Read on for highlights from this coverage.

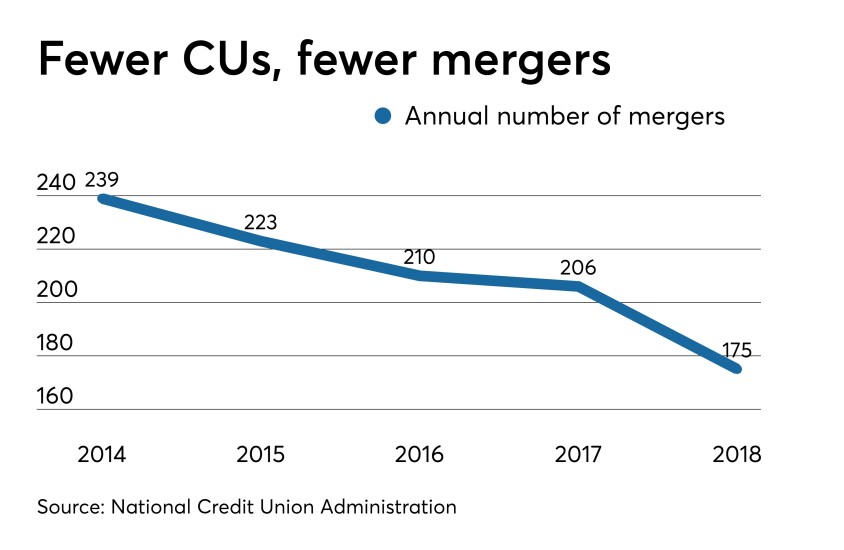

Be prepared for mergers

For more,

Identifying talent that can take on bigger roles

“I think the focus has been to develop succession planning strategies throughout the organization by identifying people who can potentially be a good fit for a particular role and be developing staff in all areas of need, not just at an executive level,” said Steve Koenen, president and CEO of Altra Federal Credit Union in Onalaska, Wis.

For more,

Rising cyber threats

For more,

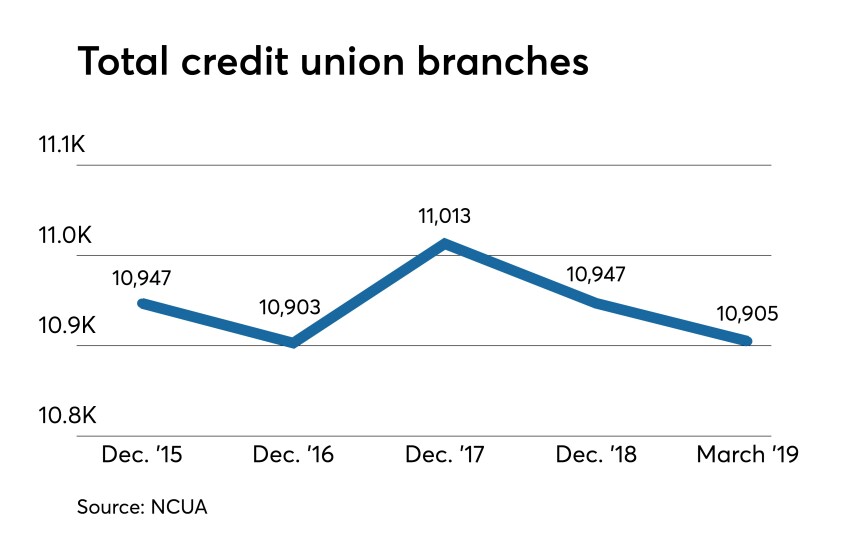

Don't give up on branches

“The branch still has significant value, but the management of why people go in and how they interact with the intuition is different. We believe financial institutions have to create a journey and an experience that is meaningful for members [and] customers,” said Jeff Winter, senior vice president with design and build firm NewGround.

For more,

Don't underestimate the importance of analytics

For more,

Much to tackle

For Southwest Louisiana Credit Union in Lake Charles, La., the driving question is, “If we [are] suddenly no longer open for business, why would the community miss us?” said CEO Ronaldo Hardy.

For more,