-

Weeks away from succeeding Michael Corbat, Jane Fraser said she’d consider streamlining some units or divesting others as part of her effort to kick-start return on equity.

January 15 -

CEO Charlie Scharf’s long-awaited expense-reduction plan got a chilly reception from investors.

January 15 -

The Pittsburgh company intends to continue adding commercial offices and retail branches in markets it had been eyeing before agreeing to buy BBVA USA for $11.6 billion.

January 15 -

Diane Arnold, who will succeed the retiring Gregory Shook in July, has been with the bank since 2002. She is currently the chief lending officer.

January 14 -

The deal is a sign of further consolidation among Twin Cities-area credit unions, following another combination announced in May.

January 14 -

The bank agreed to acquire A Mortgage Boutique, which operates in six states.

January 14 -

The Mississippi bank will pay $108 million for the parent of FNB Bank, which has branches in Alabama, Georgia and Tennessee.

January 13 -

Driver Management will try for a second straight year to gain a board seat at First United.

January 13 -

The Stamford, Conn.-based credit card issuer said Tuesday that Brian Doubles, the president and former chief financial officer, will succeed Margaret Keane in April.

January 12 -

Bank of America’s employee-funded political action committee is putting its allocation decisions on hold after a right-wing mob stormed the U.S. Capitol last week.

January 12 -

Flush with excess capital, Bank of Montreal, TD Bank and others say they might be in the market to do a cross-border deal.

January 11 -

Bank stocks have climbed because of expectations that the change of power in Washington will hasten vaccine distribution and speed the economic recovery. The boost could give executives more flexibility to pursue acquisitions or make other strategic moves.

January 11 -

Following similar decisions by big banks, the Consumer Bankers Association and Mortgage Bankers Association said they will halt all political contributions to elected officials as some lawmakers face harsh criticism for comments that incited the storming of the U.S. Capitol.

January 11 -

In a letter to credit unions, NCUA urged federally chartered shops to expand their fields of membership to underserved areas, regardless of geography, in order to boost financial inclusion in the wake of the pandemic.

January 8 -

Discussions to combine Penobscot County Federal Credit Union and The County FCU began in June 2019 but the deal was not completed until the end of 2020.

January 7 -

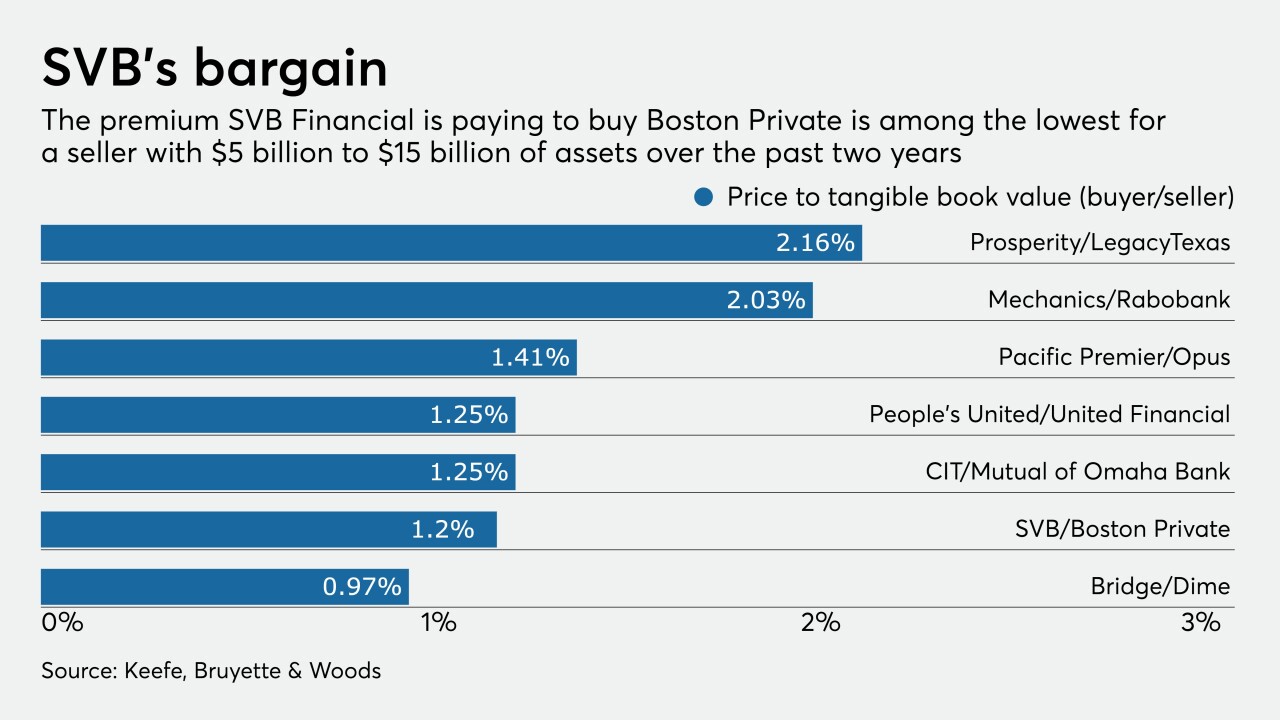

HoldCo Asset Management wants more details about the banking company’s pending merger with SVB Financial. The shareholder's concerns center on payouts to the seller's management team and questions about the sale process.

January 6 -

The combined institution will hold roughly $30 million in assets and serve about 4,000 members.

January 6 -

The multifamily lender named Michael Levine as board chairman, succeeding Dominick Ciampa, who held the role for 10 years. The move comes less than a week after longtime CEO Joseph Ficalora abruptly retired and was replaced by Thomas Cangemi.

January 6 -

If you haven't met Suzanne Shank you should. She is the chair and CEO of Siebert Williams Shank & Co. LLC, the nation’s largest female-and minority-owned, privately held finance firm, which she started with the legendary Muriel Siebert. Join us in an intimate conversation and hear her perspective on some of the most critical issues of the day.

January 6 -

Acquiring Boston Private could put the parent company of Silicon Valley Bank years ahead of schedule in catering to the investment needs of high-tech and biomedical clients, whose industries have thrived during the pandemic.

January 5