Best Practices 2019

For well over a decade, this program has recognized some of the industry's most innovative growth strategies with one specific requirement: measurable results. The techniques outlined here, from new member recruitment to digital banking, increasing efficiencies and more, are all within the spirit that has guided this program since its launch.

Read on for this year's winners.

Best Practice: Branching/Facilities

Spread out across 17 acres, First Tech Federal Credit Union’s new corporate campus is similar to the campus model employed by Google, Microsoft and others. Located on the west side of Portland, Ore., and surrounded by wetlands and a park, the campus includes ponds, trees, walking trails and more.

“In any organization you definitely want to emulate some experiences you want to in turn deliver to your customers, so certainly that was a factor in looking at how we might design a new campus,” said Monique Little, chief people and administrative officer. She added that the strong labor market also played a role in helping the credit union make moves “that would position us not just to serve our members well but to acquire and retain the best talent.”

Little explained that the new campus arose partly out of a need to plan for future growth. The CU’s former facility was leased and at capacity. The new office is 156,000 square feet, includes a coffee shop and allows for a more flexible work environment. Total capacity is about 900 people, and about 700 currently work on-site.

While Little did not disclose details about costs, she said First Tech carefully monitored spending on the project and took steps to keep expenses down, including constructing the building with a cross-laminated timber frame that was 3% to 5% cheaper than steel construction and able to be completed within 15 months.

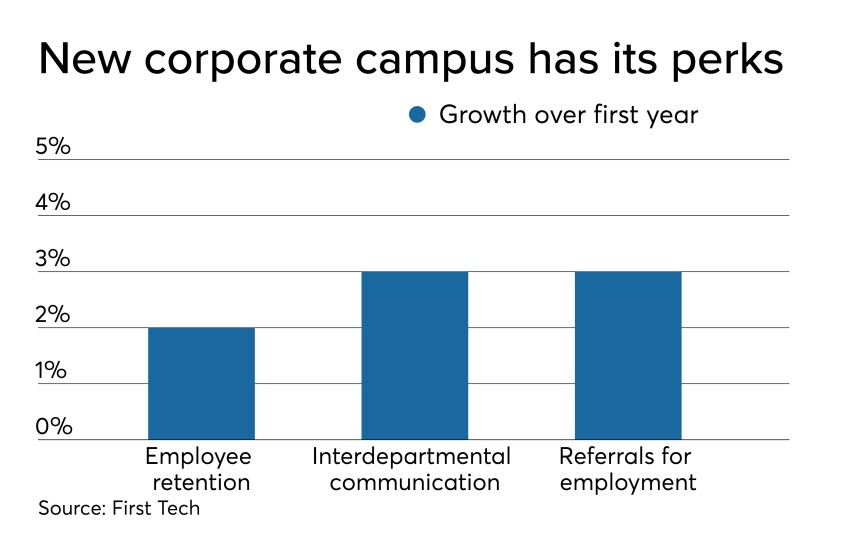

The project appears to have paid off. Among other factors, the credit union’s own research shows the move has increased employee retention by at least 2%, boosted interdepartmental communication by 3% and raised the number of employees who would recommend First Tech as an employer by 3%.

Little said First Tech’s experience still has plenty of lessons that can apply to credit unions that aren’t big enough to move to a campus-style facility.

“Bringing people along and making them part of a project is something you can do at any size, and the smaller you are, the easier it is to do,” she said.

Best Practice: Digital Banking

An updated account-opening process at Michigan State University Federal Credit Union has enabled the $4.4 billion-asset institution to reduce the amount of time it takes to join by combining membership and loan applications into one online portal.

“We wanted to shorten the time it takes for employees to process [applications] and make it easier for members,” explained Benjamin Maxim, AVP of software development. “The process before was apply for a membership, get approved, then apply for a loan; we’ve bundled it into one so employees can approach it all at once.” One added benefit, he said, is that the credit union is less likely to lose out to other lenders since the process is faster.

Maxim noted that over time the East Lansing-based shop realized it wasn’t getting the level of traction it wanted with the student market, and new CFPB rules surrounding credit card marketing had also changed how the CU could market credit cards to students. As a result, the credit union built what it calls its “student package” of basic checking, savings and credit products. Not only is it designed as an introductory banking offering “with as much stuff to make them sticky accounts and get as much share of wallet as possible,” he said, but it’s also done presented in an easy, one-click-button manner similar to ecommerce platforms many college students are already familiar with.

As a result of all of this, MSUFCU representatives said, the credit union saw a 74% increase in new online account openings during the 10 months following the launch, along with a 31% decrease in abandonment for online membership applications. More than 800 applications were started and 730 accounts opened in that time. MSUFCU currently has accounts for approximately half of the university’s freshman class, CU officials said. Between May and September of 2018, the credit union opened more than 2,600 student accounts.

Maxim said one of the major takeaways for other credit unions is to put the focus on convenience, especially for younger members.

“You don’t know what you’re looking for as a young member,” he said. “You may not be used to working with a financial intuition or you may be used to shopping on Amazon. We tried to make an experience similar to what they’re used o interacting with versus what we need from them.”

Best Practice: Wild Card

According to SVP and COO Tyler Beck, the key to success was understanding who the credit union serves in a field of membership that expands across a five-hour stretch of Southern Alabama and Southern Georgia.

“We want to be the dominant financial institution in our market serving the working class,” he explained. “That’s the communities we serve – the rural market. We understand hat to bring on more members we’ve got to meet them where they are.”

That starts with removing barriers which might prevent members from joining, including offering everyone who is eligible to join the chance to open a checking account with a debit card, even if that member has struggled with previous banking relationships.

“That has fueled a lot of our growth, because people, through word of mouth, they know we’ll give them the opportunity,” said Mike Bridges, VP of marketing and communication. The credit union is big on the idea of a “second-chance checking product,” noted Beck and Bridges, but shies away from calling it that.

“We don’t want our members to feel like secondhand people,” said Beck.

Pushing checking and debit has also helped increase interchange income. Noninterest income as of Q3 is up 19% from one year prior. In the first year after launching its growth initiative, Five Star grew its checking portfolio by a whopping 21%, averaging 11 new retail checking accounts per branch per week for a total of more than 9,000 new member accounts or 530 new accounts per branch.

Five Star also continues to open new branches with a focus on modern touches like ITMs as a way to help sustain its growth and ensure it stays relevant for the consumers it wants to serve.

Beck emphasized that CUs of every size can find lessons in Five Star’s success.

“We’ve made great strides in trying to understand who we’re serving and having honest discussions about how we get out of our own way to serve those members how we know they need to be served,” said Beck. “We have some frustrations about not being a large institution…but serving members with a lower average balance [means it’s] just going to take more of those members to get there.”

Best Practice: Membership Growth

According to President and CEO Shawn Wolbert, the key was doubling down on partnerships and moving beyond the branch.

“We wanted to help more people,” explained Wolbert. “We could get 12 or 15 or 20 people into a seminar at a time [at the credit union], but we can’t hold them every day of the year. We had community partners … who would have meetings and have 50 to 100 people there, so changing our focus to working with those community partners helped them and it helped us grow membership.”

Because those consumers already trust those partners, she added, “our stepping in to provide financial wellness counseling had them trust us as well. In underserved communities, trust is one of the biggest obstacles for people to reach out and get financial services when they’ve been used to going to a payday lender or a check casher.”

While the credit union is SEG-based and serves the largest hospital in the state, it’s low-income designation allows underserved consumers in low-income zip codes around Indianapolis to join as well.

Along with shifting to a larger audience, Wolbert said what has also helped is working one-on-one with local providers to determine the needs of their audience and then working to meet those needs. In one instance, that meant working with a nonprofit agency’s newly hired financial wellness counselor to train them and provide branded materials on the topic. Then, for those that organization serves, FHFCU was able to do credit counseling and work individually with them on how to improve their credit score and other financial issues.

Membership growth at FHFCU was just 1.9% in 2017 but by the end of 2018 it had risen to 9.4%, thanks in part to expanding financial wellness programming, reported Wolbert. New memberships have remained strong through the first three quarters of 2019 and Wolbert is targeting about 8.5% growth by year end. Along with new members, the CU’s loan-to-share ratio has risen from 56% in 2017 to 69% today, she said.

Best Practice: Efficiencies

“Like a lot of other companies, we would set a lot of goals and a lot of projects. I don’t want to say we wer settingtoo many, but you become overzealous and you don’t manage the process as best you could,” explained Veronica Trotta, director of strategic analytics and process reengineering.

While the program was initially implemented with one new staff member to help keep a variety of projects on track and on budget, and has helped the credit union avoid overpromising and underdelivering in departments across the organization but particularly on initiatives that report directly to the board of directors.

The new department has overseen everything from broadening digital banking initiatives to transitioning to an off-site cloud-based hosting service. “That’s a huge process that requires everyone in the organization to participate,” explained Trotta. “So the PMO was really crucial in managing hat process to make sure all the different areas got together and managed that.”

What began with one person has now grown to a team of three, but the commitment to better management runs across the credit union. Trotta said the credit union uses PPM Beacon software to keep on top of things and roughly 30% of State Department FCU’s staff are involved in some sort of project management. The number of jobs involved has also grown significantly, rising from 66 in 2018 to 103 for 2019.

While the new system has helped keep budgets and planning in line, the credit union has not yet done a deep dive on ROI – something Trotta said is in the works for 2020. For now the cost benefit comes from increased efficiencies since overall staffing has not increased outside of the three members of the PMO team.

For shops that don’t have the resources to launch a dedicated office for project management, Trotta suggested, “at the very least try to make sure you do a better job of allocating resources to your projects, because tha’s where people get in trouble. You only have so many people to facilitate these things and often times your goals are a little more lofty than your resources allow.”

In short, she said, keep it simple.

Best Practice: Lending

CUTX’s digital transformation process included retraining employees while also deploying beta teams to test each new initiative before it rolled out. The focus was on using analytics to identify what officials called “member personas” to help determine how to best serve each consumer.

“If you have a credit card, are you a transactor or a revolver – do you use your credit card and pay it off every month or always hold a balance?” Chris Del Guidice, VP of digital strategy, said as an example. “When I have the right data I can make an offer that’s relevant to you. If you pay it off every month, you’re not interested in a low rate, you’re interested in points. Whereas if you’re somebody that keeps a balance and makes the minimum payment every month, you probably are interested in rates and cash back.”

Similarly, he said, if the credit union understands that a consumer is coming to the end of the life cycle on his or her car, that can help make more relevant offers. The key, he said, is using data to customize the right offer for each member segment.

During the first month of launch on CUTX’s new website, total leads reportedly grew by 363%, with home equity and mortgage applications up 20% and auto loan leads up by more than 30%. Organic Google visibility also doubled.

As new competitors enter the market, said Del Guidice, CUs must find a way to embrace emerging technologies while also staying true to what makes the industry unique.

“The reason people become a member is this experience, this sense of community,” he said. “But you still want to make things easy for them so they don’t go online to a fintech and they feel comfortable with that brand so we have that brand loyalty.”

Best Practice: Deposit Growth

“A lot of institutions were running close to 100% for their loan-to-share ratio,” said Steven Reider, president of the consulting firm Bancography. “Deposits are critical. Credit unions can’t grow unless they have deposits.”

Western Vista Credit Union in Cheyenne, Wyo., boosted its deposits by 16.5% from Jan. 31 to Oct. 31 using a traditional form of marketing – a direct mail campaign. The $166 million-asset credit union partly attributes its success to the targeted nature of the effort. It was seeking larger deposits so it only sent the mailings to neighborhoods that met specific household income requirements.

Patelco Credit Union used data in a different way to create a successful deposit campaign. After a previous certificate offer fell flat, the Pleasanton, Calif.-based institution decided to solicit feedback from members on what they wanted. It was the first time the $7.2 billion-asset institution had used this method for a deposit product.

The overwhelming favorite was a three-year CD that allowed them to extract their money each year but would also reward them for keeping the product by boosting its interest rate annually. The campaign generated $368 million in new deposits from more than 5,100 members.

Finally, Technology Credit Union used its knowledge of its members in a slightly different way. The credit union is based in San Jose, Calif., near the Napa Valley winery region. Because of that, management believed that members would be interested in a promotion that linked deposits with wine.

The $3 billion-asset Tech offered a specially created wine bundle from Revel Wine (valued at $100) to members who put at least $2,000 into a CD. The campaign was initially focused on members with a money market account of at least $5,000.

The pilot campaign ran from Feb. 14 to March 31, bringing in more than $610,000 in certificate deposits with an average certificate amount of over $15,000. At the same time, it costs Tech CU $3,550 in expense representing just 0.5% of what was brought in.

For more on all three credit unions’ deposit strategies,