-

-

U.S. retail customers who said their primary bank met their needs for guidance gave it much higher grades, according to J.D. Power’s annual survey.

July 1 -

The feature has become popular during the coronavirus pandemic, providing a quick and simple way for credit unions to confirm users' identities as well as promote products and services.

May 10 -

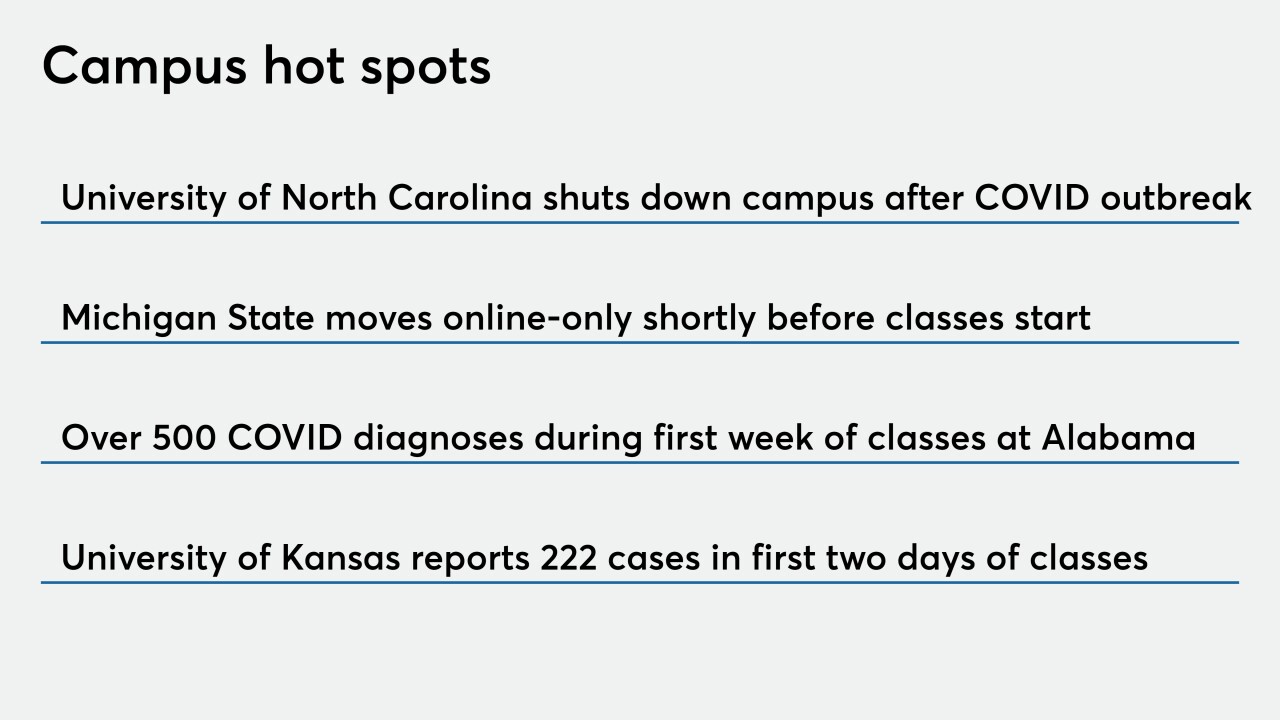

Institutions serving colleges and universities traditionally see membership surge in the fall, but are now planning for a decline as classes move online.

August 27 -

The credit bureau will consider borrowers’ rental payment history and professional licenses; bank looks to build business on the other side of the Atlantic.

November 7 -

Surety's first online bank, booyah, is aimed at college students and young grads.

October 1 -

Challenger banks promote the concept of empathy in banking, which sometimes means forgoing revenue to build up customer goodwill.

June 26 -

Some credit unions are embracing technology that makes it easier for consumers to start the notoriously difficult process of changing financial institutions.

April 11 -

Credit unions around the globe added more than 40 million members between the end of 2013 and 2017, according to a new report from the World Council of Credit Unions.

October 16 -

Banks should rethink even existing services, such as the branch experience, said top executives at the Oracle Industry Connect conference.

April 13 -

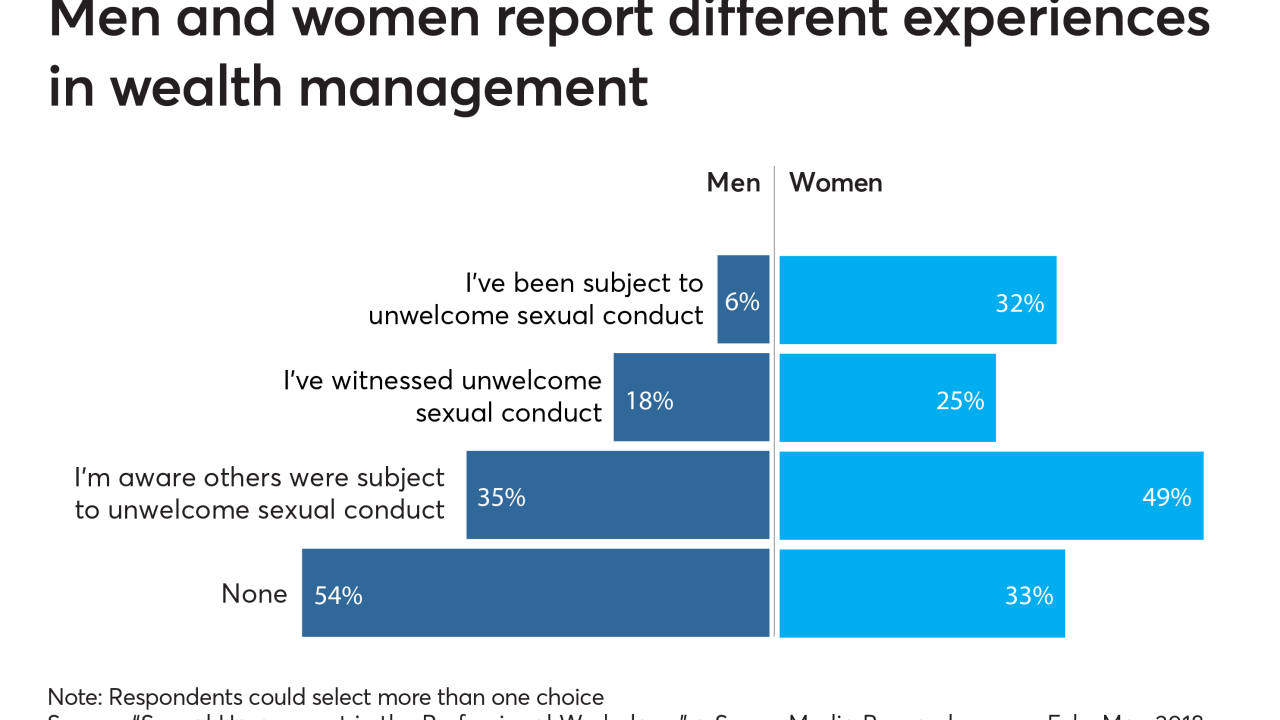

It’s tough enough to grapple with sexual harassment in the workplace. It’s more complex when clients are involved.

March 28 -

Marquette Bank is proof that community banks don't have to be the fastest or flashiest to compete with online lenders. Instead, the Chicago bank closely mirrored fintech offerings while promoting personal service to set itself apart.

February 8 -

Tech startups differ from a bank’s typical commercial clients; many want a trusted financial adviser.

November 21