In this month's roundup of American Banker's favorite stories: the inaugural list of the Most Powerful Women in Credit Unions goes live, TIAA exits the banking space, the Consumer Financial Protection Bureau investigates U.S. Bancorp over unemployment payments during the pandemic and more.

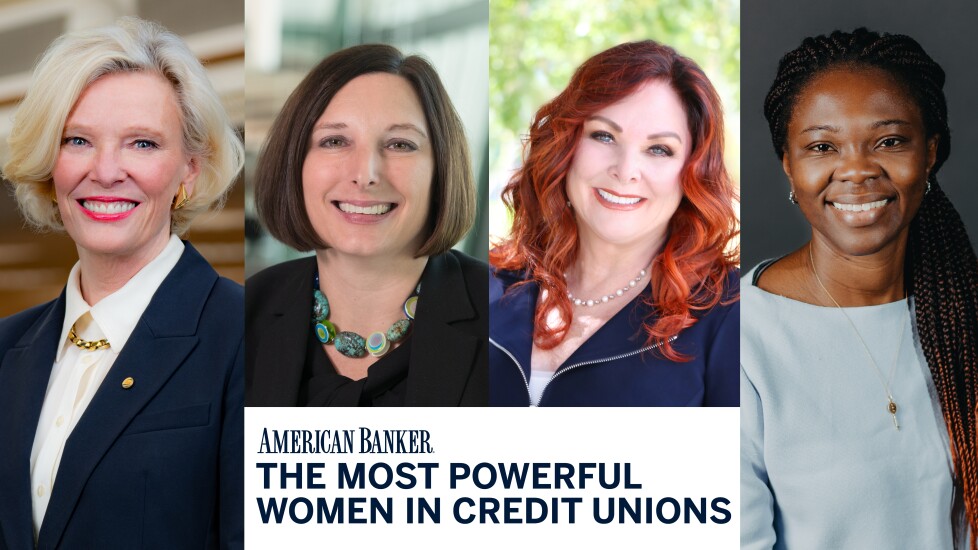

The Most Powerful Women in Credit Unions, 2022

In its inaugural Most Powerful Women in Credit Unions listing, American Banker is proud to share the stories of 25 of the women leading the credit union industry through times of rapid and unprecedented change.

Deposit outflows are forcing some banks to play defense

The quickly shifting picture — an effect of the Federal Reserve's rapid interest rate increases — is prompting many banks to raise their deposit rates to prevent customers from leaving for higher-yielding alternatives.

Some depositories are also filling in the gaps by turning to costlier options, such as the brokered deposit market or

Bankers design a new blockchain that works like bitcoin — but it's regulated

The idea is to counter the rapid rise of unregulated digital currencies with an approved and supervised form of digital dollar, and along the way help modernize many outdated payment rails and other tech platforms used in financial services.

Retirement giant TIAA to exit banking

The privately held retirement giant said Thursday that the investors — which include funds managed by Stone Point Capital, Warburg Pincus, Reverence Capital Partners, Sixth Street and Bayview Asset Management — will each own noncontrolling interests in TIAA Bank. The parties did not disclose the financial terms of the planned sale.

Under the terms of the deal, which is expected to close in 2023, nearly all the $38.6 billion-asset bank's current assets and business lines will be acquired by the new ownership.

CFPB probes U.S. Bank over unemployment payments during pandemic

The Minneapolis company disclosed the CFPB probe in a securities filing Tuesday. It also said that it is cooperating fully with all pending investigations. A company spokesperson declined Wednesday to provide further comment.

U.S. Bancorp's filing did not specifically mention fraud, but numerous banks have been contending with the consequences of fraud in connection with expanded unemployment insurance payments during the COVID-19 pandemic.

What happens when the CFPB's funding question hits the Supreme Court?

Legal experts are gaming out the various options for the CFPB after a three-judge panel of the U.S. Court of Appeals for the 5th Circuit

Constitutional scholars and legal experts said the Supreme Court is likely to expedite a review of the case as early as next year, in its current term, given the potential impact on other federal agencies — particularly the Federal Reserve.

Swipe fees may come to a head in lame-duck Congress

The legislation, spearheaded by Sens. Richard Durbin, D-Ill., and Roger Marshall, R-Kan., would require large banks to allow credit card transactions to occur on at least two unaffiliated networks. One of them would have to be a smaller network, rather than Visa or Mastercard. The House has also introduced companion legislation.

The bill was originally

Credit union regulator says liquidity risk is top priority for 2023

The speed at which this situation developed is part of why liquidity risk is among the National Credit Union Administration's biggest priorities going into 2023, John Kutchey, eastern regional director for the National Credit Union Administration.

"The world has changed pretty significantly over the last six, seven, eight months. The rapid increase in interest rates has changed the landscape of just about everything, including your balance sheet," said Kutchey, who spoke at the CrossState Credit Union Association's

American Banker exclusive: Venus Williams on pay equity and a winning mindset

But the five-time Wimbledon singles champion is also a pay equity advocate who successfully convinced the celebrated British tournament's organizers to give equal prize money to both the male and female champions.

In 2005, the day before she competed to win the Grand Slam for the third time, she met with the International Tennis Federation board to discuss the pay gap for women in the sport. It didn't work.

2022 bank reputation: Payoff for thinking outside the box

But F.N.B. Corp. in Pittsburgh has proved to be an exception to this because of the unusual choices management has made in developing its new office building.

The partially constructed 26-story tower, to be called FNB Financial Center, is scheduled to open in 2024 with the bank serving as the anchor tenant. It will occupy the former site of the Civic Arena, where the Penguins, Pittsburgh's National Hockey League team, once played. The Hill District neighborhood that surrounds this site is historically Black, and experienced turmoil in the 1950s and 1960s when a redevelopment project displaced many residents.