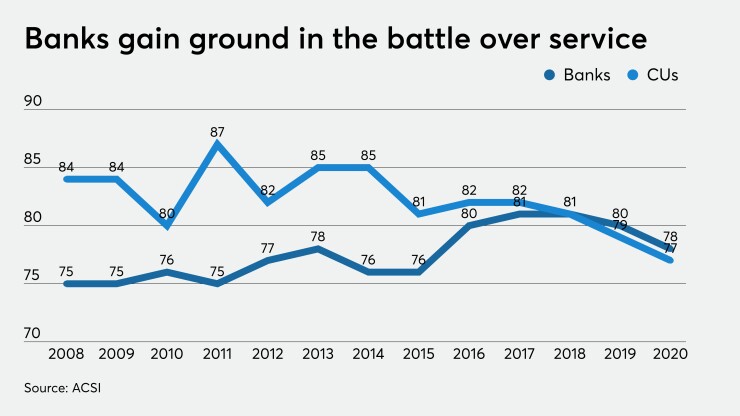

Credit unions continue to lose ground in the battle for member satisfaction.

For the second year in a row,

“The edge of satisfaction superiority that credit unions used to enjoy for a very long time has really dissipated,” said David VanAmburg, managing director at ACSI. “The question becomes, is that inevitable for all time or is it something that could change?...Is it built into the very nature of them as smaller institutions that they’ll continue to lack the resources, generally speaking, to have that digital advantage the big banks have?”

Credit unions still perform well in the survey, with an overall score of 77 out of 100, but continue to see their score slip while banks improve. Some institutions may dismiss the study out of a belief that their own members are satisfied, but many suggested that thinking is narrow-minded and could be a mistake.

The industry “should put a significant amount of stock” in the ACSI numbers, said Steve Williams, a cofounder of the consultancy Cornerstone Advisors. “We felt we could always, as grassroots financial institutions, out-hustle the big guys, but what the big guys are proving with digital-first strategies over the last decade is that it’s not just hustle. It’s design, it’s leveraging technology, it’s creating a brand — and they are having much more success."

While digital banking gained ground over the last decade, the number of credit unions shrank by about 30% in that period, with most of those losses being felt at the smaller end of the spectrum. Credit unions across the asset spectrum have put their own digital banking platforms in place, but a significant portion of the industry remains behind the curve, with minimal digital solutions or none at all.

“The perspective around good service is changing,” said Brandon Michaels, CEO of JSC Federal Credit Union in Houston.

Historically CUs ranked highly for satisfaction because so much of banking was driven by human interaction, whether in the branch, over the phone or in a drive-thru lane, he added.

“But digitzation of financial services is changing the way we think about good service, so if you don’t have a good app, a good online banking provider — if you still require a customer to go through the same hoops they went through 20 years ago — that’s not considered good service," Michaels said. "I think credit unions have [seen declining satisfaction scores] for the last several years because we compete on a face-to-face level of being nice to each other and not the heavy sales approach, but we have not adjusted to the changing perspective of what service means.”

Some of that is borne out in this year’s ACSI results. Credit unions at best held steady and in many cases lost ground year-over-year in their scores, dropping points in areas including courtesy and helpfulness of staff, speed of in-branch transactions, and satisfaction with websites and mobile apps. Banks also lost ground in those same areas, and ACSI suggested CUs’ satisfaction scores may have been hit disproportionately hard by the pandemic but could rebound once consumer behaviors revert to normal as the pandemic recedes.

“Credit unions are smaller, generally, and pride themselves on in-person, individualized service which by necessity went by the wayside during a lot of the lockdown,” said VanAmburg. “They had to rely much more on virtual delivery of service which big banks can very easily do [with] all of the cool sizzle on the digital side that not all credit unions have been able to mirror.”

Many credit unions attempted to replace that loss of face-to-face interaction during lockdown by beefing up video banking offerings, but VanAmburg said there may only be so much video can do to replicate that experience.

“It’s a move that will benefit, but it’s not clear to me — and it’s not clear from our data — that it would completely rectify that scenario…especially as the pandemic continues and possibly even deepens, because it isn’t an absolute substitute.”

But as the digital banking gap widens, it’s going to make the years ahead extremely difficult for smaller institutions, which make up the bulk of the industry, added Michaels.

“There are thousands of really, really small credit unions and I just don’t see how they’re going to be able to survive in the future,” he said.

Banks’ rising ACSI scores may also be tied to more time having passed since the 2008 financial crisis and Great Recession, as consumer sentiment regarding big banks improved.

“When you’re already at the bottom it’s easier to go up,” quipped Stephanie Sievers, CEO of both Star of Texas Credit Union in Austin and Sisseton-Wahpeton FCU in Agency Village, S.D. She added that when credit unions’ scores peaked in 2011 at 87, "you had nowhere to go but down.”

“I think there is a much more sincere embracing of corporate social responsibility and community [from banks] than there was 10 years ago,” said Williams. He suggested not only did banks realize it was easier to win the public relations battle by giving back, but also the winds have changed in recent years to put a greater emphasis on diversity and accountability to the communities businesses serve.

Sources were split on whether a wider adoption of technology can help solve the problem. Consumers aren’t going to start expecting less sophisticated banking tools, after all, and Sievers said many institutions may use the pandemic as an opportunity to more broadly embrace technology.

“But I feel it’s the other way around — it’s our opportunity to go deep on customer service and ramp up our interactions,” she said.

Sievers added that while many CUs put a premium on member interactions, that can sometimes get lost as institutions grow and focus more on adopting new technologies and gaining efficiencies.

“It’s more high touch on the smaller level and as you get bigger and bigger, you do lose that,” she said.

She added, “It’s not efficient to have a two- or five-minute conversation at the teller line with every single member that comes through the door, but from a satisfaction standpoint, if that’s the metric you’re looking at, it would be higher; that would make satisfaction levels go up.”