-

The operating environment is dramatically different than it was pre-pandemic and presents all-new challenges for financial institutions. Tried-and-true strategies that led to high performance for many years are no longer going to be successful. Join Bonnie McGeer, Executive Editor of American Banker, and Claude Hanley, Partner at Capital Performance Group, as they highlight important trends and comb through data from top-performing banks across the country for insights that will help regional and community financial institutions thrive in 2021. Executives will learn what metrics will be most critical to focus on to maintain high performance going forward.

-

The Arizona company will pay $1 billion for the parent of AmeriHome Mortgage, which manages a $99 billion mortgage servicing portfolio.

February 16 -

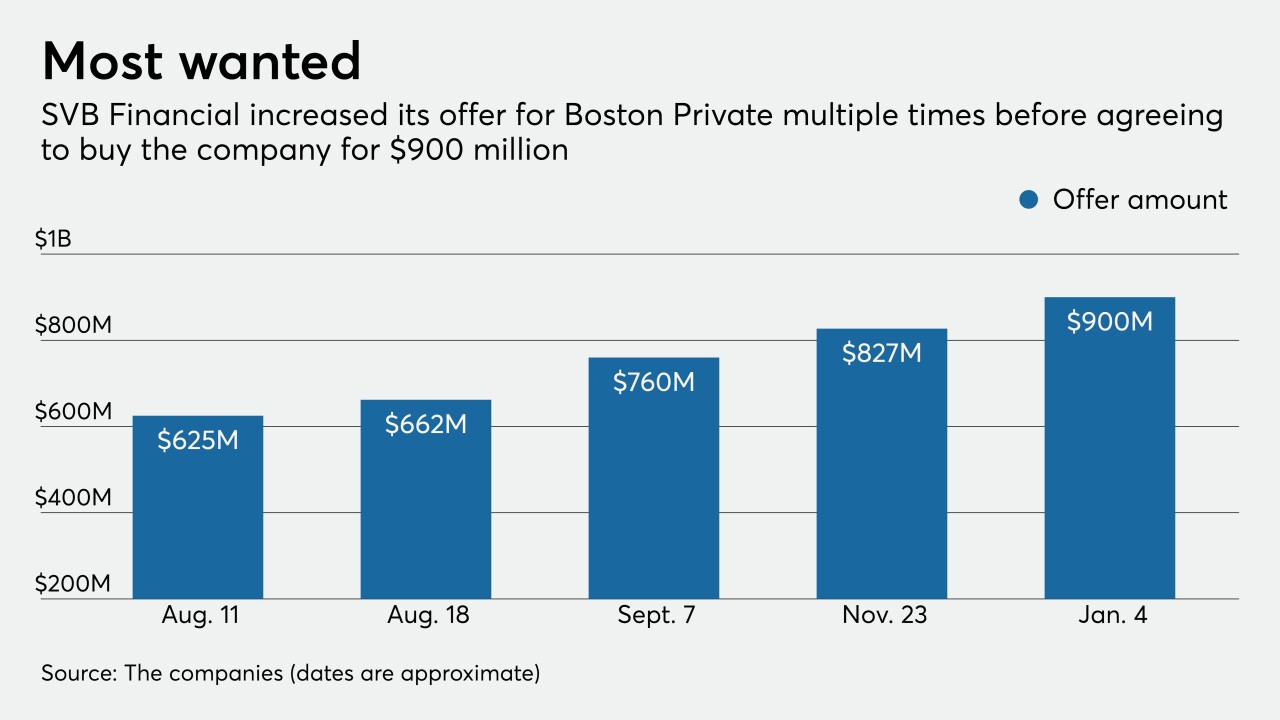

The leadership at Boston Private Financial Holdings wanted to establish a wealth management partnership with SVB Financial Group — but ended up striking a deal to sell the company to SVB instead.

February 16 -

A planned combination with Premier Federal Credit Union in Greensboro, N.C., will expand the Charlotte-based credit union's reach in the Tar Heel State.

February 16 -

A deal to merge with First General Credit Union in Norton Shores, Mich., will extend the Detroit-area institution's reach across the state.

February 12 -

A plan to make expansion easier for credit unions is getting pushback not just from bankers, but also from the regulator's current chairman and a former board member.

February 12 -

ATG Trust, which has $387 million of assets under management, handles land trusts and administers court-supervised guardianships.

February 10 -

The combined institution will hold assets of more than $335 million and serve over 20,000 members across eight counties in Oregon.

February 9 -

Environmental, Social, and Governance (ESG) principles have moved from nice-to-have to business critical. Hear how Citi is facilitating and driving change.

-

Home loans accounted for the bulk of the industry’s lending gains in 2020, but inventory shortages in some markets and an uneven economic recovery may dim prospects this year.

February 9 -

A recently approved TIP charter, the latest in a series of growth initiatives over the last five years, will allow the Tampa-based credit union to serve anyone working in the medical field statewide.

February 8 -

The North Carolina-based credit union, which purchased the vacant bank branch last summer, serves some members across the state line but has not had a brick-and-mortar presence there until now.

February 5 -

First Foundation is relocating its corporate headquarters to Dallas, where the tax burden is lighter and it sees more opportunity to beef up lending, add wealth management clients and pursue acquisitions of community banks.

February 5 -

The onset of COVID-19 forced the industry’s largest trade group to put its Open Your Eyes campaign on hold, but nearly a full year later it’s still struggling for industry buy-in.

February 5 -

Scott Ford is the new president of the 1,400-employeee wealth management unit that caters to affluent clientele of the Minneapolis company.

February 3 -

The San Antonio-based company has promoted Paul Vincent to president of its banking unit. Neeraj Singh, previously chief risk officer for Citi’s U.S. consumer bank, has joined the parent company as chief risk officer.

February 3 -

The Miami bank, which called off a proposed sale to a credit union last year, recruited Ramon Rodriguez from City National Bank of Florida to oversee its local lending and global banking operations.

February 3 -

The Flint-based credit union is the state's third in just over one year to get the OK for an expansion allowing anyone who lives or works in the state to join.

February 3 -

The California company acquired Civic Financial Services, which makes loans to residential real estate investors.

February 3 -

Any business loan growth the industry sees this year will be closely tied to mass vaccination efforts and a broader economic recovery, meaning it may take until at least the third quarter for pent-up demand to translate into new opportunities.

February 3