-

The company plans to shutter five locations, or roughly 12% of its network, next month.

April 20 -

The San Diego company will pay $55 million to Morgan Stanley for a business that has 200 custody relationships, $23 billion of custodial assets and $1.2 billion of deposits.

April 20 -

Trabian Technology, which builds digital products and mobile applications, is the latest in a series of technology-related purchases by MVB.

April 19 -

The company would gain 10 branches around Sacramento as part of the $135 million acquisition.

April 19 -

The Connecticut company will have more than 200 branches and $64 billion of deposits after completing the acquisition.

April 19 -

It’s easy — but pointless — to lament the havoc that the economy has wreaked on performance metrics lately. Instead, draw up an opportunistic new plan, urge your employees to focus on execution and worry less about what rivals are doing.

April 16

-

After just 45 days on the job, the Citigroup CEO is jettisoning uncompetitive overseas operations, vowing to ramp up wealth management and touting the long-term importance of the company’s Banamex unit. More moves are on the way, she says.

April 15 -

The Charlotte, N.C., company has shuttered 400 branches in the past year and intends to close nearly 500 more by early 2022. It’s also eliminating office space and reducing headcount as it aims to keep quarterly expenses under $3 billion.

April 15 -

PNC Financial Services Group Chief Executive Bill Demchak said he wants to position the bank to perform in a sector in which smaller firms are disappearing amid a wave of consolidation.

April 14 -

The company will gain seven branches, including one in Richmond, Va., after it acquires Sevier County, which is based in eastern Tennessee.

April 14 -

Net income was boosted by a $1.6 billion release of loan-loss reserves.

April 14 -

The Michigan-based institution has positioned itself for additional growth by making it easier to qualify for membership.

April 13 -

The Wisconsin company is paying $248 million for Mackinac, which has $1.5 billion of assets and $1.3 billion of deposits.

April 12 -

The Mississippi company has never done a deal this large. But buying Houston-based Cadence would take it into high-growth markets and reduce both companies' concentrations in sectors such as energy, dining and hospitality.

April 12 -

Katz Investment agreed to buy Camp Grove Bancorp in March 2019. The Federal Reserve approved the buyer's application to form a bank holding company earlier this year.

April 12 -

Bank of Montreal agreed to sell its Europe, Middle East and Africa asset management unit to Ameriprise Financial for 615 million pounds ($847 million), marking CEO Darryl White’s biggest move yet to trim the bank’s portfolio of noncore businesses.

April 12 -

BancorpSouth would have $44 billion of assets after it buys Houston-based Cadence. The company will be rebranded, while the bank will retain the Cadence name.

April 12 -

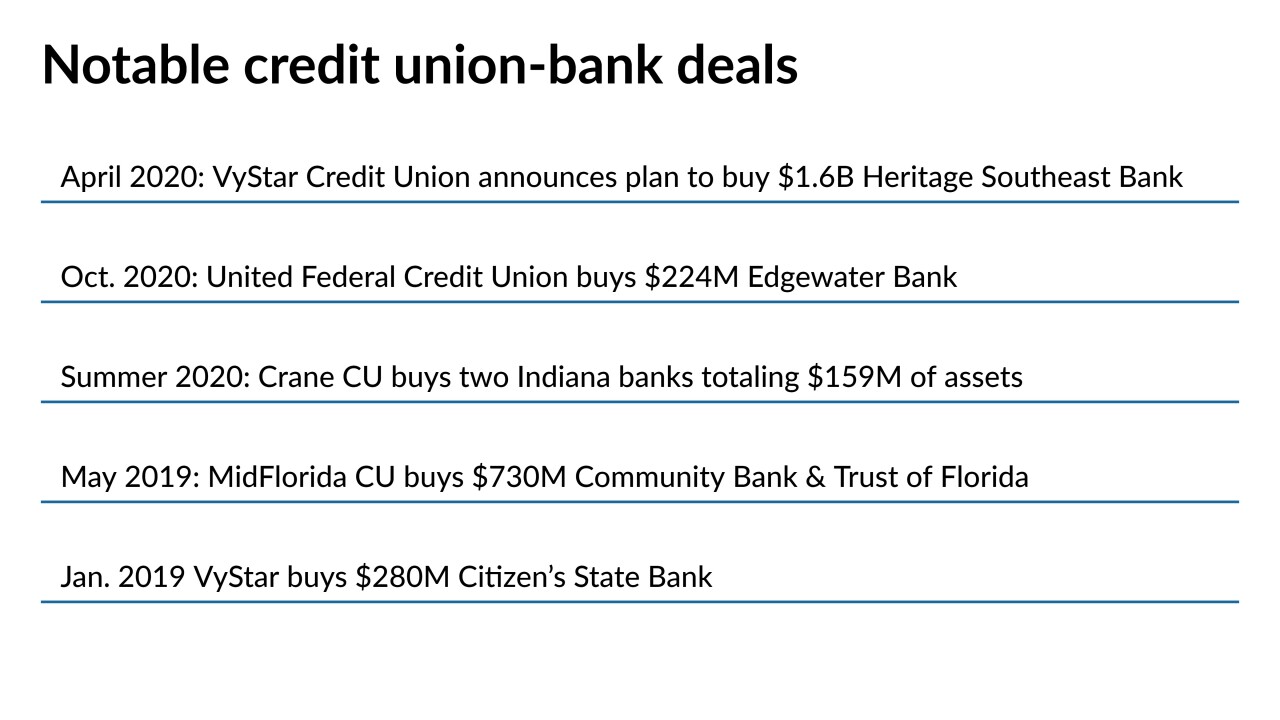

Banking trade groups have called for congressional hearings following the Jacksonville, Fla.-based credit union's agreement to purchase the $1.6 billion-asset Heritage Southeast Bank, the largest deal of its kind to date.

April 12 -

The California company has not established a time or pricing for the IPO.

April 9 -

The deal will see the $16 million-asset Georgetown FCU join the $258 million-asset PAHO/WHO. The combined institution will serve more than 7,500 members.

April 9