HOUSTON - (03/02/05) -- Cardtronics Inc., owner of thenation's largest fleet of ATMs, said Tuesday it has withdrawn itsplans to raise as much as $115 million through an initial publicoffering. The company, which filed for an IPO last May, said it iswithdrawing its plans because of continuing ongoing developmentswith regard to the company's business and financing. Cardtronicsacquired E*Trade's fleet of 15,000 ATMs last fall, giving it morethan 27,000 ATMs, far outpacing bank of America's 17,000-machinefleet. Cardtronics paid $110 million for the E*Trade machines, partof which it planned to finance through the stock offering. TheCardtronics machines form the basis of the Allpoint surcharge-freeATM network, in which more than 60 credit unionsparticipate.

-

The Made in America Manufacturing Finance Act would double the loan size threshold for SBA manufacturing loans to $10 million. It would be the first change to the limit since 2010.

4m ago -

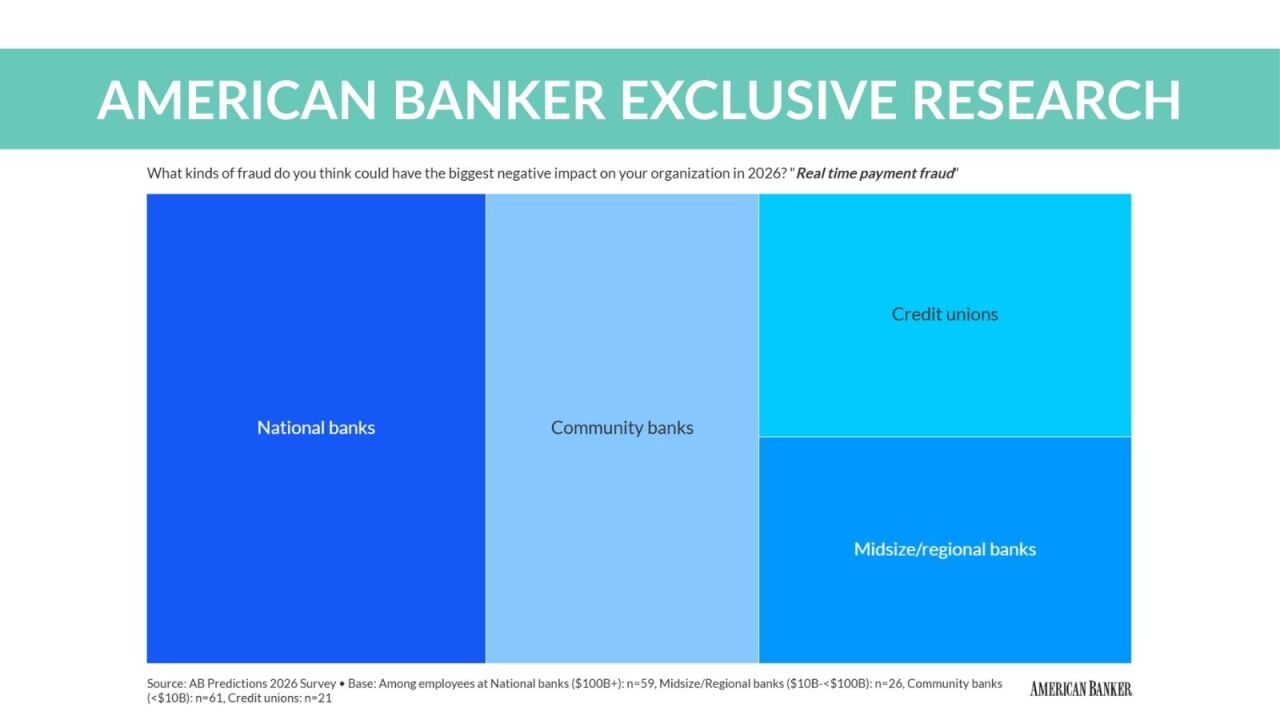

Executives have more trust in the central bank's board than their smaller-bank brethren, according to American Banker's 2026 Predictions report.

1h ago -

The sports betting company said it would stop accepting credit card deposits for its sportsbook, casino and racing products in the U.S. Wagers placed using credit cards are typically more expensive than those made with other forms of payment.

2h ago -

The crypto crash highlighted an overlooked aspect of stablecoins: They have both a stable value and a market-traded price, but the two don't always match. What does the risk of de-pegs mean for payments?

7h ago -

The Federal Housing Finance Agency and Ginnie Mae agreed to look more closely at credit line use, according to the Government Accountability Office.

8h ago -

A Washington court denied a plaintiff request, pointing to past Supreme Court rulings that showed a compelling interest for the state's special-purpose credit program.

8h ago