International Women's Day

Despite those metrics, women continue to rise above obstacles that for decades or more were seen as insurmountable. There are now more women in Congress than ever before — 127 to be exact (23.7 percent), with 106 Democrats and 21 Republicans. Twenty-five women are in the U.S. Senate whereas 102 women are in the U.S. House of Representatives, which is roughly a quarter of each chamber. Women are quickly garnering more representation in the workplace and are banding together to elevate their female peers as they pursue the C-Suite and other tradtionally male-dominated arenas.

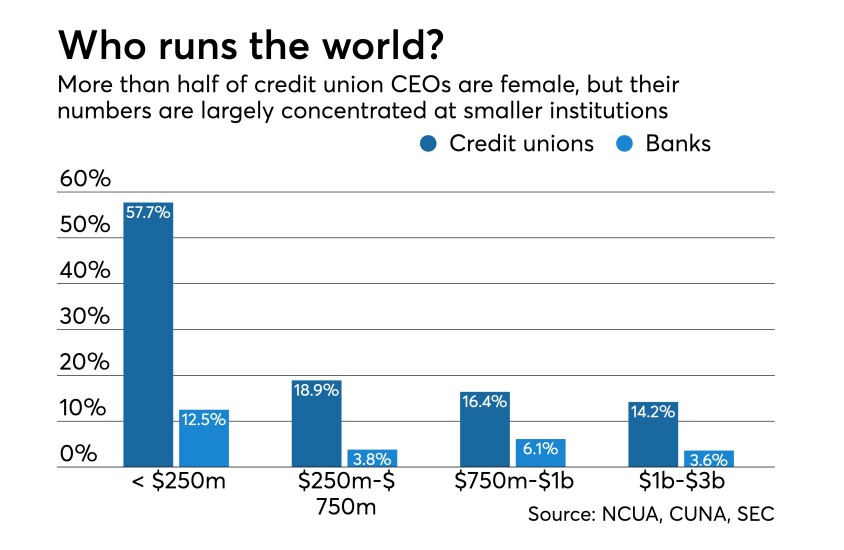

Women have excelled in the credit union movement, and a recent study from the Credit Union National Association revealed that as many as 52 percent of credit union CEOs are female. But there is still work to be done, as the majority of female CEOs run smaller institutions, many of which pay less.

In honor of International Women's Day, Credit Union Journal reached out to women from across the industry to get a sense of how they're working to close the gender gap and the impact other women have had on their careers. Read on for a sampling of their responses.

Some responses have been edited for length and/or clarity.

Lucy Ito, president and CEO of the National Association of State Credit Union Supervisors

As one of the few women leading a national credit union organization, I understand both the opportunities and challenges women face in the industry. NASCUS routinely scans its own staff, elected leadership, regulators and credit union executives for visibility opportunities. Also, we include not only our women leaders and staff, but also our men leaders and staff in engagement with the World Council of Credit Unions' Global Women’s Leadership Network events. Advancing women in the industry is not just a women’s issue!

How have women contributed to your career?

Several women have served as examples of leading, sharing and pushing. Women heroes of mine in the credit union system include:

Diana Dykstra (president & CEO of the California & Nevada Credit Union Leagues and 2019 Herb Wegner honoree) challenged me to fight complacency to constantly do better for credit unions.

Teresa Freeborn (president & CEO of Xceed Federal Credit Union) gave me an eye-opening reality check and self-accountability lesson on measuring the actual representation of women and men in executive positions and on boards of directors at all levels of the credit union system.

Sarah Canepa Bang (retired executive) demonstrated the power of looking outside of the credit union system and outside of financial services to anticipate what credit unions will need tomorrow.

When Shruti Miyashiro (president & CEO of Orange County’s Credit Union) speaks, I and everyone else listen and learn (in awe) as she helps the rest of us connect the dots of what credit unions need to be monitoring and questioning.

State regulators Linda Jekel (retired from Washington Department of Financial Institutions Division of Credit Unions), Mary Ellen O’Neill (Connecticut Department of Banking) and Mary Hughes (Idaho Department of Finance) have all served as role models for straight-shooting, pragmatic, and creative problem-solving—assuring safety and soundness while fostering growth.

Michelle Kaufman, VP of employee services at Navy Federal Credit Union

At Navy Federal, we pride ourselves on having a work environment that allows women the opportunity to succeed. Nearly 70 percent of our employees are women, and we’re proud to be recognized as an employer of choice for women by FORTUNE, and...as a FORTUNE 100 Best Companies to Work For in 2019. While a large segment of our employee population is women, our numerous learning and development programs and career opportunities are designed for all team members to thrive and grow. Providing these opportunities to team members is part of how we ensure our members are met with the exceptional service they’ve come to expect from Navy Federal. In the spirit of International Women’s Day, we’re also proud that Mary McDuffie, a 20-year Navy Federal leader,

How have women contributed to your career?

I began my career with Navy Federal over 25 years ago as a military spouse, serving as a member service representative in our Naples, Italy branch office. Since then, I’ve held various roles throughout the credit union, and I’ve been fortunate to serve under many leaders and mentors who have given me great career guidance and helped shape who I am today as a leader in our organization. One individual, in particular, who has contributed to my career is Debbie Calder, Navy Federal’s new chief operating officer. She has been an inspirational Navy Federal leader, to women and men alike, for over 28 years. Debbie has influenced me by sharing her professional knowledge, expertise, and sage advice throughout my career.

Eleni Giakoumopoulos, Global Women's Leadership Network program director at WOCCU

The World Council established the Global Women’s Leadership Network in 2009 to address and facilitate the industry’s gender gap while also leveraging resources to strengthen the economic security of women and their families. The GWLN vision is to provide women with the opportunity and resources to make a measurable difference in the lives of each other, in the lives of credit union members and in their communities. Through a large network of volunteer chapters known as sister societies, GWLN continues playing a role in the credit union/cooperative movement while uplifting and supporting women on a global scale. This year GWLN marks a major milestone, celebrating its 10th anniversary, reflecting on progress and looking forward to continued growth.

How have women contributed to your career?

For me personally, I am grateful to a former female supervisor who gave me the “push” I needed to get my master’s degree. She kept telling me that it would open new doors and it eventually did. She was very demanding and I learned a great deal from her. Most important, to advance professionally, you need to believe in yourself and take risks.

Kelly Garmon, chief marketing officer at Georgia’s Own Credit Union

Georgia’s Own views diversity and inclusion as a foundational business strategy. We understand that embracing and valuing differences between people equates to statistically stronger performance. As it relates specifically to the advancement of women within the organization, Georgia’s Own ensures equal access to opportunities in a number of ways. We are creating and providing visibility to career paths for our staff; we also have a series of Lunch and Learns slated, kicking off with the stories of women executives and how they have advanced within the organization. We have a Diversity and Inclusion Officer who gauges internal views on diversity via surveys and works to understand and leverage opportunities for improvement. Finally, we use firms like the "Mom Project," a hiring group that assists women re-entering the workforce after taking time away with their children.

How have women contributed to your career?

My dissertation focuses on women leaders in the credit union industry and specifically identification of those factors that compel women to persevere into leadership roles. The findings emphasize the importance of words of encouragement from others, since historically women have had fewer role models at the executive level relative to men. In my career, I think this verbal encouragement and the expression of belief in my potential has had a profound impact on my career. I’m certain I would not have applied for advanced roles or pursued different opportunities without being cheered on and supported by other women.

Lynn Heider, VP of communications at the Northwest Credit Union Association

You’ve probably seen the CUNA research recently that 52 percent of credit union CEOs are women, so if you look at that on a national average, that is of interest. I can tell you that within the last couple of years, the association and its member credit unions have started several regional Global Women’s Networks, and they were supported by male and female credit unions and CEOs to get those started from the ground up. They’re great opportunities for women in the profession o come together and network and help each other grow, and we’re very supportive of the Global Women’s Leadership Network. They’ve had a presence at our annual MAXX convention for the last two years. The chapters in this region meet on a pretty regular basis. In addition to that we have our council program for virtually every profession within the credit union, and even if you’re early in your career you’re welcome to come and participate in those programs and network, share ideas and meet with potential mentors. Almost everything we do on the professional-development front is an opportunity for women to come into the industry and then grow in it through mentorship and networking and professional-development opportunities. I wouldn’t say those council are only focused on women at all, but they’re yet another opportunity for women in the industry.

Lisa Jennings, first senior EVP at Pentagon Federal Credit Union

PenFed is committed to ensuring women continue to advance at PenFed and across the industry. Over 60 percent of [our] employees are women and many of them are in leadership roles within the company.

We offer many benefits to support our employees in their careers, wellness, finances and in their communities. One of the benefits PenFed offers employees is "Momseze," a care and education solution that connects parents with nurses and other experts and provides support around some of the challenges working mothers face. PenFed also provides eligible employees an employer match for childcare costs for children up to school age.

The PenFed Foundation will launch a Women Veterans Entrepreneur Investment Program later this year to bridge the gap of investment capital to female veteran entrepreneurs by providing funding, female representation in the investment process, and a platform to empower those entrepreneurs to lift other female veteran entrepreneurs.

PenFed is providing a $50,000 sponsorship to fund the completion of The Glass Ceiling film chronicling the untold inspiring story of Pasang Lhamu Sherpa, the first Nepali woman to summit Mt. Everest.

How have women contributed to your career?

When I joined PenFed it was very encouraging to be surrounded by many women – especially given that was 35 years ago. It really inspired me that [the credit union] supports women in this industry and I’ve been able to grow with the company and take on my current role.

I’m proud to be one of the chairs of the PenFed Women’s Leadership Group that focuses on developing and supporting our female leaders through educational, networking and community service opportunities.

Michelle Pagni, EVP of human resources at San Diego County Credit Union

I think it’s important to first note that SDCCU embraces diversity and inclusion and is committed to practices that are fair and not based on gender, and instead are focused on talent, experience and skill set. And as an organization, we are dedicated to the professional development of all employees and promoting from within. Last year, more than 150 of our nearly 900 employees received a promotion.

With that said, SDCCU is led by a phenomenal president and CEO, Teresa Campbell. In addition to Teresa, there are eight others who comprise our executive leadership team, four of whom are women — including myself; our CFO, Ashlee Micale; EVP of IT, Valerie Kwiatkowski; and EVP, ERM and Chief Risk Officer, Carolyn Kissick. That balance of women in leadership trickles down throughout all levels in our organization, which is indicative that we are taking steps as an organization to ensure women continue to advance within the industry.

On my team alone, two women were promoted to higher level positions last year — one was promoted to vice president of employee relations and the other to vice president of HR administration.

How have women contributed to your career?

I have been very fortunate to have worked for the past eight years for an exceptional leader at SDCCU who has given me the necessary tools and resources and empowered me to continually step out of my comfort zone to achieve more. Her influence has elevated my role in the credit union and made a tremendous impact on my personal/professional growth and development and overall career.

Emily Steele, president of Temenos (North America), which works with CUs across the country

I firmly believe that diversity is vital to innovation, and to success. We take an inclusive approach to networking and hiring. We recognize that our team members can, and do, bring diverse perspectives. This creates a challenger environment that is open enough to bring new and different ideas to the table while inviting everyone to come together on common ground. With that innate open mindedness, here in North America we have created a leadership team that is roughly 50 percent women, 50 percent men, and brings together people of diverse cultures, beliefs and socioeconomic backgrounds. That diversity continues from the top down.

Going forward, we are also working on two internal initiatives – women in business and women in leadership. These are forums that invite women to share their experiences and advice, but also invite men to come in and understand our world, and share their perspectives on how we can step outside traditional norms. As part of these initiatives, each of our offices is also offering opportunities such as training, networking, and awareness programs.

How have women contributed to your career?

Both men and women have played an immense role [in my career]. My career path, and path to leadership, would not be the same without the mentorship of multiple male leaders, especially when you consider that 15 years ago I was the only woman at the table. Both men and women have a contribution to make as we work toward more diversity, and a better balance across gender, cultural and socioeconomic backgrounds.

If I look at women specifically, of course they have absolutely played a role in my career. With a 50/50 ratio of male and female leaders in my region, and a diverse team whether you look at implementation, development, customer service, marketing, finance, sales or strategy, I am surrounded by women who treat each other with respect, who quietly or vocally bring their experiences to the table, and who work together to make Temenos, the industry, and the world a better place."