-

In addition to overseeing the bank’s lines of business, technology and operations, Kevin Blair will now be responsible for human resources, credit administration and all customer-facing support functions.

December 13 -

As bank locations close, credit unions are filling the gap in many major cities, but the study also showed CU facilities closing up shop in high numbers.

December 12 -

Many business customers are putting off expansion because they can’t find enough workers to fill available jobs.

December 11 -

The bank, whose 7(a) originations have plummeted in recent years, is developing a portal that will let applicants upload documents, complete forms and track application progress.

December 11 -

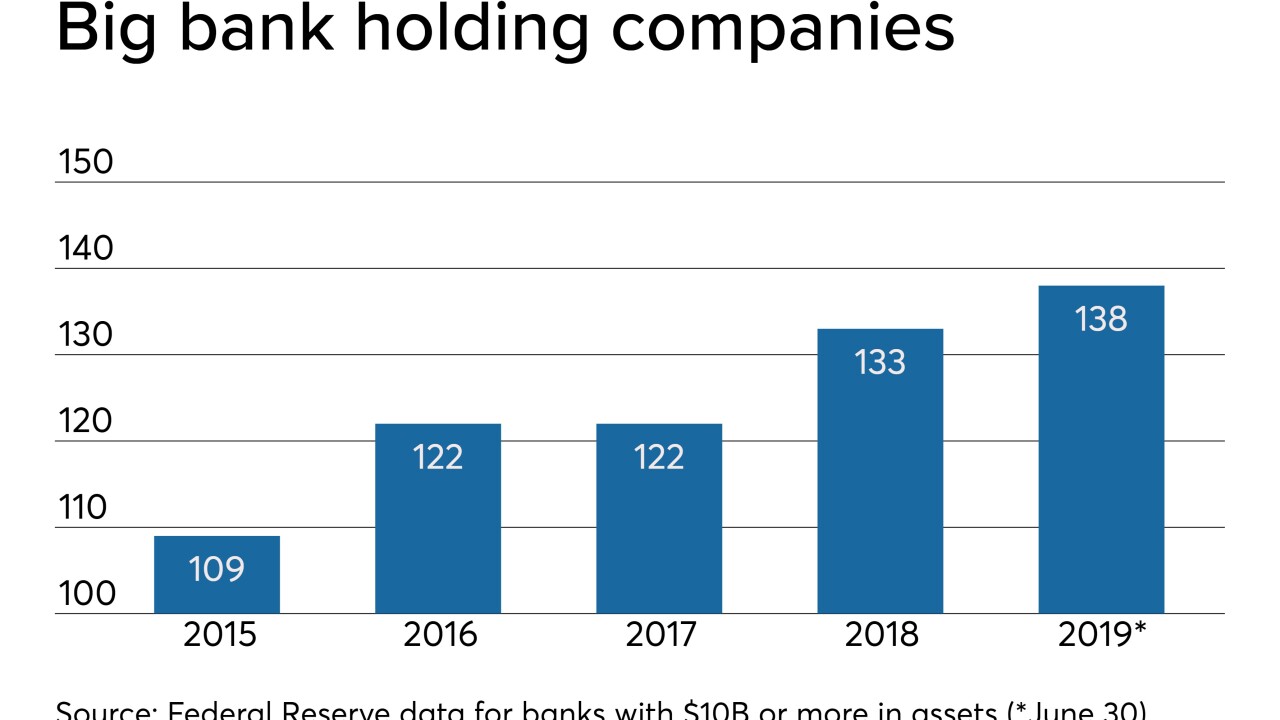

Several banks abandoned their BHCs two years ago to cut costs and reduce regulatory burden. But the strategy never really took hold as most bankers determined there were more benefits to having holding companies than eliminating them.

December 10 -

More than 50 banks and banking groups responded to the National Credit Union Administration's call for public comment as it attempts to explain why a new field of membership provision won't permit redlining.

December 10 -

House and Senate lawmakers have denied a push by banking groups to grant banks the rent-free access to military installations that credit unions have.

December 10 -

Raging Capital Management also urged the company's board to repurchase stock and think about selling a minority stake in the payments processor Evertec.

December 10 -

Raging Capital Management also urged the company's board to repurchase stock and think about selling a minority stake in the payments processor Evertec.

December 10 -

The company will gain branches in Northampton County as part of the $79 million deal.

December 10 -

Fairfax County Federal Credit Union's new name is intended to illustrate a reach well beyond what its original name implies.

December 10 -

Big Tech’s entry into the financial services space and changes in consumer behavior patterns could push some institutions away from Facebook and Twitter, but a host of new platforms are vying for the industry's attention.

December 10 -

Absorbing Health Facilities FCU will deepen S.C. Federal's presence in the city of Florence.

December 9 -

The deal will create a bank with nearly $50 billion in assets.

December 9 -

Cost cutting and systems integrations are short-term priorities, but over time CEO Kelly King and his heir apparent, Bill Rogers, will have to exploit the combined BB&T-SunTrust's revenue potential and prove the biggest post-crisis merger was a good idea.

December 9 -

The company will merge Fidelity Savings and Loan and Washington Savings Bank into its own bank.

December 7 -

The $28 million-asset AB&W Employees Credit Union will merge following a year of uneven financial results.

December 6 -

The company will pay $122 million for six branches and nearly $1 billion in assets.

December 5 -

While digital channels are becoming more popular, many banks remain committed to highway advertising.

December 5 -

The Albany-based credit union has picked up tiny City of Schenectady Employees FCU, which has struggled with profitability issues for years.

December 5