be Independent's sixth since 2015 and would continue a wave of consolidation among Boston-area banks.

April 22 -

Under the leadership of former Chief Risk Officer John D'Angelo, the new environmental, social and governance office will oversee the bank's sustainability and corporate social responsibility functions.

April 22 -

The Maryland company is closer to addressing claims it lacked sufficient controls under its previous management.

April 22 -

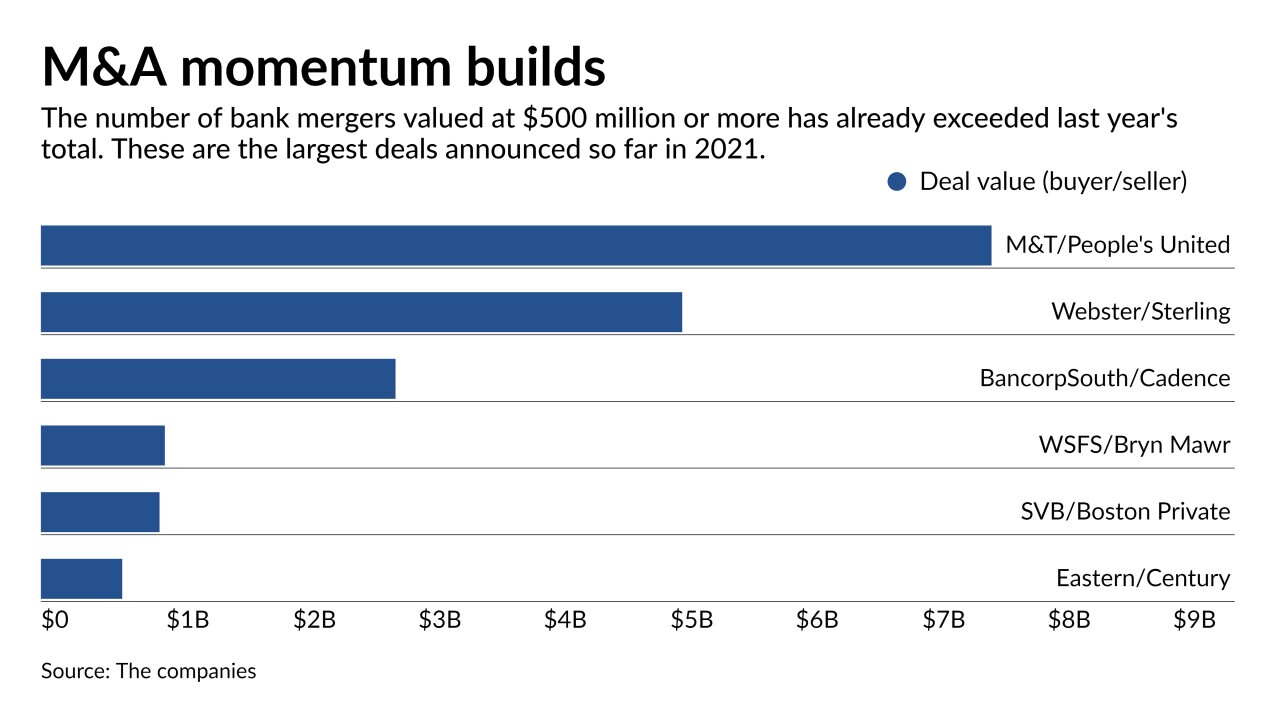

Clarity on credit quality has bankers ready to strike deals after a lengthy pause. A steady rise in stock prices has also given potential buyers the financial wherewithal to pursue acquisitions.

April 21 -

Cal Poly Federal Credit Union's recent merger into SchoolsFirst highlights the difficult choice many small institutions face: diversify your field of membership or risk going out of business.

April 21 -

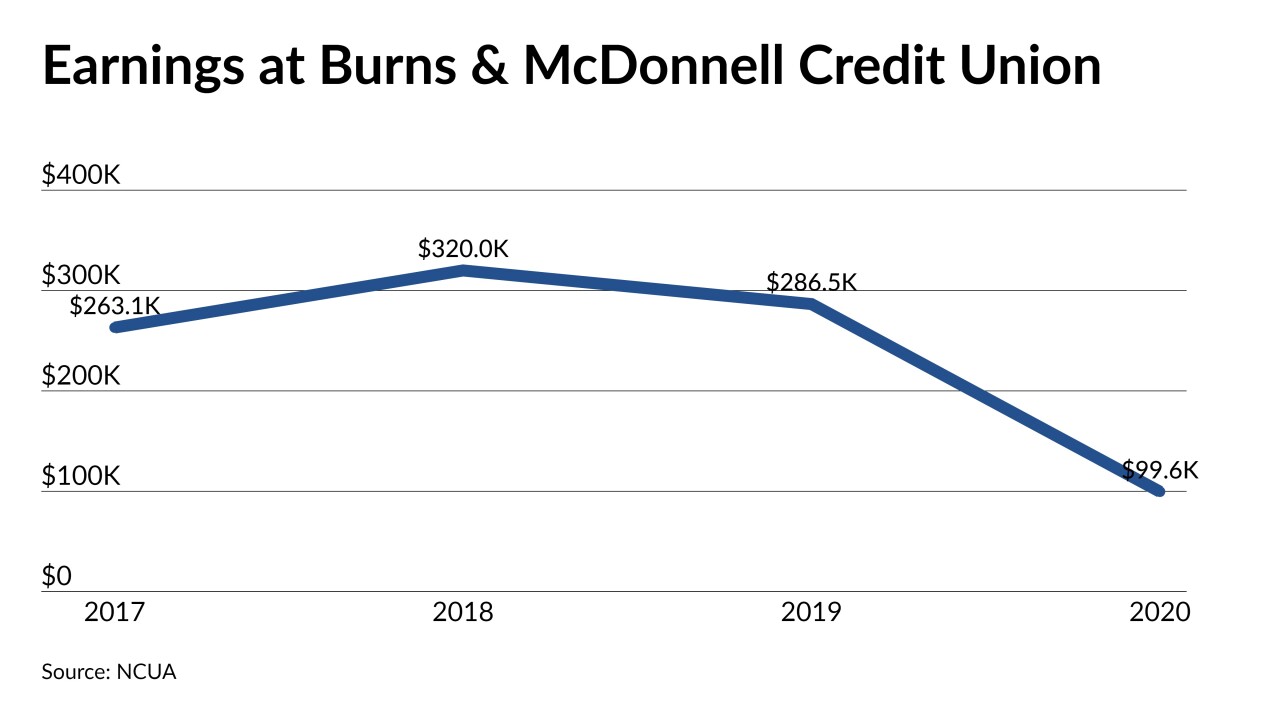

Burns & McDonnell Credit Union holds just $27 million of assets and is seeking approval to merge into CommunityAmerica, which serves the KC metro region and is the largest credit union in Kansas and Missouri.

April 21 -

The Ohio company has opened just 32 of 120 new branches it plans in the region by 2022, but those offices are making a sizable contribution to growth.

April 20 -

The company plans to shutter five locations, or roughly 12% of its network, next month.

April 20