This is the third story in an ongoing series on niche consumer lending products at credit unions. The first two installments are available

Consumers can get a car loan nearly anywhere, but aircraft loans are harder to come by. A small number of credit unions are working to change that perception.

Most airplane loans are usually only made to individuals with a high net worth or to aviation enthusiasts, but by offering something as unusual as an aircraft, some credit unions hope to differentiate themselves from their peers and strengthen member loyalty. Just as important for credit unions, delinquency rates on these aircraft loans tend to be very low.

We Florida Financial, a $508 million-asset credit union based in Margate, Fla., launched its aviation lending program in January 2017.

“Aviation is a large part of the Florida community, which is our general field of membership,” said Alex Martin, the aviation program manager at We Florida, citing data from the Federal Aviation Administration which shows about 47,000 certificated pilots in the credit union’s field of membership.

“We do routine direct mail marketing to these pilots, as their information is publicly accessible through the FAA,” Martin added. “I would estimate that most pilots either rent airplanes, are members of flying clubs, have friends that own an airplane, or simply have the license because it is required for their job. ... Fortunately, the majority of pilots are very big aviation aficionados, many of whom dream about one day owning their own airplane.”

Since very few financial institutions – especially credit unions – offer aircraft loans, he said, “this new loan program actually allows us to open new accounts and attract new members.”

Wings Financial Credit Union, a $5.07 billion-asset institution based in Apple Valley, Minn., originally was chartered to serve employees of Northwest Airlines, and has been offering aircraft loans for about 40 years.

“Many of our members who worked for the airline, especially pilots, purchased personal aircraft, so we’ve had demand for them since we started offering them,” said Brent C. Andersen, vice president-marketing. “Today we serve pilots from most of the nation’s airlines and they are the primary purchasers of aircraft among our members, and we still see a small but steady demand for these loans.”

No post-recession bounceback

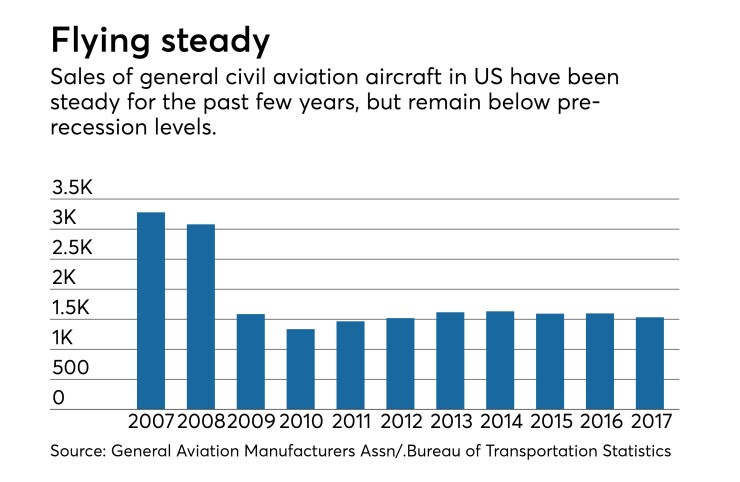

According to the General Aviation Manufacturers Association, U.S. aircraft sales remain below pre-recession levels (when more than 4,000 aircraft were delivered to buyers). In 2017, 1,596 aircraft were sold, up from 1,531 in 2016. (For comparison, some 17.2 million autos and trucks were sold in the US in 2018).

Those numbers represent general aviation and exclude scheduled air services and non-scheduled air transport operations.

GAMA noted one reason why sales have stayed low is because the price has doubled since the recession. Indeed, the average price of a piston-engine aircraft (the most common type sold) has jumped from $328,000 in 2007 to $662,000 in 2017.

According to Douglas Royce, a senior aircraft/engine analyst at Forecast International Inc., deliveries of piston aircraft reached 2,675 units in 2007, a level they haven’t come close to reaching since then.

“Since 2009, production has been in the range of 900-1,000 aircraft annually,” he said. “I'm going to speculate here and suggest that with aircraft volume down, manufacturers would have lost some economies of scale, increasing costs of production. They would need to increase retail pricing to adjust.”

In addition, a change in the mix of product models on offer may also have increased the average price.

“The introduction of new high-end piston models equipped with the latest in avionics would drive the average price of the market higher, even though lower priced models remained available for customers,” Royce added. “With fewer ‘entry level’ customers available due to tighter credit and fewer new pilots entering the market, manufacturers could be catering to more high-end customers who can afford the best-equipped and optioned aircraft than they once did. Offering more aircraft at the high end would drive the average price of aircraft higher.”

Martin said We Florida’s average closing amount is somewhere in the $200,000 range. “However, we currently finance aircraft loans starting at $57,200 up through $600,000,” he said. “We have received loan requests for both ends of the spectrum.”

Northern Skies Federal Credit Union, a $127 million-asset institution based in Anchorage, Alaska, has been offering aircraft loans for many years, given that its membership once primarily comprised employees in the aviation industry.

Gubby Spring, VP of lending at Northern Skies, said her credit union originated 14 aircraft loans last year, with loan amounts ranging from $40,000 to $100,000.

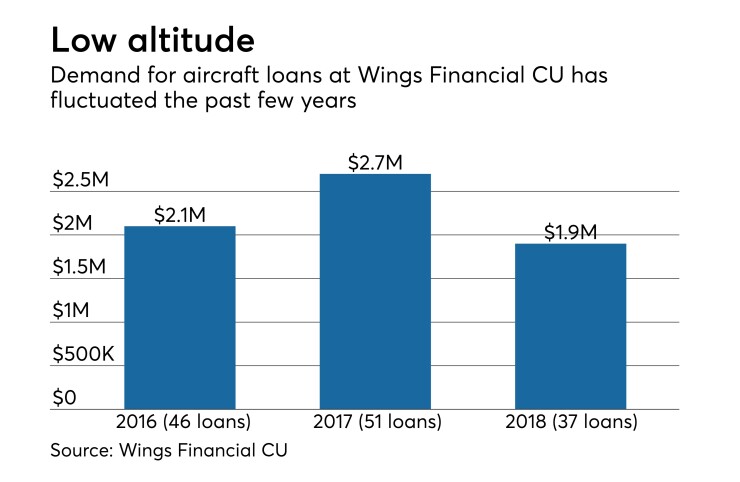

Wings Financial booked just 37 airplane loans in 2018, but Andersen said demand has “remained relatively steady” for the last several years. ”We have seen a small, but consistent interest in these types of loans.”

Not your ordinary loan

As a niche product, these loans must be underwritten differently than a traditional consumer loan.

Northern Skies’ Spring noted that although aircraft borrowers tend to be “very strong” with respect to credit, this type of loan carries a higher rate of risk due to the nature of the use of collateral. “The collateral can be more difficult to recover and aircraft are usually considered a luxury item, meaning if a member had to choose between their aircraft payment and their mortgage payment, they would likely choose the latter,” she explained.

Steve Reider, president of Bancography, cautioned that aircraft loans need special expertise and care.

“Any pure luxury purchase … [is] highly synchronized with the overall economy,” he said. “This was evident in the recession, when defaults soared and demand imploded for RVs, boats and airplanes. Second, you have the credit-evaluation risk inherent in any product sold so infrequently. … And whether the [financial institution] has the expertise in-house to properly evaluate is uncertain.”

They also carry additional risks if the loan goes bad, added Reider.

“You can adjust for the greater risk of such a product through pricing, but still, if default occurs, an airplane is difficult collateral to sell – you can’t just take it to the local auction or post it on the website like a used car,” he quipped. “And correspondingly, when the market is illiquid, it’s more difficult to deduce and attain fair market value in disposition, so recovery on losses will prove challenging.”

With many economists suggesting the U.S. could dip back into a recession by the end of next year, wider economic conditions are likely to play a major role in loan volumes for this product.

A significant economic shock similar to 2008, said Martin, would lead We Florida to expect “a reduction in new [aircraft] loan originations. Fortunately, most of our borrowers have exceptionally high net worth, so we are not concerned about an increase in delinquency in this scenario.”

Most prognosticators have said any potential recession in the next few years is likely to be minor in comparison with the global shocks a decade ago.

Martin further indicated that aircraft sales figures generally have no correlation to auto sales. “Aircraft sales (which result in aircraft loans) tend to fluctuate with the overall performance of the economy,” he said. “Thanks to the historically strong economy over the past seven to 10 years, the aircraft buying market has also been very strong.”