Hoping to grow in 2020? It could be a challenge.

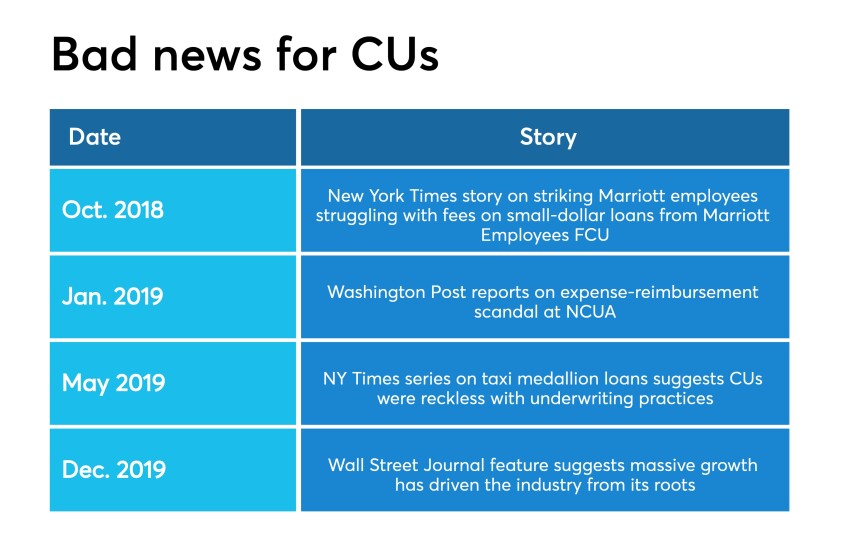

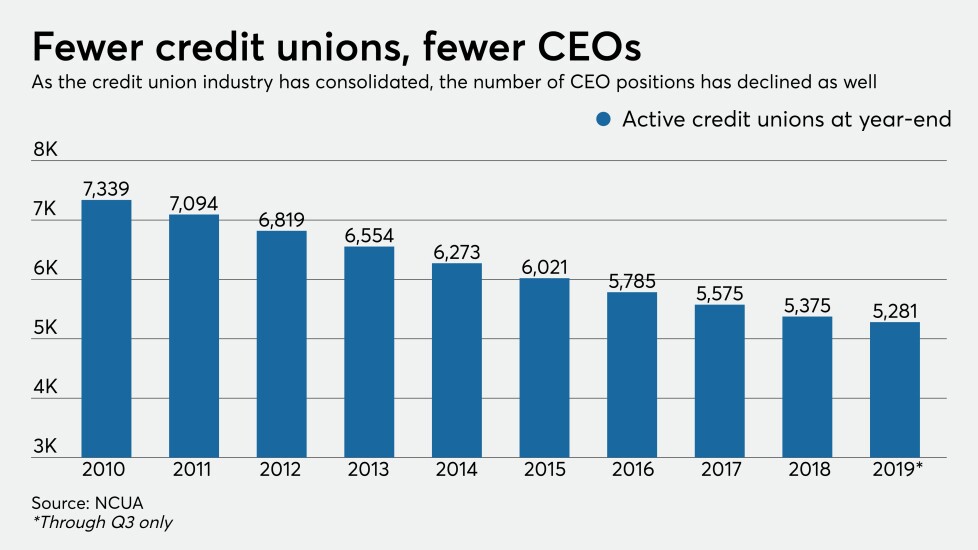

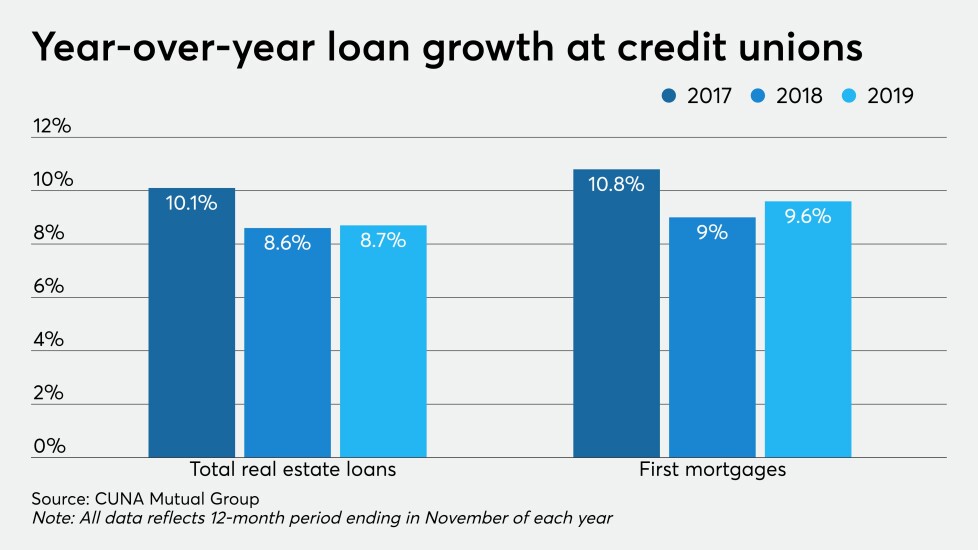

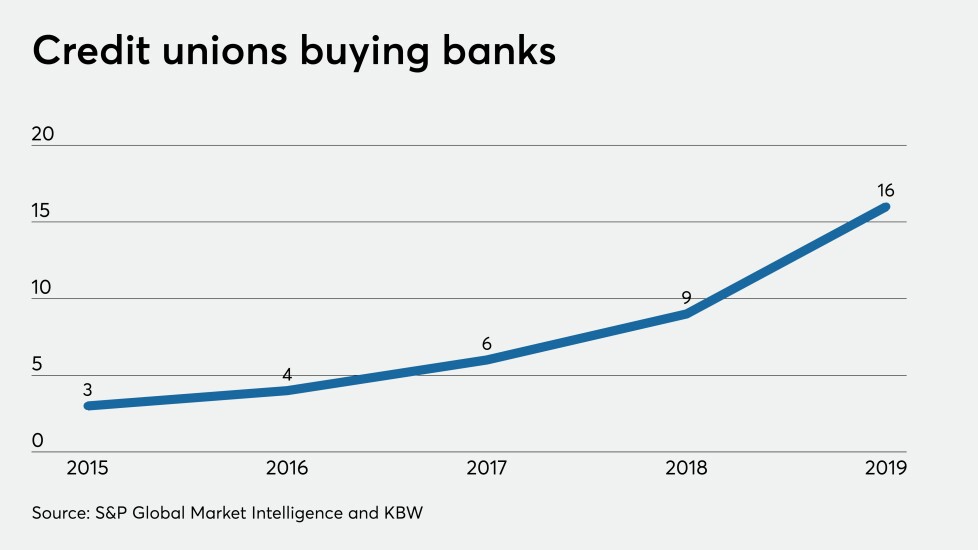

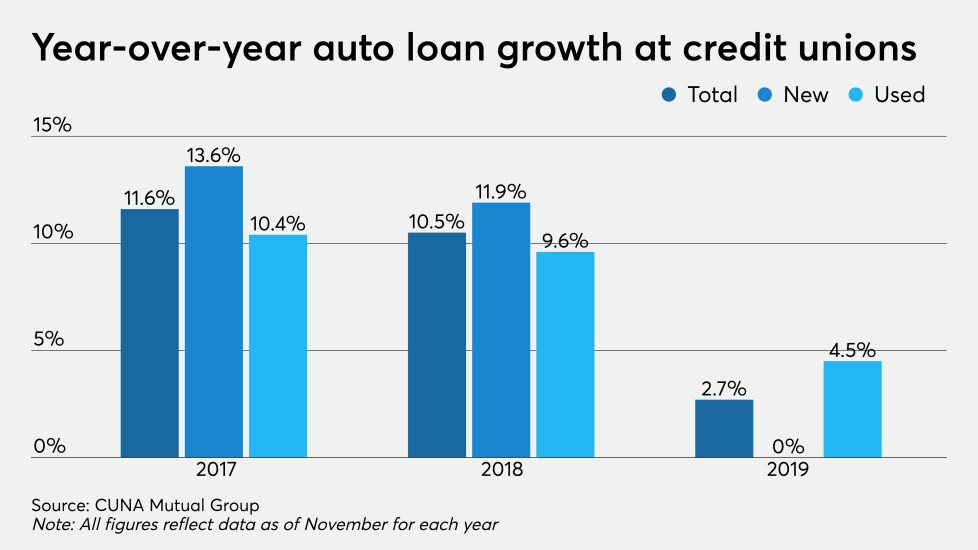

Throughout January, Credit Union Journal featured stories on how an evolving political, regulatory and economic landscape could shape the year ahead for the industry. CUs must content not only with the potential for shifts in how consumers view their institutions, but shrinking demand for mortgages and auto loans, recruiting struggles in a consolidating industry and more.

Read on for highlights from the January special report.